|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Outlook August 2025: Navigating Pullbacks, U.S. Yield Impact, and Fed Rate Cut Prospects

Gold Price Outlook August 2025: Navigating Pullbacks, U.S. Yield Impact, and Fed Rate Cut Prospects

2025-08-04 @ 21:00

Gold prices have experienced a pullback recently, influenced by rising U.S. Treasury yields and profit-taking by traders after a strong rally in late July. As yields rebounded, the attractiveness of gold as a non-yielding asset was reduced, leading to a short-term decline in prices. Despite this, gold reached notable highs last week, buoyed by weaker U.S. payroll data, which raised expectations for Federal Reserve rate cuts and increased safe-haven demand.

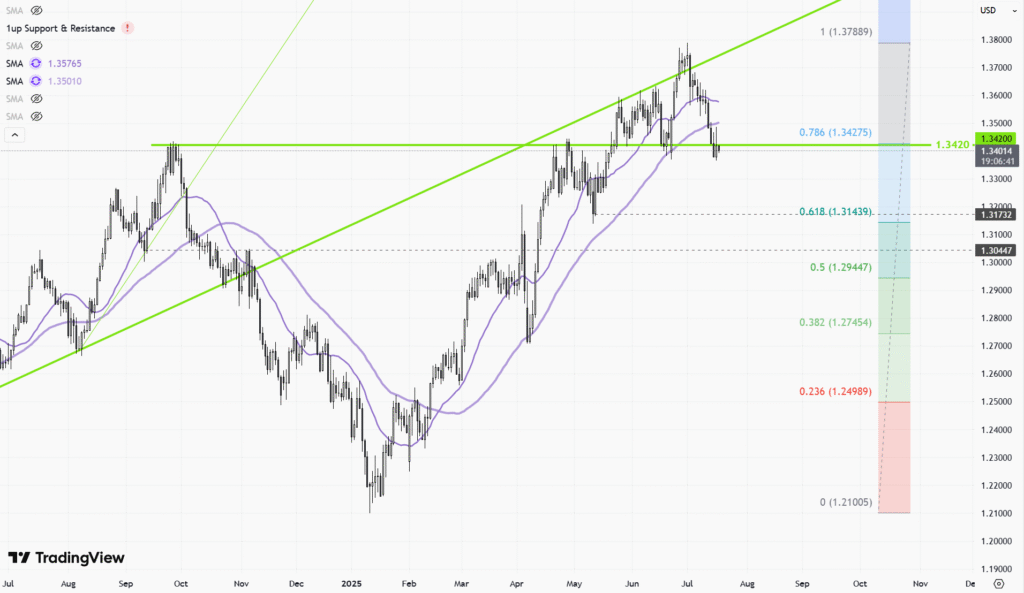

Market volatility remains a key factor for gold moving into August. While gold’s current trading range is holding firm between $3,200 and $3,500 per ounce, the environment is characterized by lighter trading volumes and a lack of fresh catalysts in early August. Still, an upside breakout is possible if external developments, such as new economic data or geopolitical events, spur buying interest.

Experts suggest that the possibility of U.S. rate cuts later this year remains supportive for gold in the medium term. The Federal Reserve’s recent comments indicate it is taking a wait-and-see approach, and traders are gearing up for potential policy shifts as more economic indicators are released. In the near term, gold may remain range-bound, with price direction hinging on the interplay between monetary policy expectations and global risk sentiment.

For investors, the current dip could represent an opportunity to position for further gains later in the year if rate cuts materialize and safe-haven flows return. However, short-term fluctuations are likely as markets digest economic data and reassess the outlook for monetary policy and global growth. As always, closely monitoring yield movements and central bank announcements will be key to navigating gold’s next move.