|

| Gold V.1.3.1 signal Telegram Channel (English) |

Canadian Dollar Holds Steady Ahead of Bank of Canada’s Key Interest Rate Decision on June 4

2025-06-02 @ 13:12

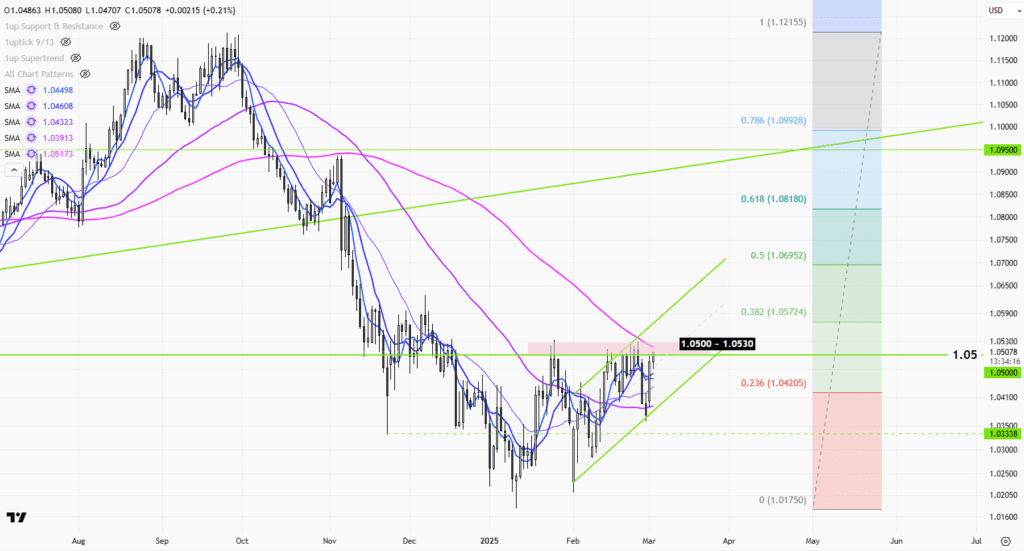

The U.S. dollar has been steadily slipping against the Canadian dollar, continuing its downward trend during the Asian trading hours on Monday, June 3. Currently hovering near 1.3720, the loonie’s strength is underpinned by expectations that the Bank of Canada (BoC) will keep interest rates on hold at its June 4 policy meeting.

Over the past few weeks, the Canadian dollar has been gaining ground. As of Monday, USD/CAD had declined to 1.3731 from a recent high of 1.3913 on May 20. Since the start of the year, the U.S. dollar has dropped about 4.4% against the loonie, a sign that investor confidence in the Canadian currency is returning.

Much of the market’s focus is on whether the BoC will maintain its policy rate at 2.75%. Based on current overnight index swaps pricing, there’s roughly a 70% chance the BoC holds steady.

Josh Nye, Senior Economist at RBC Global Asset Management, notes that unless there’s a major miss in upcoming GDP data, the central bank is likely to stay the course. He highlights that the BoC has already cut interest rates seven times since last summer but paused in April to reassess the broader economy.

Key economic indicators such as core inflation, consumer spending, and labor market trends are increasingly shaping the BoC’s next move.

Jack Manley, Global Market Strategist at J.P. Morgan Asset Management, points to a surprise uptick in April’s core inflation, which is now at the upper end of the BoC’s target range. This, he says, significantly lowers the chance of another near-term rate cut. “We’re seeing signs of artificially boosted retail sales and sticky core inflation—this kind of backdrop suggests the BoC is likely to remain cautious.”

David Doyle, Head of Economics at Macquarie Group, emphasizes the importance of how the central bank interprets headline versus core inflation. With diverging trends between the two, any shift in the BoC’s tone could hint at when future cuts might resume.

Labor market dynamics are another important piece of the puzzle. Stephen Brown, Deputy Chief North America Economist at Capital Economics, says that if employment continues to falter while core inflation stays above target, the BoC will face tough decisions balancing inflation control with economic support.

In the days ahead, markets will be closely watching the BoC’s statement and press conference for any clues on the rate trajectory and its assessment of economic risks. Expect USD/CAD to react accordingly.

For investors focused on forex, this week’s BoC decision and forward guidance could set the tone for the Canadian dollar in the second half of the year.