|

| Gold V.1.3.1 signal Telegram Channel (English) |

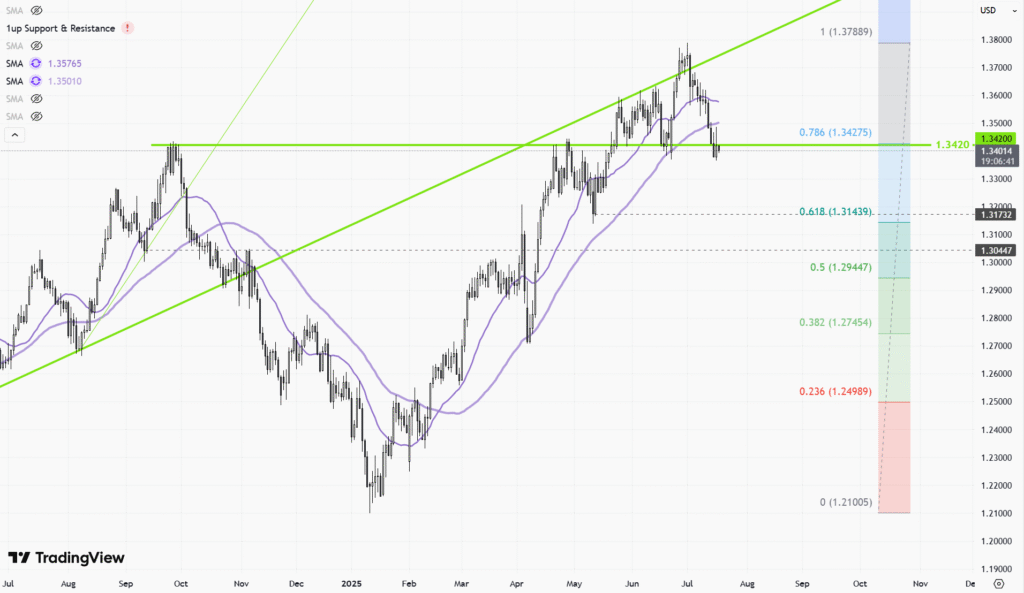

USDCAD-Daily

2025-08-21 @ 16:39

Market Overview

The USD/CAD currency pair rose sharply over the past week, climbing above 1.38 and reaching 1.3882 by August 21, 2025, reflecting continued weakness in the Canadian dollar. The move was driven by rising expectations of a Bank of Canada rate cut after recent weak inflation data, coupled with July’s unexpected labor market losses in Canada. Meanwhile, U.S. dollar strength persisted due to market uncertainty about the Federal Reserve’s policy direction, with investors focusing on upcoming Fed commentary and the possibility of renewed monetary easing. Persistent U.S. tariffs, economic divergences, and technical momentum above key resistance levels also contributed to the bullish trend in USD/CAD. Despite short-term volatility, the outlook remains sensitive to central bank actions, economic data, and geopolitical developments.

USDCAD Daily Candlestick Chart – Thorough Technical Analysis

Visible Technical Patterns and Indicators

- Trend: The pair is entrenched in an uptrend, marked by persistent higher highs and higher lows since bouncing off support near 1.3745–1.3800. Price has reclaimed and held above recent key pivot levels, underscoring bullish momentum.

- Support and Resistance:

- Major support: 1.3745–1.3800 (solidified by previous swing lows and former resistance-turned-support).

- Immediate resistance: 1.3880–1.3905 (recent swing highs and upper daily closes).

- Further resistances: 1.3940 and 1.3990 (prior reaction highs and technical extension targets).

- Secondary support: 1.3820 (minor pullback zone).

- Recent Candlestick Formations:

- The chart shows a sequence of strong bullish candles after a moderate pullback, with a recent candle displaying a long lower wick—signaling buying pressure and demand absorption at the lower end of the session.

- No classic reversal patterns (e.g., doji, shooting star) are evident at resistance yet, though price is pushing into an established overbought region.

Implied Technical Indicators and Signals

- Moving Averages:

- Price has moved above the 100-day moving average, confirming medium-term bullish bias and acting as a dynamic support, with the next watchpoint at the 200-day MA (likely near 1.4035).

- Slope remains positive, indicating alignment of moving-average-based trend-followers.

- Relative Strength Index (RSI):

- RSI is trending above 60, pointing to sustained bullish momentum but nearing overbought territory (typically above 70). This increases the likelihood of short-term corrections without undermining the larger uptrend.

- MACD (Moving Average Convergence Divergence):

- Based on the trend and lack of strong bearish divergences, MACD is likely showing a positive histogram and the signal line above zero, further supporting upward momentum.

- No imminent bearish crossover is implied; however, extended moves increase the risk of consolidation.

- Bollinger Bands:

- Given the recent acceleration, daily candles are likely closing near or even outside the upper Bollinger Band, a sign of strong momentum but also heightened mean-reversion risk.

Prominent Chart Patterns

- Possible Continuation Formation:

- Absence of classic reversal patterns (e.g., head and shoulders, double top).

- The current action favors a continuation pattern scenario, such as a bull flag or pennant, where shallow pullbacks are rapidly bought.

- No large-scale symmetrical triangles or ranges are evident; instead, the structure supports trend continuation.

Candlestick Patterns and Implications

- Engulfing or Hammer:

- Recent daily candles with long lower wicks suggest buyers are stepping in rapidly, echoing elements of a hammer, which is bullish at or near support.

- No significant bearish engulfing or doji patterns currently visible at resistance, but vigilance is warranted given extended conditions.

Trend Assessment

- Current Direction:

- USDCAD remains in a robust uptrend on the daily timeframe.

- Minor overbought readings and proximity to resistance levels increase odds of short-term pullbacks, yet the larger bullish structure remains intact.

Updated Support and Resistance Levels

- Support:

- 1.3745–1.3800 (major structural support)

- 1.3820 (minor interim support below resistance)

- Resistance:

- 1.3880–1.3905 (immediate ceiling, recent highs)

- 1.3940

- 1.3990 and 1.4000 (psychological zone and measured move targets)

Additional Relevant Insights

- Momentum: Sustained, but possibly stretched, hinting at near-term consolidation risk.

- Volume (if available): Not included on the chart but, given the breakout, typical expectation would be a volume increase on up days, a confirming factor for trend strength.

- Event Risk: High-impact economic releases (e.g., FOMC minutes, Canadian CPI)USDCAD Daily Chart Technical Analysis – August 21, 2025

Visible Technical Patterns & Indicators on Chart

- Trend: USDCAD remains in a medium-term uptrend, with price action posting higher highs and higher lows after a pronounced upward reversal off the 1.3745–1.3800 support region.

- Support & Resistance Levels:

- Support: Major support is clustered between 1.3745 and 1.3800, with minor support at 1.3820.

- Resistance: Immediate resistance stands at 1.3880, followed by 1.3905, 1.3940, and then the psychological 1.4000 zone.

- Candlestick Activity: Recent daily bars display strong bullish momentum with sizable solid bodies and some long lower wicks—indicative of demand absorbing supply on any dips. No classical bearish reversal candle patterns are evident near resistance.

Technical Patterns & Indicators Implied, Not Displayed

- Moving Averages: Price has reclaimed and remains above the 100-day moving average, confirming a bullish technical structure. The next higher technical target is near the 200-day MA, expected around 1.4035. Both moving averages are likely sloped upward, providing dynamic support.

- RSI: The Relative Strength Index is currently in the 60–70 range, underlining persistent bullish momentum but suggesting conditions are nearing overbought. This increases the likelihood of a short-term corrective pullback rather than an immediate trend reversal.

- MACD: Momentum gauges such as the MACD are consistent with the ongoing uptrend: the main line is likely above the signal line and above zero, with a positive histogram. There are no clear divergence signals yet, but momentum is stretched.

- Bollinger Bands: Price is likely pressing against the upper Bollinger Band, a confirmation of the strength in the trend but also a technical warning for potential interim mean-reversion moves or sideways consolidation.

Chart Patterns & Candlestick Formations

- No Classical Reversals: There are no clear head and shoulders, double tops/bottoms, or triangles. Instead, the price structure is displaying potential bull flag or pennant continuations, confirmed by shallow retracements and aggressive buying on dips.

- Candlestick Signals: Several recent bars show long lower shadows, resembling hammers that reinforce underlying demand. No bearish engulfing or indecision patterns like doji near the recent highs, but as overbought readings deepen, vigilance is warranted for reversal setups.

Trend Direction Assessment

- Direction: The daily trend is firmly bullish, characterized by persistent buying and momentum continuation. However, with price near resistance and momentum extended, expect possible consolidation or minor mean-reverting corrections before the next upward leg.

Major Support & Resistance Levels

- Support: 1.3820, 1.3800, 1.3745

- Resistance: 1.3880, 1.3905, 1.3940, 1.3990–1.4000

Other Relevant Technical Insights

- Momentum Shifts: While the broader structure is bullish, an RSI nearing overbought and candles pressing Bollinger extremes hint at an imminent pause or minor correction phase, not a full reversal.

- Volume (if available): Would typically confirm trend extension on high volume during breakouts; lacking on-chart volume, this must be inferred from price development.

- Event Risk: Immediate FOMC minutes and Canadian inflation data add high volatility risk that could accelerate or reverse technical moves.

Actionable Technical Outlook

USDCAD is embedded in a strong daily uptrend, trading above key moving averages and technical support zones. Immediate upside may be capped by overbought momentum and major resistance at 1.3880–1.3905, with room for corrective dips toward 1.3820–1.3800. Unless a reversal pattern (e.g., bearish engulfing, head and shoulders) forms or price closes convincingly below 1.3745, the prevailing trend remains bullish; pullbacks into support are likely to attract buyers. Stay alert to short-term volatility spikes from upcoming US and Canadian data releases.