|

| Gold V.1.3.1 signal Telegram Channel (English) |

August Wholesale Prices Fall Unexpectedly: What This Means for Inflation, the Fed, and Markets

2025-09-11 @ 00:00

Wholesale Prices Drop Unexpectedly in August: Implications for Inflation and the Markets

August brought a surprising piece of news to the financial world: U.S. wholesale prices, measured by the Producer Price Index (PPI), declined by 0.1%. This is the first time the PPI has registered a negative reading since April and marks a notable shift compared to the previous month’s substantial gains. The unexpected dip comes at a critical juncture, as the Federal Reserve weighs its next interest rate decision.

Breaking Down the Decline

The PPI is a key indicator of wholesale inflation, tracking the prices that businesses receive for their goods and services before they reach consumers. In August, economists had predicted an increase of 0.3%, but instead, wholesale prices slipped by 0.1%. Even when excluding the usually volatile food and energy sectors, the “core” PPI also fell by 0.1%. Both figures show a reversal from July, when wholesale prices had climbed by 0.7% after a historical revision from the initial 0.9% gain.

This month’s negative number stands out, especially when considering the recent trends. Until August, wholesale prices had remained relatively strong, signaling continued inflationary pressures through the supply chain. The sudden downturn suggests that those pressures may be easing, at least temporarily.

What’s Behind the Softness in Wholesale Prices?

Digging deeper into the data, the weakness in August’s PPI was largely due to falling prices for wholesale services, which dropped by 0.2% compared to July. This was attributed to slimmer profit margins at retailers and wholesalers. In essence, the cost pressures on these businesses seem to have eased, possibly because of softer demand or slower price increases at earlier stages of the supply chain.

Lower profit margins can be a double-edged sword: While they relieve some inflationary pressure, they may also signal that businesses are struggling to pass higher costs on to consumers—either due to increased competition, cautious consumer spending, or both.

What Does This Mean for the Federal Reserve?

The timing of the drop in the PPI is particularly significant. The Federal Reserve is widely expected to make a pivotal decision on interest rates in the near future. The consistently high inflation over the past two years has prompted aggressive rate hikes, aiming to bring inflation closer to the central bank’s 2% target.

A cooling in wholesale price growth could give the Fed some room to pause or slow its pace of rate increases, especially if other data points, such as consumer inflation and employment, show similar moderation. Nevertheless, one month of lower wholesale prices does not guarantee a longer-term trend. The central bank will likely look for continued evidence of easing inflation before making significant changes to its current policy trajectory.

How Are Markets Reacting?

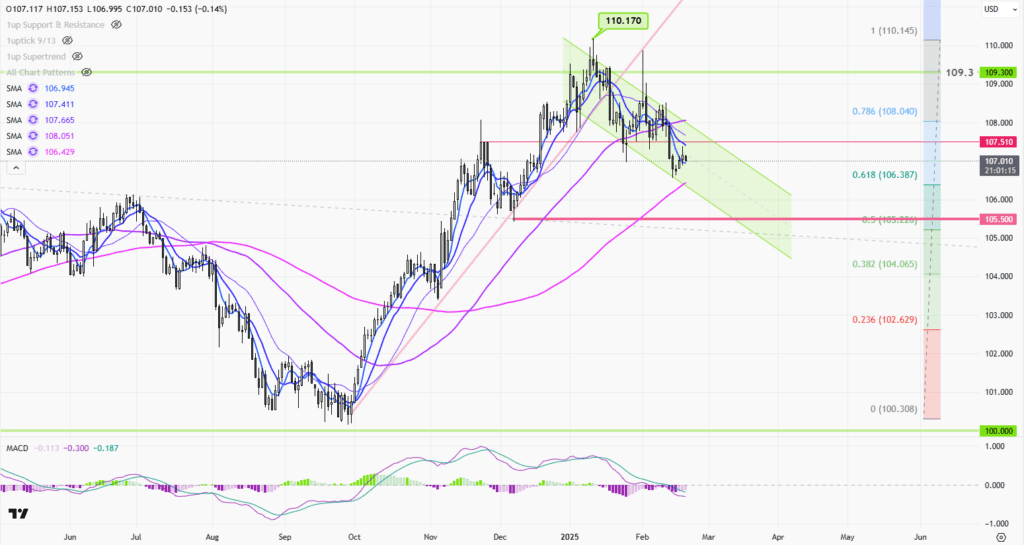

Financial markets keep a close eye on inflation data, as it shapes expectations for interest rates, which in turn affect borrowing costs, corporate profits, and investment strategies. The negative PPI reading for August may calm some recent nerves about runaway inflation. In fact, yields on U.S. Treasury bonds—which track expectations for future interest rates—have been sensitive to these monthly inflation updates.

Lower wholesale inflation could lead to slightly lower yields, especially if investors believe it might slow the Fed’s rate hikes. However, with uncertainty still lingering about the overall inflation outlook and Federal Reserve policy, market reactions may remain mixed until there’s more clarity from policymakers.

What Should Investors and Consumers Watch For Now?

As we move into the fall, the following will be key risk factors and signals to monitor:

- Further developments in the PPI and the closely related Consumer Price Index (CPI), which directly measures retail inflation.

- Changes in retail and wholesale profit margins—these can reveal deeper trends in consumer demand and pricing power.

- Federal Reserve communications, especially regarding their views on inflation and interest rates.

- Signals of broader economic activity, such as job growth, consumer spending, and supply chain dynamics.

Conclusion: A Pause or a Turn in Inflation?

August’s surprising dip in wholesale prices represents a possible turning point for inflation, but it’s too early to declare victory over rising costs. Investors, businesses, and policymakers will need to watch subsequent data closely to determine whether this is the start of a new trend or just a temporary interruption. For now, the numbers offer a bit of relief—and a hint of hope that the worst of the inflation surge might be behind us.