|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Prices Soar to Historic Highs in 2025: Key Drivers and Future Outlook Explained

2025-09-09 @ 01:01

Gold prices have recently shattered records, marking a historic surge that has garnered the attention of traders and investors around the world. As of early September 2025, spot gold is trading near $3,586 per ounce, and futures prices have climbed above $3,650. Year-to-date, this represents an impressive 30-36% gain. The dramatic rally in gold can be attributed to a combination of economic, monetary, and geopolitical factors that continue to stoke demand for the precious metal.

One of the main catalysts behind gold’s ascent is a series of unexpectedly weak U.S. jobs data. In August, the U.S. economy added only 22,000 new jobs—far below the expected 75,000—while the unemployment rate rose to 4.3%, the highest level seen since 2021. As jobless claims crept up, investor confidence in the U.S. labor market weakened, triggering a decline in Treasury yields and further weighing on the U.S. dollar index. This softer labor picture strengthened the market’s conviction that the Federal Reserve will cut interest rates at its upcoming meeting, with traders pricing in nearly a 100% chance of a 25-basis-point cut, and speculation mounting over a possible 50-basis-point move.

These expectations of easier monetary policy are fuelling the narrative for higher gold prices. When rates fall, the opportunity cost of holding non-yielding assets like gold diminishes, making the metal more attractive as a store of value and hedge against both inflation and currency depreciation. These dynamics have pushed gold sharply up as investors reposition for the next monetary policy phase.

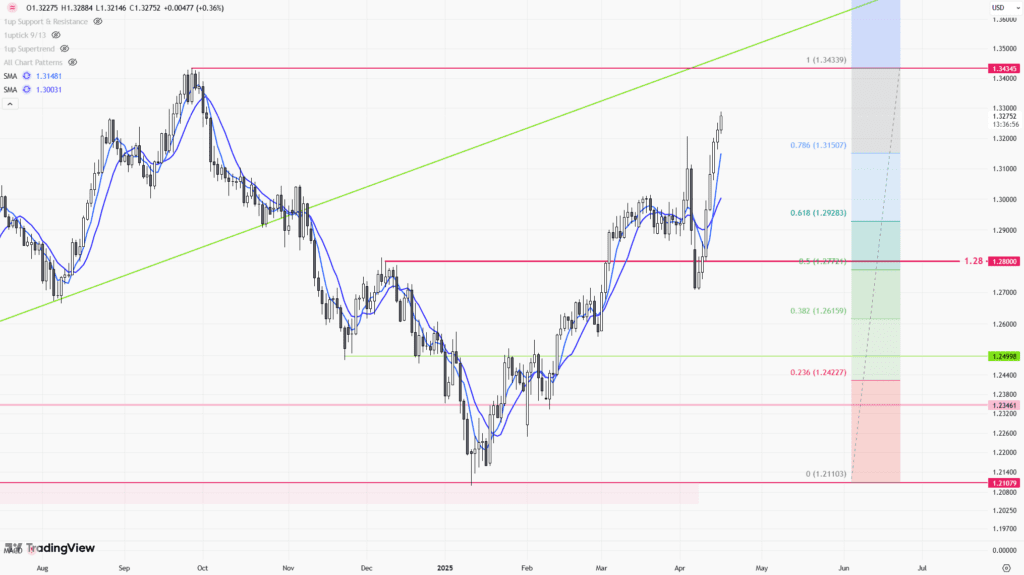

Another significant driver has been the continued decline of the U.S. dollar. Over the past month, the dollar has slipped by over 2%, making gold more affordable for buyers using other currencies and helping support robust global demand. This currency depreciation is set against a backdrop of persistent central bank gold buying, as institutions look to diversify reserves and hedge against geopolitical and economic uncertainties. The steady accumulation of gold by central banks worldwide has reinforced confidence in the metal’s long-term value and its role as a safe-haven asset.

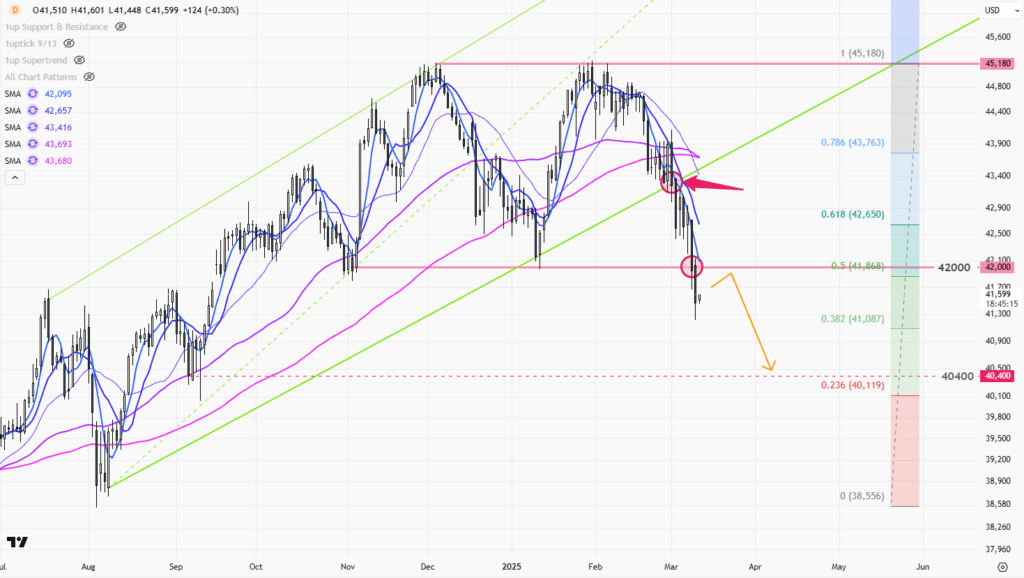

Geopolitical risks continue to amplify the bullish outlook for gold. Tensions in various regions, combined with lingering questions about the direction of U.S. monetary policy, have increased appetite for safe-haven investments. For both individual investors and large institutions, gold stands out as a reliable vehicle for wealth preservation and risk management, especially when traditional asset classes face heightened volatility.

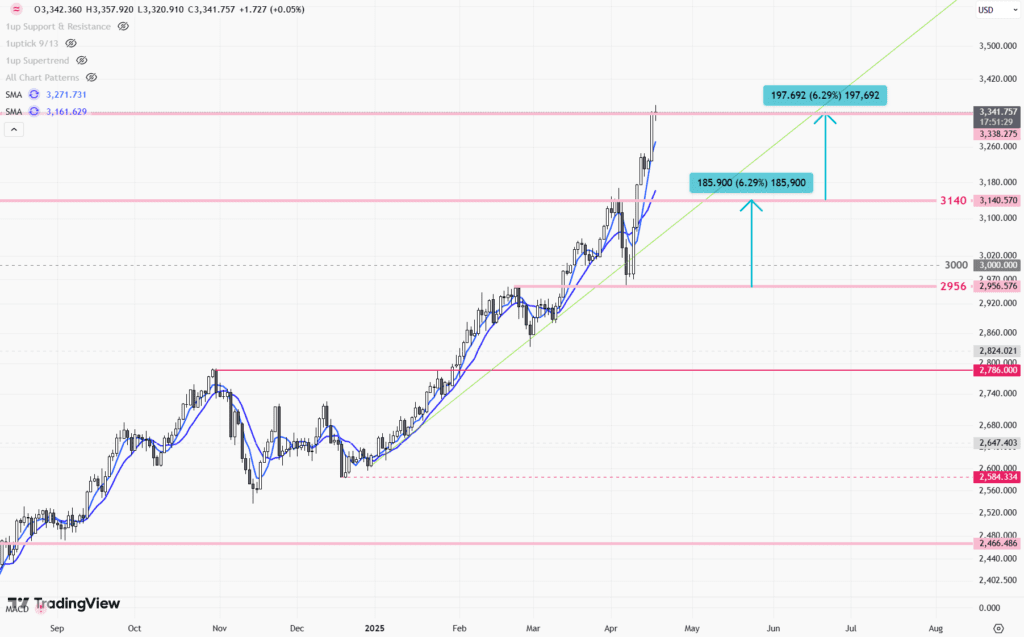

Looking ahead, analysts see potential for gold to test even higher levels in the coming months. Many experts now forecast gold prices could reach $3,700 per ounce in the near term, with more bullish projections eyeing the $4,000 mark before the end of the year if current trends persist. Survey data reveals a wide range of estimates—some consensus forecasts point to year-end averages near $3,679 and even as high as $4,500 depending on how macroeconomic scenarios develop.

However, the market is not without volatility. Gold’s rally could pause or retrace in response to sudden improvements in economic data, sharper-than-expected moves in Treasury yields, or shifts in investor sentiment. Additionally, as the rally advances into uncharted territory, profit-taking and technical corrections may emerge, especially if short-term traders look to lock in rapid gains.

Despite these caveats, the prevailing trajectory suggests continued strength. Unlike previous cycles, today’s gold rally is underpinned by both fundamental demand—central banks, institutional hedging, and physical investment—and macroeconomic tailwinds like falling rates and a weakening dollar. This multifaceted support lends greater credibility to the move and may keep prices elevated even in the face of near-term fluctuations.

For investors and traders, the message is clear: the bullish momentum in gold remains powerful. With structural support from global central bank actions, dovish monetary policy, and persistent geopolitical risk, the gold market is firmly in the spotlight. As prices march toward unprecedented highs, market participants will be watching closely for clues from upcoming economic reports, central bank pronouncements, and shifting global dynamics to gauge how much further this rally can run.

In summary, gold’s explosive rise in 2025 stands as a testament to its enduring appeal in times of uncertainty. Whether targeting $3,700 or even $4,000, gold is proving once again that when the world feels unsure, the yellow metal’s shine becomes all the more attractive.