|

| Gold V.1.3.1 signal Telegram Channel (English) |

[Daily Closing 🔔] Gold – Gold Prices Slip as Stronger U.S. Dollar and Easing Safe-Haven Demand Weigh on Market

[Daily Closing 🔔] Gold – Gold Prices Slip as Stronger U.S. Dollar and Easing Safe-Haven Demand Weigh on Market

2025-05-01 @ 12:53

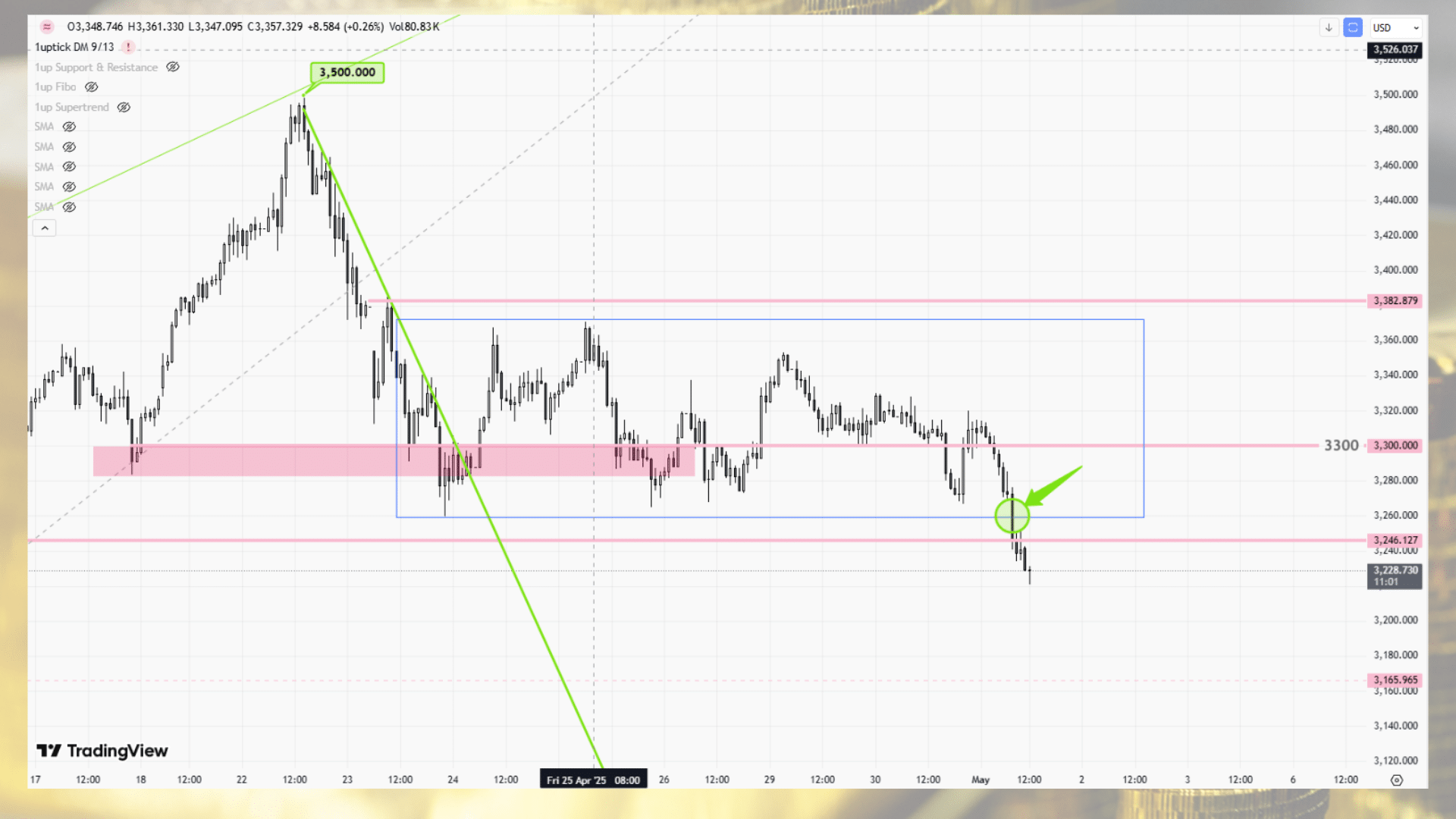

Spot gold (XAU/USD) fell for a second straight session over the past 24 hours, pressured by a stronger U.S. dollar and easing demand for safe-haven assets. During early trading, gold slipped to $3,265.45 per ounce—a roughly 0.7% drop from the previous day. U.S. gold futures also dipped, settling at $3,273.70, down 1.4%. Still, prices remain up nearly 5% for April, putting gold on track for a fourth consecutive monthly gain.

The U.S. dollar index rose 0.2%, hitting new recent highs. Although first-quarter GDP unexpectedly contracted by 0.3%, markets are backing away from expecting near-term rate cuts by the Federal Reserve. Expectations of persistently high interest rates have lent support to the dollar, which in turn weighs on gold’s appeal, as it doesn’t yield interest.

Reduced geopolitical tensions also dented gold’s safe-haven lure. China announced tariff exemptions on some U.S. ethane products, while Washington reported positive developments in talks with India and other trade partners. Signs of improved dialogue between the U.S. and China prompted some bullish traders to take a step back.

Attention now shifts to Friday’s upcoming U.S. nonfarm payroll report. Analysts expect around 62,000 new jobs for April, with the unemployment rate holding steady at 4.2%. A stronger-than-expected report could solidify the Fed’s hawkish stance, limiting gold’s upside.

From a technical standpoint, the $3,260 level is a key support zone. A break below could trigger further downside toward $3,200. On the flip side, if prices stabilize and break above resistance at $3,350, gold may retest its monthly highs. In the near term, volatility remains elevated, and investors should closely monitor economic data and the dollar’s movement as the primary drivers of gold prices.