2025-05-08 @ 13:47

Gold prices saw significant turbulence on May 7, with intraday swings exceeding $60—marking the steepest single-day drop in two weeks. The renewed U.S.-China trade talks and shifting expectations around the Federal Reserve’s interest rate decisions stirred up uncertainty, driving a surge in safe-haven demand. Meanwhile, ongoing geopolitical tensions and continued physical gold purchases by central banks provided a floor for prices. Investors should closely monitor the $3,380 to $3,420 range and adopt agile strategies to navigate heightened market volatility while managing risk effectively.

2025-05-07 @ 11:20

Gold prices dipped slightly this week, retreating to around $3,380 per ounce, as upcoming high-level talks between the U.S. and China eased market concerns and reduced demand for safe-haven assets. However, analysts maintain a bullish outlook, citing continued central bank purchases and persistent geopolitical tensions as strong support for gold. Investors are encouraged to use this short-term pullback as an opportunity to rebalance their portfolios and strengthen their positions in precious metals.

2025-05-07 @ 10:58

On May 6, 2025, international gold prices surged to $3,432.50 per ounce, marking a recent high. This sharp increase was driven by rising geopolitical tensions, uncertainty surrounding the Federal Reserve’s monetary policy, and a weakening U.S. dollar—factors which fueled a spike in safe-haven demand. Investors are now closely watching the Fed’s interest rate decision and Chair Jerome Powell’s remarks scheduled for May 7, as both are expected to play a pivotal role in shaping gold price trends in the near term. Stay updated with the latest gold price movements and in-depth technical analysis to keep a pulse on the dynamic gold market.

2025-05-06 @ 12:30

**Gold Prices Surge to $3,333 Amid Geopolitical Tensions and U.S. Tariff Policies**

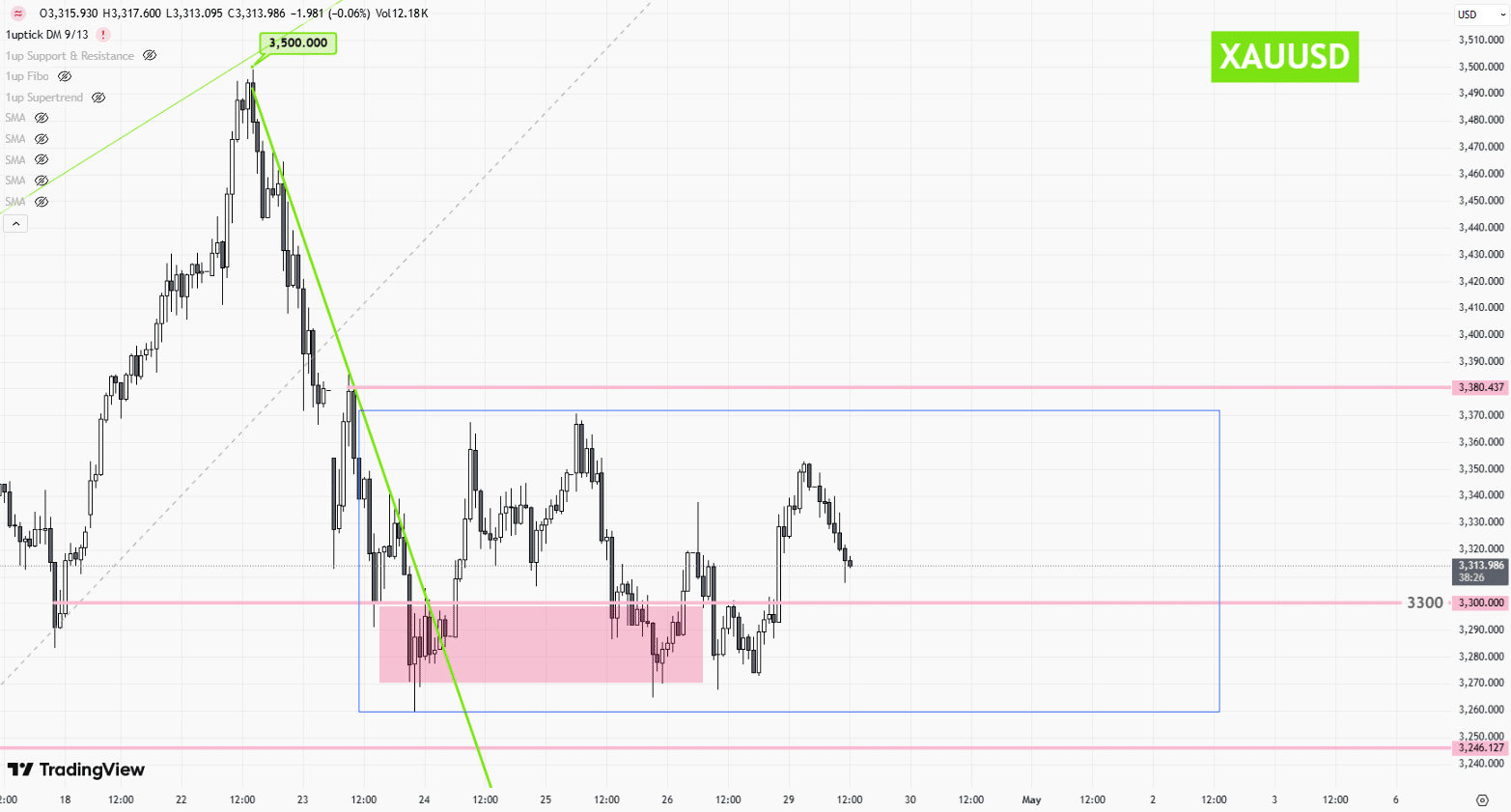

Gold prices have soared to $3,333 per ounce—a one-week high—driven by escalating geopolitical tensions and renewed concerns over U.S. trade tariffs. A pullback in the U.S. dollar and continued gold buying by central banks are further boosting demand for this classic safe-haven asset.

With the Federal Reserve’s upcoming interest rate decision on the horizon, investors should keep a close eye on the $3,290 support level for potential short-term trades, while also considering strategic opportunities for long-term portfolio positioning.

2025-05-03 @ 14:17

Gold prices slipped 2.1% this week, snapping a four-week winning streak, as stronger-than-expected U.S. nonfarm payroll data dampened hopes for near-term interest rate cuts. The rebound in the U.S. dollar and Treasury yields further pressured bullion. Additionally, easing trade tensions between the U.S. and China, along with softer demand during China’s May Day holiday, reduced safe-haven buying. On the technical front, the key support level to watch is $3,200. Investors should closely monitor upcoming Federal Reserve policy signals and global geopolitical developments, both of which could play a crucial role in shaping gold’s next move.

2025-05-02 @ 13:34

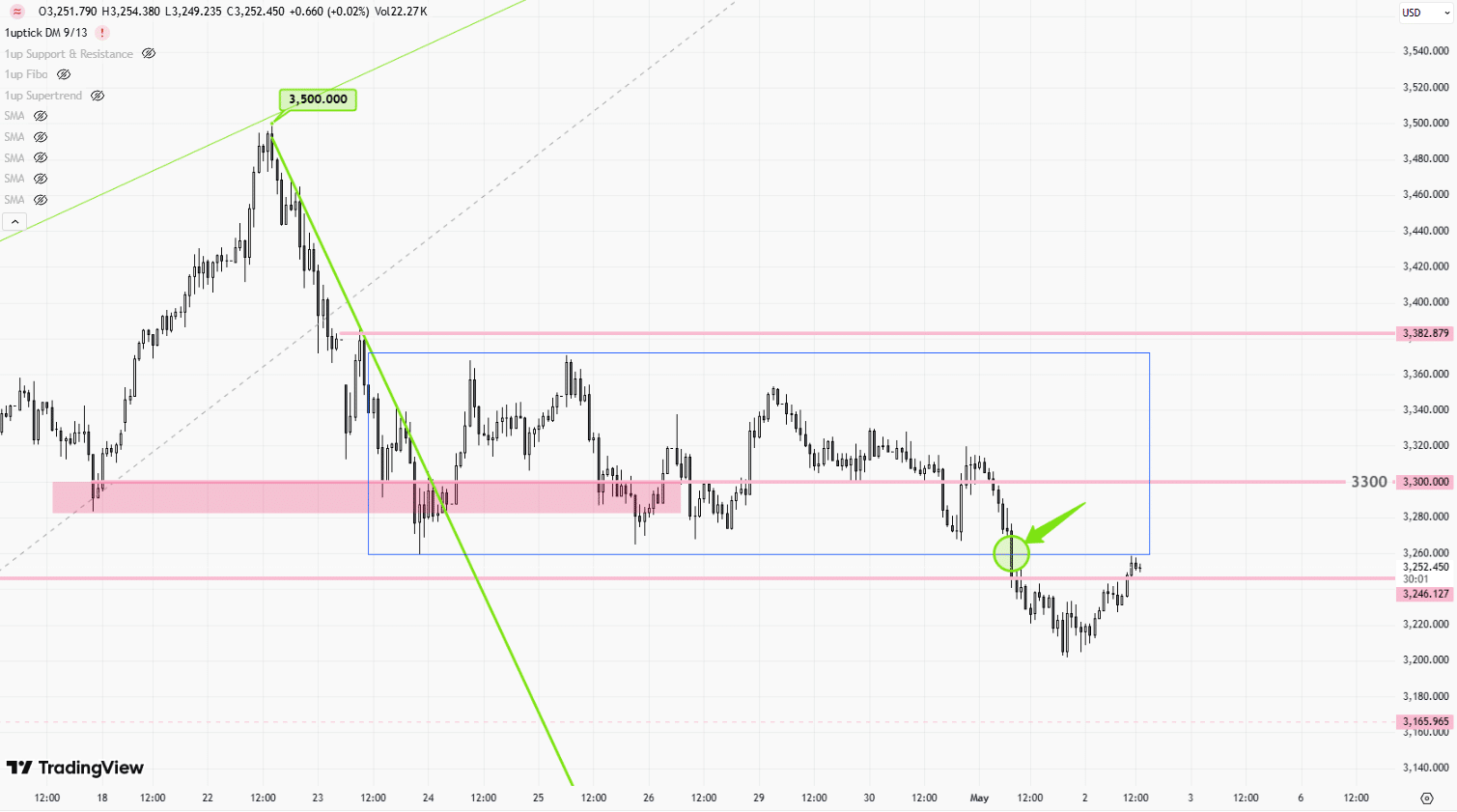

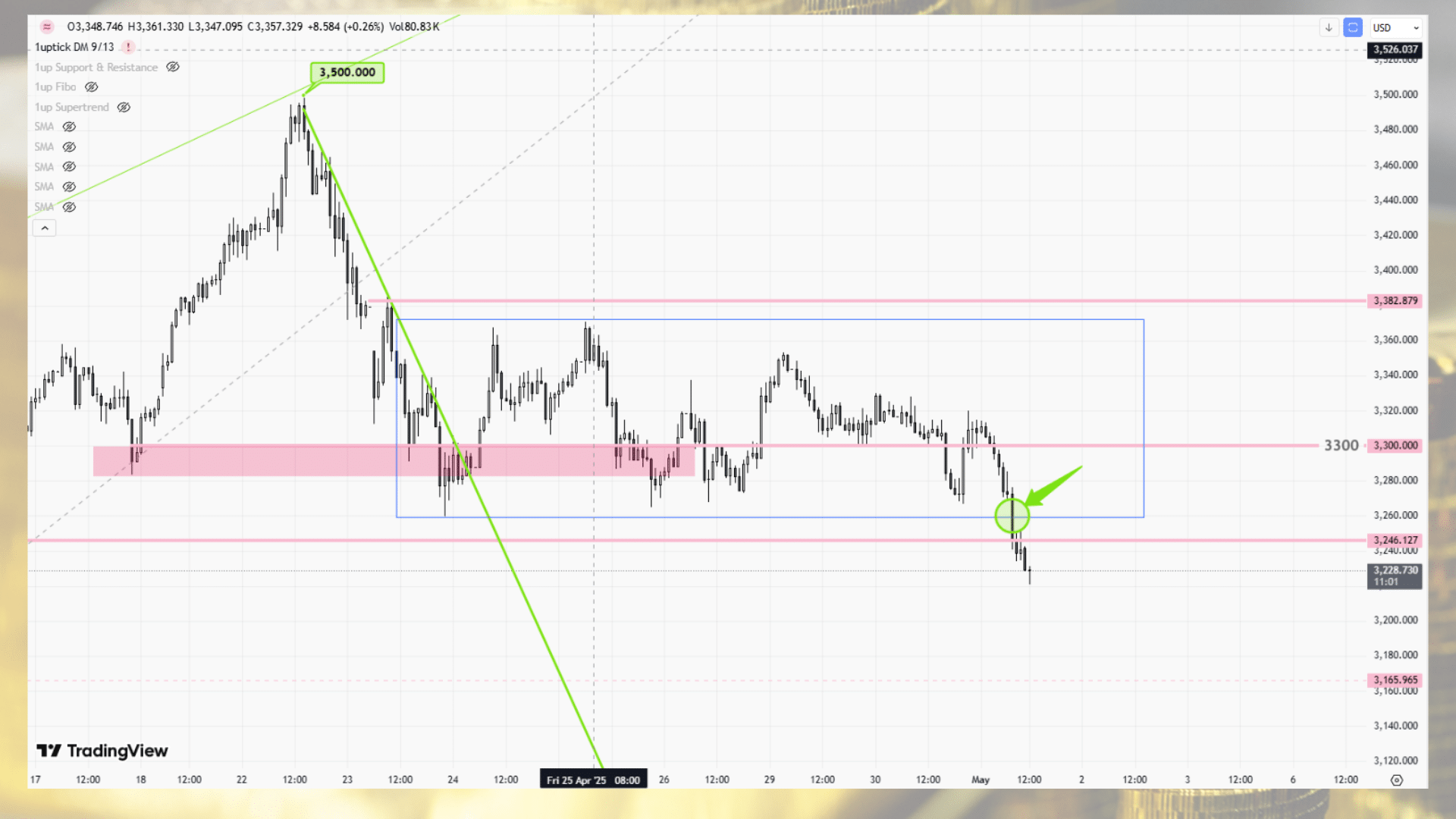

Spot gold prices dipped this week, slipping 0.26% in a single session as a stronger U.S. dollar and waning safe-haven demand weighed on the market. After breaching the key $3,300 technical support level, gold’s near-term outlook appears mixed, with both risks and opportunities on the horizon. Upcoming U.S. non-farm payroll data and potential shifts in U.S.-China tariff policy could mark a turning point for gold prices. Stay informed with the latest gold price trends and investment insights to navigate the evolving precious metals market.

2025-05-01 @ 12:53

Spot gold (XAU/USD) fell for a second straight day, pressured by a stronger U.S. dollar and fading demand for safe-haven assets. Prices dipped to $3,265.45 per ounce, testing key technical support levels. Investors are now turning their attention to this week’s U.S. non-farm payroll data, which could influence the Federal Reserve’s interest rate outlook and, in turn, impact the direction of gold prices. Stay updated with the latest gold market analysis and investment strategies to navigate shifting market trends.

2025-04-30 @ 15:16

Spot gold prices fell 0.78% over the past 24 hours to $3,316.70 per ounce, as improving market sentiment and investor caution ahead of upcoming U.S. inflation and employment data weighed on prices. A stronger U.S. dollar and technical selling added further pressure. However, if the upcoming economic indicators point to a slowdown, gold could see a short-term rebound. Stay informed with the latest gold price trends and market insights to make smarter investment decisions.

2025-04-30 @ 11:48

Spot gold prices fell 0.78% over the past 24 hours to $3,316.70 per ounce, as improving market sentiment and investor caution ahead of upcoming U.S. inflation and employment data weighed on prices. A stronger U.S. dollar and technical selling added further pressure. However, if the upcoming economic indicators point to a slowdown, gold could see a short-term rebound. Stay informed with the latest gold price trends and market insights to make smarter investment decisions.

2025-04-29 @ 12:27

Spot gold has shown a dip-and-rise pattern over the past 24 hours, rebounding sharply as uncertainty over U.S.-China trade talks and increasing demand for safe-haven assets pushed prices higher. Gold briefly touched an intraday high of $3,338 before closing at $3,347.80. A weakening U.S. dollar and falling Treasury yields also contributed to gold’s upward momentum.

With key U.S. economic data—including GDP and non-farm payrolls—set to be released soon, market attention is intensifying. From a technical perspective, gold still holds short-term bullish momentum. Traders are closely watching the resistance level at $3,370 and the support zone near $3,260.

Stay updated with the latest gold price trends and market analysis to make informed trading decisions.