|

| Gold V.1.3.1 signal Telegram Channel (English) |

Edit Content

Edit Content

Edit Content

Edit Content

Edit Content

美元达到一年高点!

Home 美元达到一年高点!

美元达到一年高点!

2024-12-30 @ 00:06

价格走势

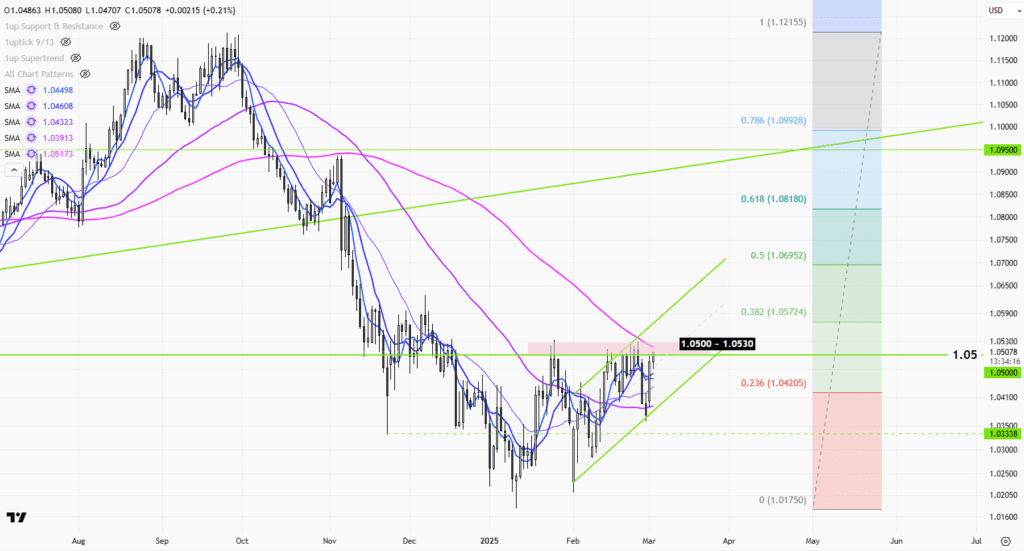

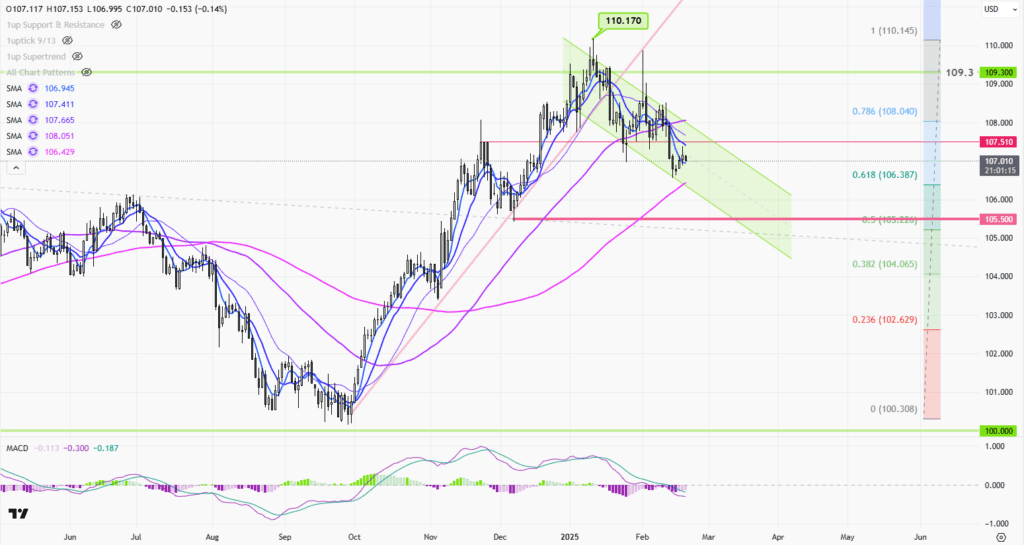

从美元(USD)的日线图来看,近几个月价格呈现出明显的上升趋势,并突破了一个长期的阻力位。初期的波动主要局限于100到108之间的区间,但近期的多头势头将价格推升至108以上,显示出强劲的买盘兴趣。移动均线呈现积极的排列趋势,为整体走势提供了额外支撑。这次突破标志着市场情绪可能正在转变,多头逐步掌控价格走势,暗示后续可能会有更大的上涨潜力。从价格的波动中可以看出,波动率和交易量都在增加,这进一步支持了整体看涨的前景。

技术分析

展望

美元的整体展望偏向看涨,主要受益于最近突破了108这个重要的阻力位。移动均线的汇聚,以及像MACD和成交量等指标的支撑,进一步强化了这种看涨情绪。打破长期的下行趋势线是一个关键的节点,暗示市场动态可能会发生变化。投资者应保持谨慎乐观,因为价格在接近108.80时可能会遇到阻力。持续关注波动率和市场反应将是关键,能够及时捕捉任何可能出现的反转或修正信号。

支撑和阻力

| 支撑位 | 阻力位 |

|---|---|

| 105.00 | 108.00 |

| 102.00 | 108.80 |

| 100.00 | 110.00 |

Tag:

Latest Technical Analysis

USD maintain in a downtrend channel!

2025-02-23 @ 15:52

Trump Says He Plans Reciprocal Tariffs, Will Affect ‘Everyone’

2025-02-08 @ 20:24

Bitcoin on a downtrend?

2024-12-31 @ 12:05