|

| Gold V.1.3.1 signal Telegram Channel (English) |

US Dollar Strengthens Against Canadian Dollar Amid Strong US Data and Geopolitical Tensions; Investors Watch Oil Prices and Global Developments

US Dollar Strengthens Against Canadian Dollar Amid Strong US Data and Geopolitical Tensions; Investors Watch Oil Prices and Global Developments

2025-06-17 @ 11:51

USD/CAD Exchange Rate Holds Steady as Markets Lean Towards the Dollar

The USD/CAD pair saw modest gains during the Asian session yesterday, climbing back toward the 1.3580 level. A rise in risk-off sentiment continues to boost demand for the U.S. dollar, as investors keep a close watch on the strength of the U.S. economy. Ongoing geopolitical concerns, particularly between Israel and Iran, have added to market caution and provided further support for the greenback.

Looking over the past week, the U.S. Dollar Index has remained relatively stable, underpinned by a series of economic releases that largely beat expectations. The Federal Reserve has kept interest rates unchanged at 4.5%, and inflation remains elevated compared to Canada, giving the dollar additional upward momentum. As of June 17, USD/CAD was quoted at 1.3569, slightly higher than the previous trading session—signaling continued bullish sentiment.

On the flip side, the Canadian dollar has shown signs of weakness. While rebounding oil prices have offered some support, Canada’s labor market has lagged behind the U.S. In April, Canadian unemployment rose to 6.9%, significantly higher than the 4.2% reported in the U.S. Meanwhile, the Bank of Canada’s benchmark interest rate remains at 2.75%, widening the rate differential and discouraging capital inflows into the Canadian currency.

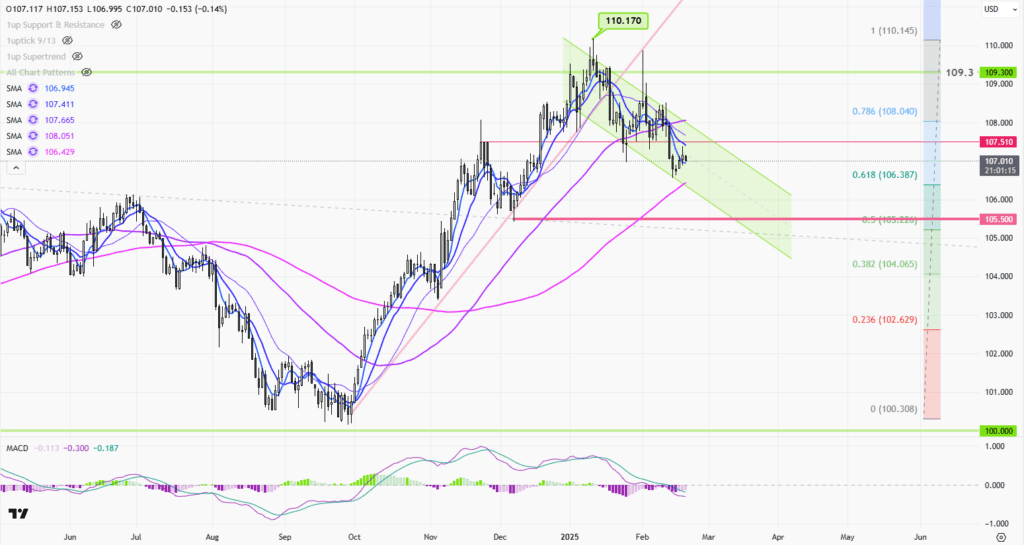

From a technical perspective, USD/CAD is currently consolidating within a short-term downward channel but is finding support near the 1.3565 level. A break above the resistance at 1.3615 could open the door for a move toward 1.3655, or even as high as 1.3805. Conversely, a drop below 1.3565 may trigger a further decline towards the 1.3485 region.

Over the coming days, the U.S. dollar is expected to remain the dominant driver in the currency pair. Geopolitical developments will be key, along with commentary from Federal Reserve officials and movements in global oil prices. Traders should remain alert to headline risks and prepare accordingly for potential exchange rate volatility.

In summary, USD/CAD is leaning bullish in the short term. A further rebound in the Canadian dollar will likely depend on a continued rise in oil prices and improvements in Canada’s economic indicators. With markets staying sensitive to macroeconomic shifts, a flexible trading approach and close monitoring of global events are advisable.