|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump’s New Tariffs Trigger Market Volatility and Inflation Fears

2025-04-02 @ 19:08

Trump’s Latest Tariff Rollout Sparks Global Economic Uncertainty

The recent reintroduction of tariffs by the Trump administration is sending shockwaves through global financial markets. With a potentially far-reaching impact on everything from household budgets to international trade relations, this new policy direction is ushering in a climate of elevated economic risk.

Here’s a breakdown of the most significant developments and what investors and consumers should watch in the coming weeks:

How Tariffs Could Cost the Average U.S. Household Thousands

Rising import taxes don’t just hit businesses — they trickle down to the cash register. According to recent projections, U.S. households could pay up to $5,200 more annually as companies pass on higher costs associated with tariffs to consumers.

- Groceries, electronics, and household goods are expected to see the steepest price hikes.

- Tariffs act as a hidden tax, impacting family budgets without direct legislative approval.

- High inflation and tariff-induced costs could further constrain consumer spending.

Job Creation? The Data Paint a Contradictory Picture

While tariffs aim to bring jobs back to American shores, economists warn that tariffs rarely achieve sustainable employment growth. In some cases, they even lead to job losses in sectors dependent on global supply chains.

- Historically, manufacturing job growth has not followed tariff rollouts.

- Small businesses and exporters are often the most adversely affected.

- Domestic production costs rise, making U.S.-made goods less competitive internationally.

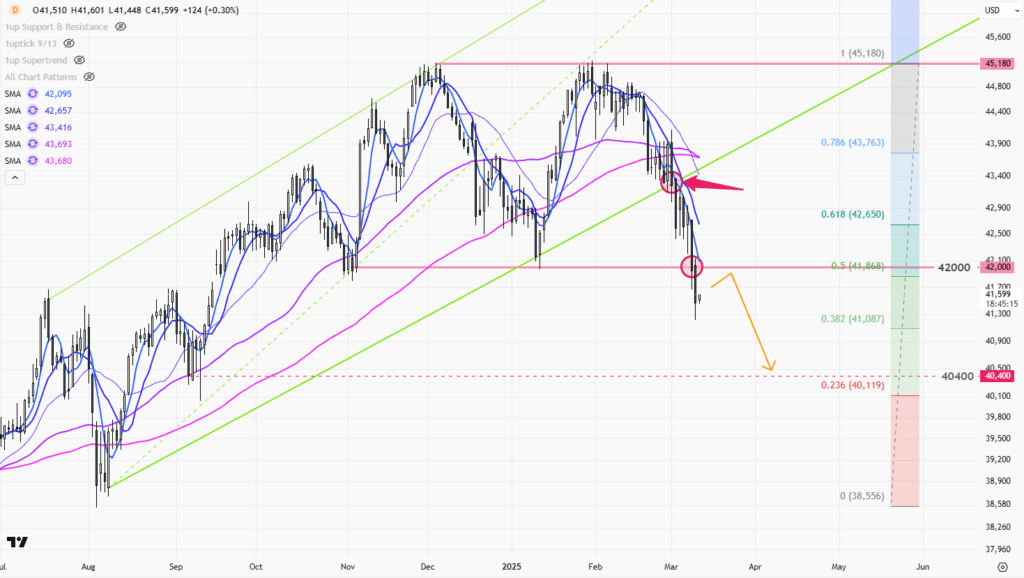

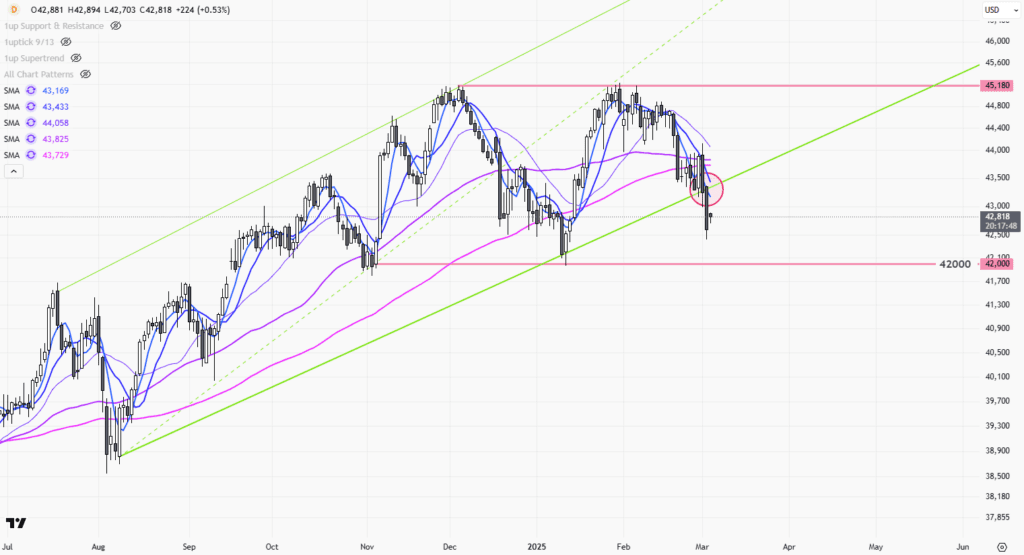

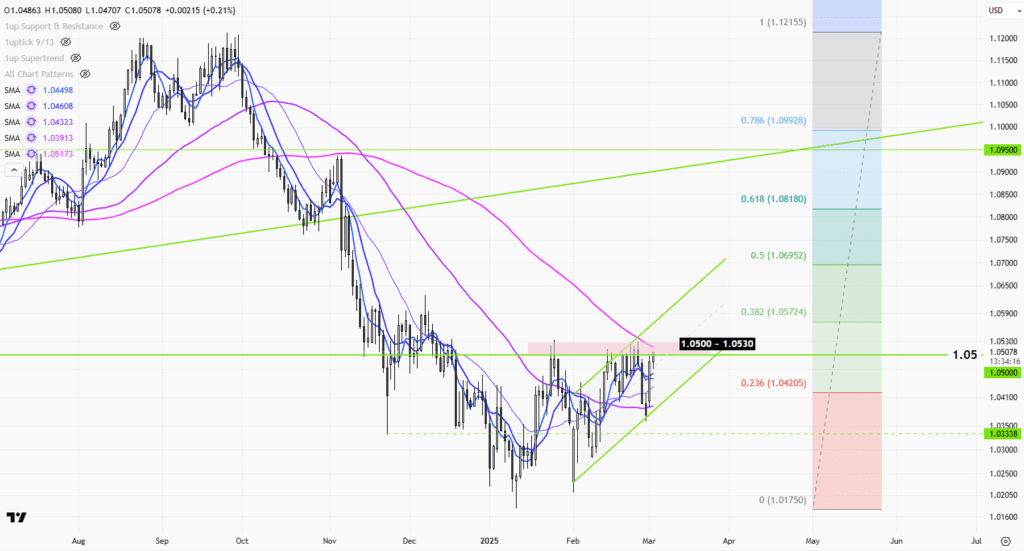

Global Equity Markets React with Caution

The financial ripples are already visible. Since the announcement, global markets have posted mixed reactions, with sectors tied to international trade bearing the brunt.

- Manufacturing and industrial stocks led the decline in both U.S. and Asian markets.

- Investors are rotating into defensive assets amid growing trade tension fears.

- Indexes like the S&P 500 and Dow Jones showed increased volatility following the announcement.

Trade Partners Poised to Strike Back

Adding more fuel to the fire, international trade allies are preparing retaliatory tariff measures. The risk of a full-scale trade war is now much closer to reality.

- The EU, China, and Canada have indicated they are reviewing reciprocal trade penalties.

- Escalating tit-for-tat tariffs could suppress global GDP growth.

- Investor sentiment capable of shifting—or even collapsing—based on abrupt foreign policy shifts.

Supply Chains Face Growing Inefficiencies and Disruptions

As American firms source many components and raw materials globally, tariffs will likely cause significant operational disruptions.

- Delays, shortages, and increased manufacturing costs are already being reported in sectors like electronics, apparel, and automotive.

- Many companies are evaluating new supplier relationships or reshoring options, both of which carry high transition costs.

- These complications could lead to consumer-facing price increases and supply bottlenecks in the next two quarters.

High-Stakes Economic Outlook Ahead

With business investment slowing already, the uncertainty brought on by this tariff policy could significantly deter capital expenditure.

- Consumer sentiment indexes have dipped sharply since the announcement.

- Business confidence is fragile, creating hesitancy around expansion and hiring.

- Volatile policy swings reduce the predictability needed for sound corporate planning.

As the tariff landscape continues to evolve, economists, policymakers, and investors alike are closely tracking its short and long-term implications on a fragile global economy.