Technical Analysis

Evaluate price trends and patterns, identify potential investments and trading opportunities!

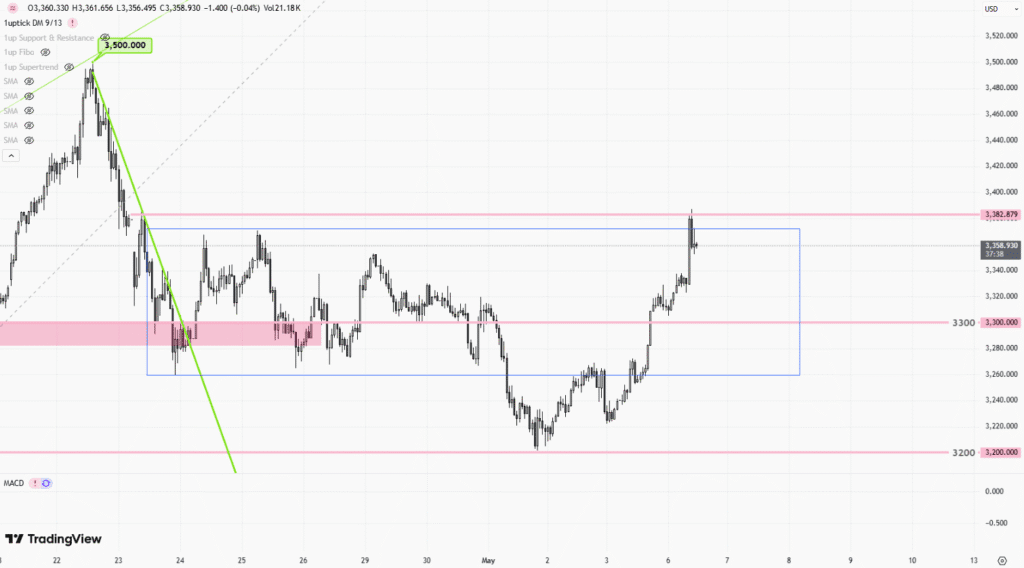

Gold Prices Swing Over $60 Amid US-China Talks and Fed Policy Shifts — Key Watch Zone Between $3,380 and $3,420

Gold prices saw significant turbulence on May 7, with intraday swings exceeding $60—marking the steepest single-day drop in two weeks. The renewed U.S.-China trade talks and shifting expectations around the Federal Reserve’s interest rate decisions…

Gold prices fell sharply as Chinese and US officials met on tariffs this week

Gold prices dipped slightly this week, retreating to around $3,380 per ounce, as upcoming high-level talks between the U.S. and China eased market concerns and reduced demand for safe-haven assets. However, analysts maintain a bullish…

[Daily Closing 🔔] Gold – Gold Prices Surge on May 6, 2025 Amid Rising Market Uncertainty and Central Bank Buying

On May 6, 2025, international gold prices surged to $3,432.50 per ounce, marking a recent high. This sharp increase was driven by rising geopolitical tensions, uncertainty surrounding the Federal Reserve's monetary policy, and a weakening…

Gold Surges Past $3,333 an Ounce as Geopolitical Tensions Rise and Dollar Retreats

**Gold Prices Surge to $3,333 Amid Geopolitical Tensions and U.S. Tariff Policies** Gold prices have soared to $3,333 per ounce—a one-week high—driven by escalating geopolitical tensions and renewed concerns over U.S. trade tariffs. A pullback…

[Daily Closing 🔔] Gold – Gold Price Outlook: Impact of U.S. Jobs Data and China-U.S. Trade Relations on Global Spot Gold Trends

Gold prices slipped 2.1% this week, snapping a four-week winning streak, as stronger-than-expected U.S. nonfarm payroll data dampened hopes for near-term interest rate cuts. The rebound in the U.S. dollar and Treasury yields further pressured…

[Daily Closing 🔔] Gold – Gold Prices Slip Amid Volatility on Thursday as Stronger U.S. Dollar Weighs on Market

Spot gold prices dipped this week, slipping 0.26% in a single session as a stronger U.S. dollar and waning safe-haven demand weighed on the market. After breaching the key $3,300 technical support level, gold’s near-term…

[Daily Closing 🔔] Gold – Gold Prices Slip as Stronger U.S. Dollar and Easing Safe-Haven Demand Weigh on Market

Spot gold (XAU/USD) fell for a second straight day, pressured by a stronger U.S. dollar and fading demand for safe-haven assets. Prices dipped to $3,265.45 per ounce, testing key technical support levels. Investors are now…

Latest FX Analysis

USDCAD-Daily

Latest Gold Analysis

Gold Trend 07/04 – Gold Enters a Consolidation Phase

1uptick Insight

![[Daily Closing 🔔] Gold – Gold Prices Surge on May 6, 2025 Amid Rising Market Uncertainty and Central Bank Buying](https://int.1uptick.com/wp-content/uploads/2025/05/2025-05-07T025824.761Z-file-1024x576.png)

![[Daily Closing 🔔] Gold – Gold Price Outlook: Impact of U.S. Jobs Data and China-U.S. Trade Relations on Global Spot Gold Trends](https://int.1uptick.com/wp-content/uploads/2025/05/2025-05-03T061704.162Z-file-1024x567.png)

![[Daily Closing 🔔] Gold – Gold Prices Slip Amid Volatility on Thursday as Stronger U.S. Dollar Weighs on Market](https://int.1uptick.com/wp-content/uploads/2025/05/2025-05-02T053426.282Z-file-1024x571.png)

![[Daily Closing 🔔] Gold – Gold Prices Slip as Stronger U.S. Dollar and Easing Safe-Haven Demand Weigh on Market](https://int.1uptick.com/wp-content/uploads/2025/05/2025-05-01T045328.050Z-file-1024x576.png)