|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump’s New Tariffs Shake Global Trade and Markets

2025-02-12 @ 16:08

Trump Announces Major Tariffs on Steel and Aluminum Imports

President Donald Trump has unveiled a series of new tariffs aimed at reshaping the U.S. trade landscape. At the forefront of these changes are 25% tariffs on all steel and aluminum imports, which have been implemented immediately. These measures align with his broader strategy to support domestic industries and correct trade imbalances.

Introduction of Reciprocal Tariffs

A significant aspect of Trump’s tariff policy is the introduction of reciprocal tariffs, which are set to match the duties imposed by other nations on U.S. goods. This means:

- If a country places a high tariff on U.S. exports, the U.S. will impose an equivalent rate on imports from that nation.

- The goal is to establish fair trade practices and reduce trade discrepancies.

- Countries like India, which impose higher tariffs on U.S. products than the U.S. does on Indian exports, are likely to be heavily impacted.

Effects on Major Trading Partners

Trump’s reciprocal tariff strategy will apply to all trading partners, including Mexico, Canada, and China. India, in particular, could face significant economic repercussions, as:

- India’s weighted average effective tariff on U.S. exports is 9.5%.

- The U.S. tariff on Indian imports is comparatively low at just 3%.

- With the new reciprocal tariffs, businesses exporting to the U.S. from high-tariff countries may face increased costs.

Rationale Behind the Tariffs

President Trump has provided multiple justifications for these tariffs, linking them to key policy goals such as:

National Security and Trade Balance

- Protecting core industries like steel and aluminum is framed as essential for national security.

- Ensuring fair market competition against foreign manufacturers.

- Encouraging domestic business growth by reducing reliance on foreign providers.

Immigration and Drug Trafficking

- Trump suggests that leveraging tariffs could compel other nations to assist in reducing illegal immigration.

- Tariffs may also be used as an economic tool to stop fentanyl smuggling, primarily from countries like China and Mexico.

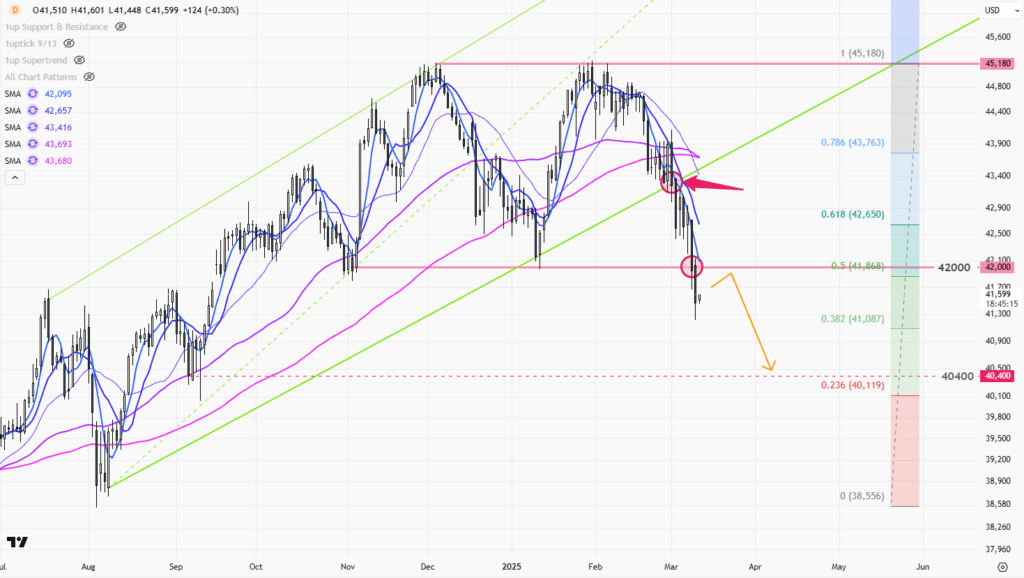

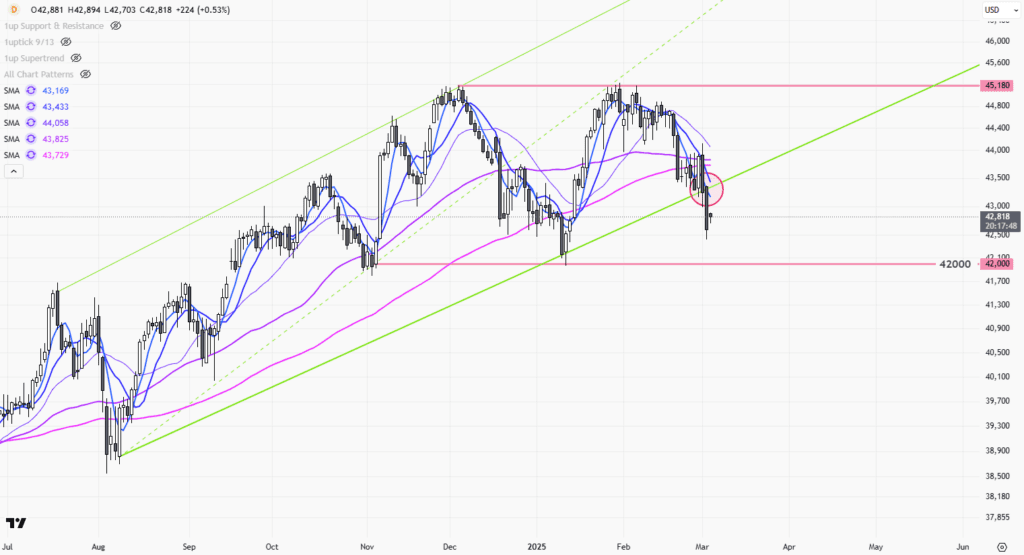

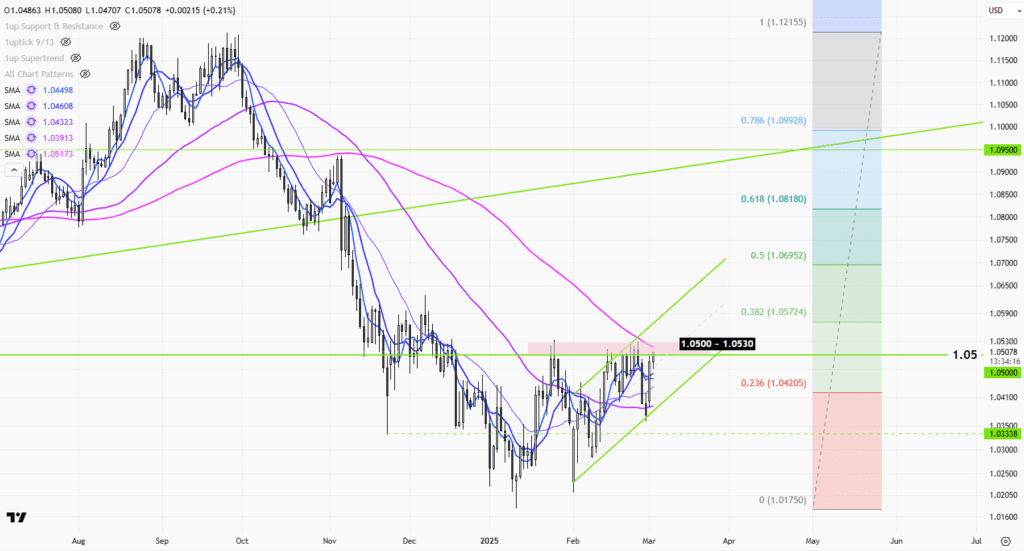

Market Reactions and Economic Implications

The financial markets have already started responding to these tariff announcements.

- Indian stock markets have seen a sharp downturn following these developments.

- The possibility of retaliatory tariffs from affected countries raises concerns of a potential trade war.

- Global investors are closely watching how Wall Street will respond to these new trade policies.

Despite existing apprehensions, some experts suggest that reciprocal tariffs might lead to more balanced trade policies, which could be favorable for long-term economic stability.