|

| Gold V.1.3.1 signal Telegram Channel (English) |

Nvidia Q2 2026 Earnings Preview: Blackwell AI Drives Record Growth and Market Expectations

2025-08-24 @ 22:00

As Nvidia prepares to release its quarterly earnings report on August 27, 2025, the financial world is closely watching the outcome. With Nvidia shares trading near all-time highs and the company dominating conversations around artificial intelligence (AI), this earnings announcement promises to be a pivotal moment for both the stock and the broader AI industry.

In recent years, Nvidia’s financial performance has set a breakneck pace for growth. Fiscal 2025 saw revenue climb to $130.5 billion, an astonishing increase of 114% over the previous year. The company’s diluted earnings per share for the year reached $2.94, marking a 147% surge year-over-year. This momentum has been underpinned by Nvidia’s expertise in AI chips and an exponential surge in demand for its cutting-edge technologies.

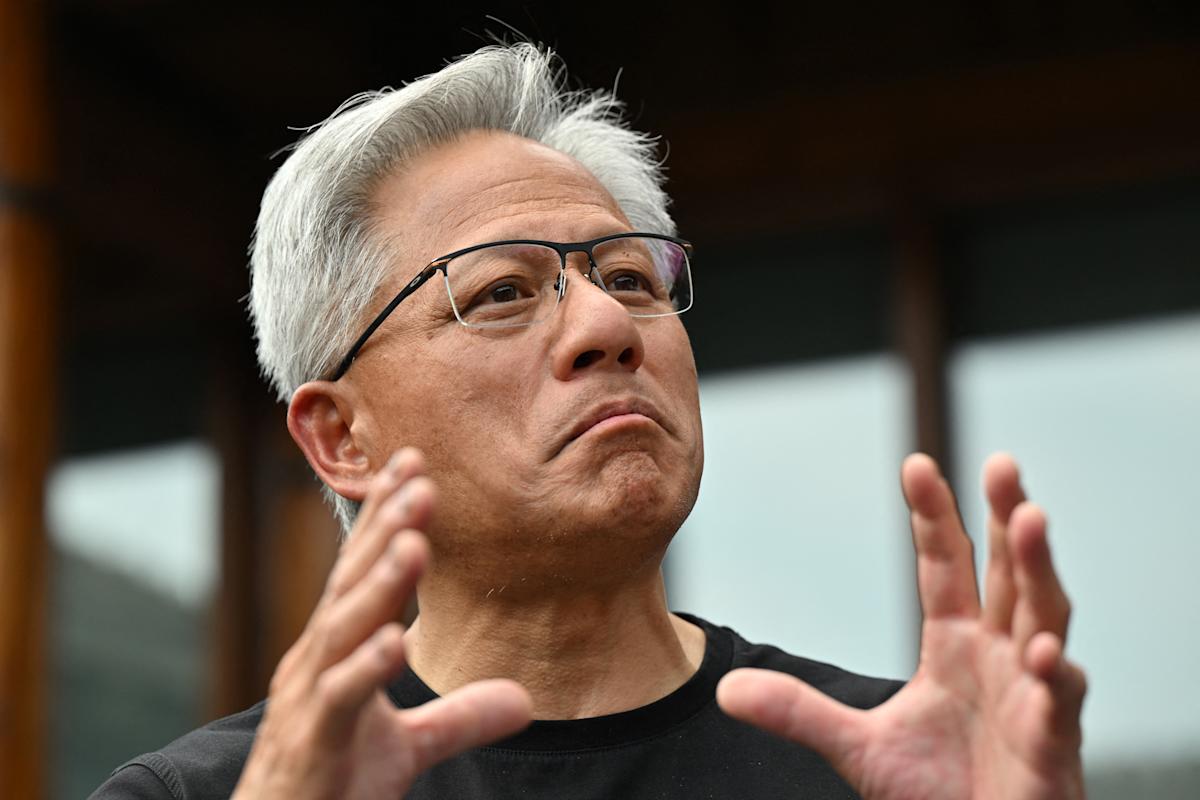

The spotlight this quarter is on Nvidia’s newest AI hardware, especially its Blackwell AI supercomputers. CEO Jensen Huang has described demand for Blackwell as “amazing,” noting that advanced reasoning AI is driving a new scaling law—every boost in computational power leads to smarter AI models and faster, more accurate answers. Nvidia’s rapid ramp-up of Blackwell production, with billions of dollars in sales already booked since launch, underscores the scale and speed at which the AI revolution is unfolding.

Nvidia’s last reported quarterly results showed $39.3 billion in revenue, a 78% jump from the same period a year ago and up 12% sequentially. The company’s gross margin continues to be robust, with expectations around 70-71% for the upcoming quarter. Such margins, bolstered by operational efficiencies and product mix, have sustained investor confidence as Nvidia aggressively invests in research, manufacturing, and global expansion.

What’s at stake in this week’s earnings announcement is more than just Nvidia’s stock price. The results are widely seen as a litmus test for the entire AI-driven rally in technology stocks. Wall Street will be scrutinizing revenue growth, margins, and guidance for future quarters to gauge whether Nvidia’s extraordinary trajectory can be maintained. The company’s recent streak of triple-digit year-over-year growth—126% in fiscal 2024, 114% in fiscal 2025—is unlikely to continue indefinitely, and investors are eager to see if the next stage of expansion can meet sky-high expectations.

Beyond the numbers, analysts are attentive to any updates on Nvidia’s key AI customers—major cloud providers, research institutions, and emerging enterprise adopters. Clues about demand trends, product roadmaps, and competitive dynamics could influence not only Nvidia’s valuation but also affect perceptions of the broader semiconductor and AI ecosystem. There is also interest in how Nvidia will address supply chain constraints and how quickly it can scale production to meet overwhelming demand.

Several factors will be central to this earnings call:

- The pace of adoption for Nvidia’s latest chips and AI systems, notably the Blackwell line.

- Margin trends, particularly gross and operating margins, as production volumes increase.

- Updated guidance for fiscal Q3 and beyond, with Wall Street eager for signs of sustained growth or adjustments to previous outlooks.

- Strategic comments from management on the future of agentic and physical AI and their potential to transform large sectors such as healthcare, manufacturing, automotive, and more.

Nvidia remains at the forefront of the AI investment story. Its influence extends far beyond semiconductor design, shaping everything from data center architecture to advanced robotics. With shares near record highs, any deviation—positive or negative—from expected earnings and outlook will have far-reaching implications across equity markets.

For individual investors and market professionals alike, Nvidia’s quarterly results are not just numbers on a page; they reflect the health and trajectory of the AI revolution itself. Whether the company can continue to exceed expectations or begins to normalize its growth rates will be critical in determining both its valuation and the sentiment across the technology landscape.

In summary, this week’s earnings report is a crucial inflection point. All eyes are on Nvidia as it attempts to justify its lofty market capitalization and maintain its leadership role in AI innovation. Regardless of the outcome, the ripple effects from Nvidia’s performance will help shape the narrative around technology investing and the future potential of artificial intelligence in the global economy.