|

| Gold V.1.3.1 signal Telegram Channel (English) |

India’s Economy Slows as Trump Tariff Threat Looms

2025-04-02 @ 20:37

India’s Economic Slowdown Deepens Amid Threat of Trump Tariffs

India, Asia’s third-largest economy, is navigating a rocky economic landscape as it contends with a pronounced slowdown and mounting external pressures. The latest blow? The looming threat of Trump-era tariffs returning, potentially affecting India’s key export sectors.

Slowing Growth Forecasts Paint a Stark Picture

Recent projections from the Reserve Bank of India (RBI) and the Central Statistical Office (CSO) have revised India’s GDP growth outlook for FY 2024/2025 downward:

- RBI forecast: 6.6%

- CSO forecast: 6.4%

This marks a dramatic decline from the robust 8.2% growth achieved in the previous fiscal year. The primary culprits behind the slowdown?

- Weak manufacturing and construction output

- Declining consumer demand

- Persistent wage stagnation in the informal sector

In Q2 of the fiscal year, the economy grew by just 5.4%—its slowest pace in nearly two years.

Trump Tariffs: Limited Exposure, Sectoral Risks

Although India’s direct exposure to U.S. tariffs may be minimal—exports to the U.S. account for a modest 2% of GDP—certain industries are vulnerable to targeted trade restrictions:

- Gems and jewelry

- Chemicals

- Metals

- Auto components

While the trade threat is largely external, the fear factor looms large. The uncertainty created by potential trade wars can chill global investor sentiment and slow down cross-border capital flows—something India can ill afford during a domestic downturn.

Signs of Recovery Shine Through the Gloom

Despite the challenges, economic forecasters see a silver lining. Goldman Sachs suggests the worst may be over, projecting GDP to improve to 6.4% in the second half of 2025.

This cautious optimism is rooted in:

- Fiscally expansionary measures such as income tax relief

- Potential RBI rate cuts aimed at spurring investments

- A more growth-focused monetary policy under the new RBI governor

However, stimulus-driven recovery carries the risk of rising inflation, especially as lower-income households continue to grapple with volatile prices and limited wage growth.

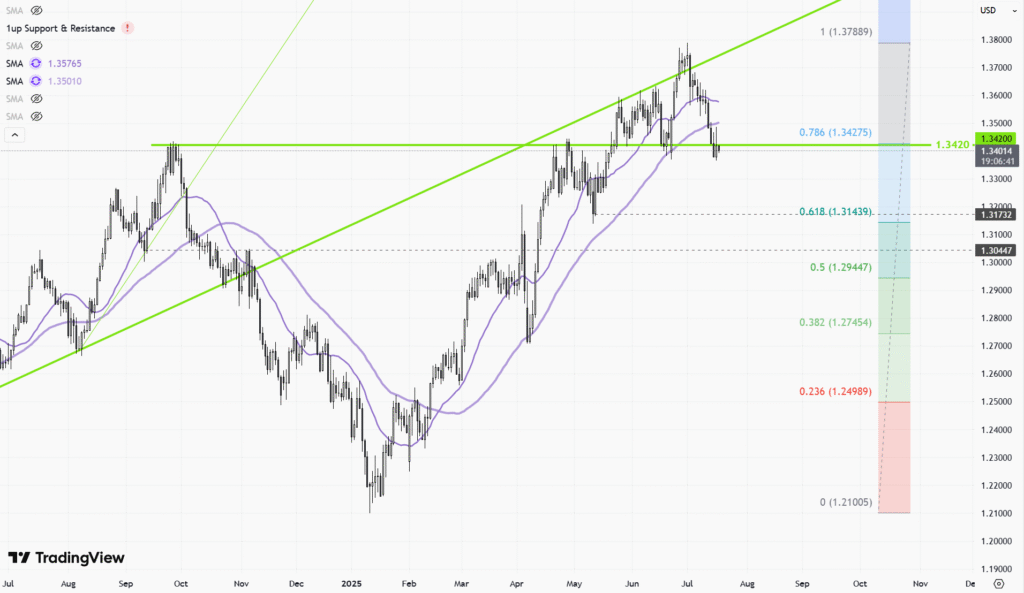

Markets Reflect Uncertainty and Correction

Indian equity markets have not escaped the turbulence. Since hitting a peak in September 2024, the NIFTY 50 has dropped nearly 10%, reflecting investor concerns over slowing growth and reduced earnings multiples.

Key market trends include:

- High exposure to small and mid-cap stocks, leading to exaggerated volatility

- Muted foreign Institutional inflows due to global macro risks

- Flight to quality stocks with strong earnings visibility

Investment analysts continue to recommend a cautious approach, prioritizing companies with resilient fundamentals and predictable cash flows.

External Accounts: Robust but Still Vulnerable

India’s external balance sheet seems stable on paper:

- Ample foreign currency reserves

- Moderate current account deficit

- Low external debt levels

However, vulnerabilities remain:

- High sensitivity to global oil prices—India has tried mitigating this by securing discounted oil from Russia

- Worryingly low levels of Foreign Direct Investment (FDI)

- Increased global exposure via inclusion in emerging bond indices

These factors raise concerns about future external shocks destabilizing India’s current account stability.