|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver Surge in Anticipation of Federal Reserve Rate Cuts Amid Economic Slowdown

2025-08-25 @ 13:14

Gold and Silver Rally as Markets Anticipate Federal Reserve Rate Cuts

In a significant shift, gold and silver have surged following Federal Reserve Chair Jerome Powell’s latest remarks, as financial markets increasingly anticipate rate cuts in the coming months. This renewed optimism comes after a period of market uncertainty triggered by persistent inflation and changing economic conditions.

Federal Reserve Signals Potential Rate Cuts

Federal Reserve policy has become increasingly dovish in tone, with Powell’s recent comments fueling expectations that the central bank may soon move to lower interest rates. The Fed held rates steady at its most recent meeting, but a split among committee members and a revised outlook for economic growth have heightened anticipation for upcoming cuts.

In contrast to earlier statements asserting “solid” economic activity, the Fed now acknowledges that growth has “moderated” in the first half of the year. Gross domestic product growth has slowed to around 1.2% per quarter, a notable drop from previous years. Two members of the Federal Open Market Committee voted in favor of a rate cut, underscoring a growing consensus for monetary easing.

Current market sentiment places the probability of a September rate cut at about 40% according to futures data, but some analysts believe the likelihood is even higher—closer to two-thirds—as the Fed is projected to enact two rate cuts by year-end. With only a handful of meetings remaining, investors are bracing for a shift in monetary policy that could have broad implications.

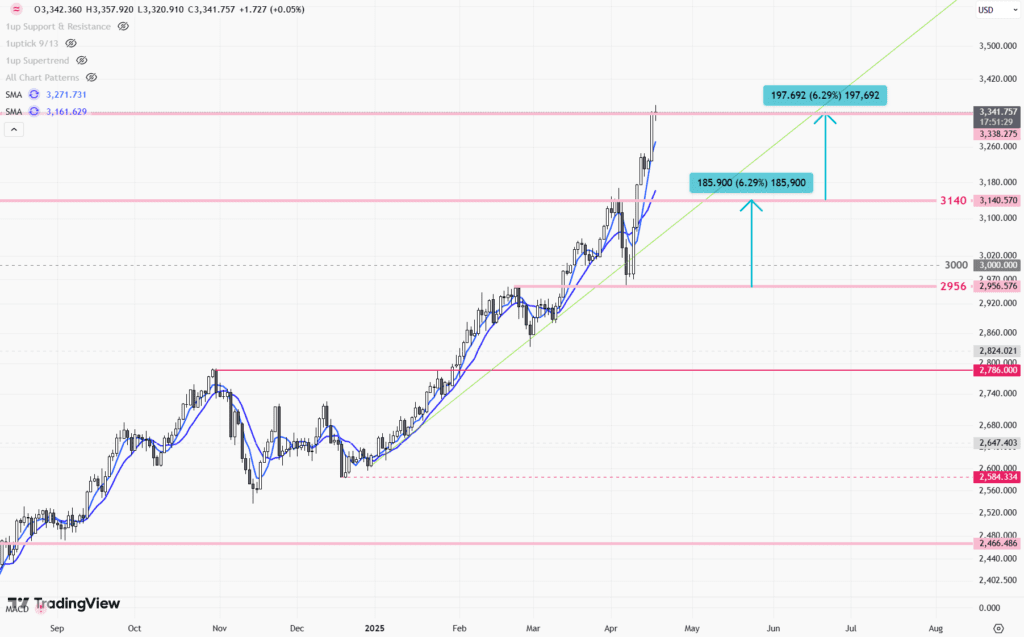

Outlook for Gold and Silver

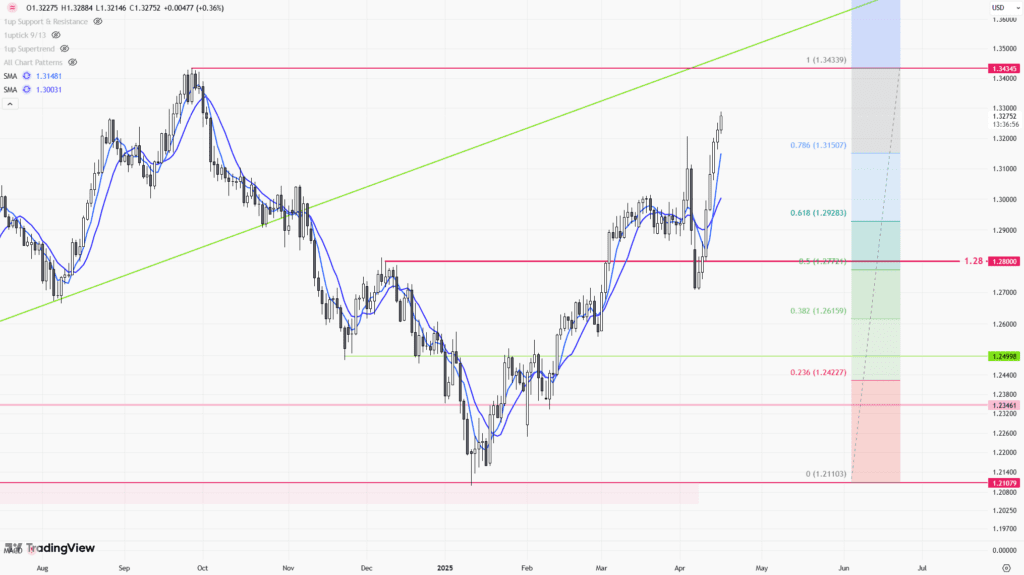

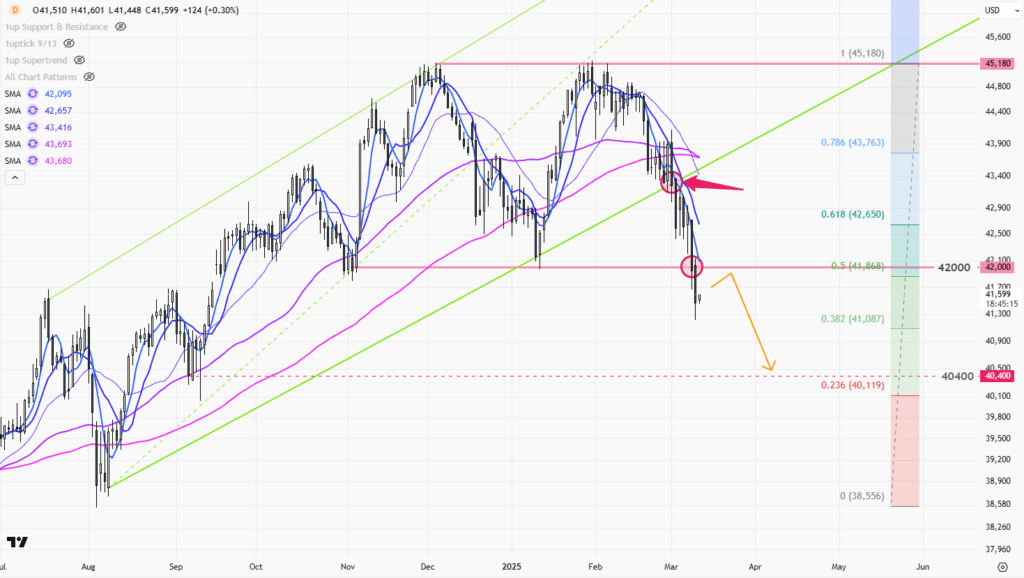

Gold and silver prices typically respond positively to expectations of lower interest rates. When central banks cut rates, returns on assets like government bonds decline, boosting the appeal of non-yielding assets such as precious metals. Following Powell’s remarks, gold rallied sharply, breaking through key technical resistance levels. Silver also registered substantial gains, benefiting from the same macroeconomic catalysts.

The bullish momentum reflects growing confidence that monetary policy will shift toward easing. Investors see gold and silver both as hedges against inflation and as attractive alternatives in a low-rate environment. Technical indicators suggest that momentum may continue, especially if the Fed moves forward with rate cuts in September and beyond.

Factors Influencing the Fed’s Decision

The Federal Reserve faces a delicate balancing act, weighing the risks of persistent inflation against slowing economic growth and signs of labor market weakness. While inflationary pressures remain a concern, early data indicate that recent tariffs have had a smaller-than-expected impact on prices. Other disinflationary trends have proved resilient, giving policymakers confidence that inflation may not accelerate significantly.

At the same time, the job market, though still healthy, shows signs of cooling, with hiring slowing and employment figures facing downward pressure from altered immigration policies and seasonal adjustments. Should the labor market deteriorate substantially, the Fed might enact larger or more frequent rate cuts to manage these downside risks.

Analysts are debating the timing and magnitude of the anticipated rate moves. Some forecast a sequence of 25-basis-point cuts at consecutive meetings, beginning as early as September and continuing into 2026. By the end of next year, the federal funds rate could fall to near 3.25%, with longer-term projections pointing even lower.

Implications for Investors and the Economic Landscape

For investors, the prospect of rate cuts means rethinking portfolio strategies. Lower interest rates typically weaken the dollar, raise gold and silver prices, and support equities—especially sectors sensitive to borrowing costs, like real estate and technology. On the other hand, bonds and high-yield savings vehicles may become less attractive, prompting a shift toward more defensive or alternative assets.

This evolving environment makes gold and silver attractive not just as safe havens, but as vehicles for achieving growth and diversification. The metals’ recent rally could be a harbinger of more sustained upward momentum if the Fed follows through with its expected cuts.

The broader economic landscape remains fluid, and uncertainty persists around inflation, job growth, and consumer spending. Though official Fed statements stress caution and a data-dependent approach, market pricing reflects growing confidence that the era of higher rates may soon give way to a cycle of easing.

Conclusion

Gold and silver have entered a new phase of bullishness following Chairman Powell’s speech and shifting Federal Reserve policy expectations. As the markets continue to price in interest rate cuts, these precious metals stand to benefit from heightened demand, portfolio reallocations, and macroeconomic uncertainty. With eyes on the upcoming Fed meetings, investors and observers alike will be watching for confirmation that monetary easing is set to begin—and for further momentum in gold and silver markets.