|

| Gold V.1.3.1 signal Telegram Channel (English) |

[Daily Closing 🔔] Gold – U.S. Credit Rating Downgrade Triggers Gold Price Rebound – May 19 Market Recap

[Daily Closing 🔔] Gold – U.S. Credit Rating Downgrade Triggers Gold Price Rebound – May 19 Market Recap

2025-05-20 @ 10:22

Spot gold prices rebounded on Monday, May 19, recovering losses from the previous trading session. According to Kitco, gold touched an intraday high of $3,250.80 per ounce and a low of $3,201.70 before closing at $3,228.40—up $26.70 on the day, or about 0.83%. U.S. gold futures also ended higher, settling at $3,237.80 per ounce, marking a 1.6% gain. The rise reflects renewed market demand for safe-haven assets.

A key driver behind the rally was Moody’s decision to downgrade the U.S. sovereign credit rating. The agency lowered its long-term rating from Aaa to Aa1 last Friday, citing growing fiscal challenges and increasing policy uncertainty. That downgrade deepened concerns over the sustainability of U.S. debt, leading investors to redirect funds toward gold and other traditional havens.

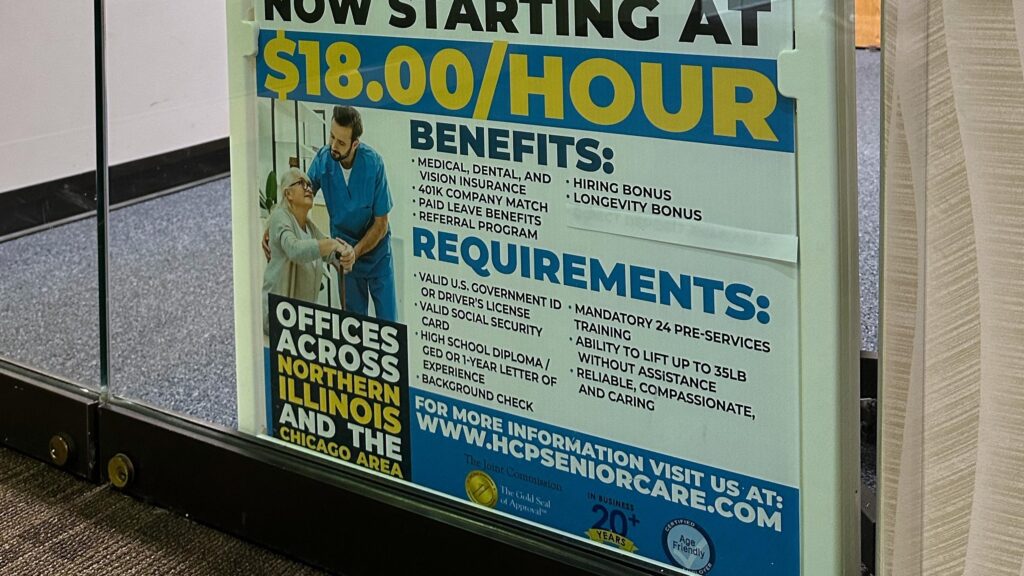

A weaker U.S. dollar also gave gold a boost. The dollar index slipped 0.7% on the day, hitting its lowest level in nearly two weeks. A softer greenback makes dollar-denominated gold more affordable for international buyers, particularly in non-dollar markets, further fueling demand. Meanwhile, markets are closely watching Washington’s moves toward reinstating tariffs on some trading partners—a development that has stoked fears over the global economic outlook and added to the flight to safety.

Geopolitical tensions and economic data added another layer of volatility. In China, April retail sales came in below expectations, and while industrial output showed modest improvement, it wasn’t enough to dispel doubts about the strength of the country’s recovery. In the U.S., political voices calling for interest rate cuts have grown louder, with former President Trump openly pushing for earlier monetary easing. This has lifted market expectations of future rate cuts, offering medium-term support for gold prices.

From a technical perspective, gold’s ability to hold above the key $3,200 level and bounce strongly suggests that buyers remain firmly in control. If risk-off sentiment continues, gold could make another run at the all-time high of $3,500.05 set in late April. However, with the Fed’s policy direction still uncertain and questions lingering over the fiscal outlook, investors should be prepared for significant price swings in the near term.