|

| Gold V.1.3.1 signal Telegram Channel (English) |

SoftBank’s $2 Billion Investment in Intel: What It Means for the Semiconductor Industry and Investors

2025-08-19 @ 22:00

SoftBank’s $2 Billion Bet on Intel: What Investors Need to Know

Intel shares surged recently after SoftBank Group, the Japanese technology conglomerate, announced a substantial $2 billion investment in the iconic American chipmaker. This move—one of the most significant tech investments of the year—signals renewed confidence in Intel’s future and highlights accelerating momentum in the global semiconductor industry.

Understanding the Investment

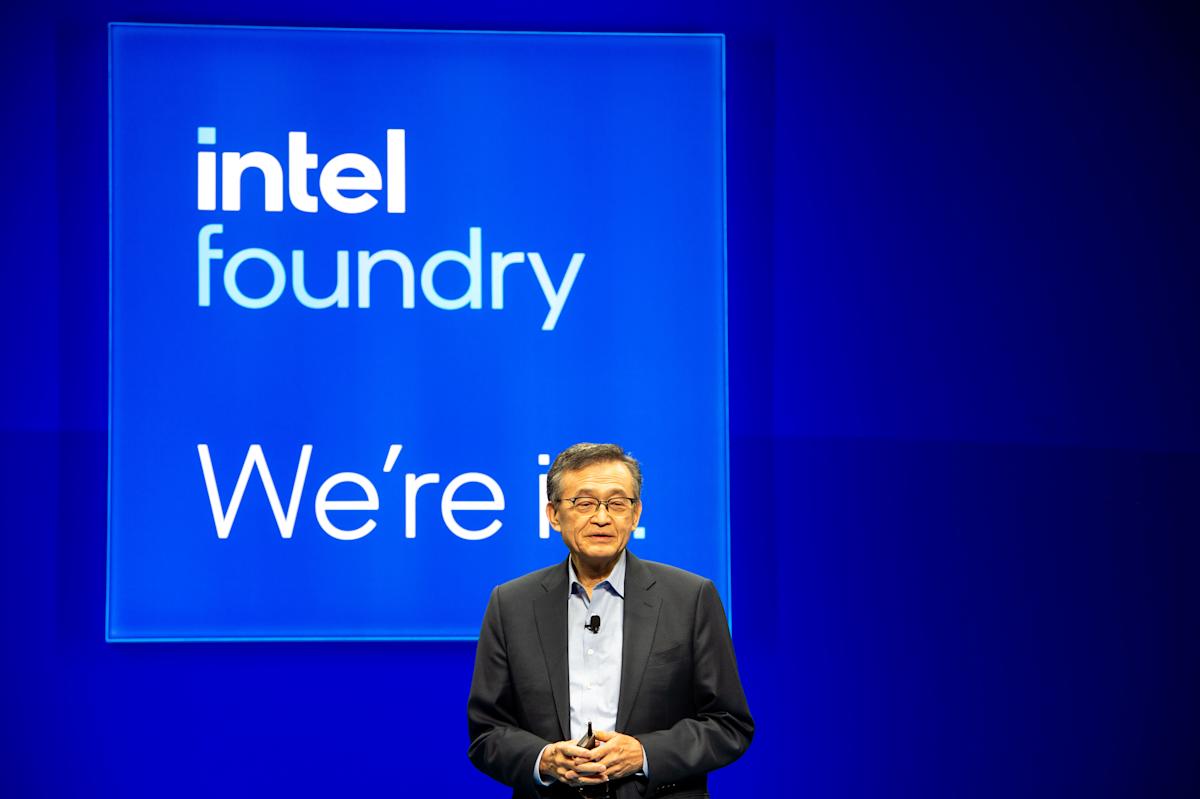

SoftBank agreed to purchase $2 billion worth of Intel’s common stock at $23 per share. This transaction represents approximately a two percent stake in Intel, and is subject to customary closing conditions. The deal was struck between SoftBank’s visionary chairman Masayoshi Son and Intel’s CEO Lip-Bu Tan, both of whom emphasized the strategic and long-term nature of this partnership.

Why Is SoftBank Backing Intel?

SoftBank’s chairman Masayoshi Son described semiconductors as “the foundation of every industry,” lauding Intel’s half-century of innovation. The rationale behind the investment is clear: supporting the expansion of advanced semiconductor manufacturing and supply in the United States, with Intel positioned at the heart of this transformation.

Intel, once an unrivaled leader in chip manufacturing, has faced stiff competition over the past decade from rivals such as AMD, Nvidia, and various Asian chipmakers. SoftBank’s significant capital injection is intended to fuel Intel’s ambitions in next-generation technologies, artificial intelligence infrastructure, and digital transformation.

Why Now? Semiconductor Sector at a Crossroads

The semiconductor industry is undergoing seismic shifts, driven by demand for AI, cloud computing, and emerging technologies. Both SoftBank and Intel expressed their commitment to deepening investments in these sectors. Intel has announced several initiatives to modernize its manufacturing capability and reassert its dominance, including new plants and research into advanced chip architectures.

SoftBank’s investment comes at a critical juncture:

- Global semiconductor demand is soaring, with AI and data centers fueling explosive growth.

- Intel has lagged behind rivals in cutting-edge manufacturing, prompting calls for renewed innovation and capital investment.

- Geopolitical tensions and supply chain vulnerabilities have made U.S.-based manufacturing more crucial than ever.

With SoftBank’s financial backing, Intel is better positioned to capitalize on these opportunities, potentially reclaiming its status as a technology trailblazer.

Market Reaction and What It Means for Investors

Following news of the SoftBank deal, Intel’s stock jumped five percent, reflecting market enthusiasm. For existing shareholders, this investment is a vote of confidence from one of the world’s most influential tech investors.

SoftBank’s history as a strategic investor is notable—last decade, the company made headlines for large bets in technology, most famously through its Vision Fund. Its investment in Intel is not just about financial returns, but also about accelerating access to advanced technologies and digital infrastructure. For Intel, this endorsement may make it easier to secure further funding, attract talent, and pursue ambitious R&D initiatives.

Leadership Commentary

Both Masayoshi Son and Lip-Bu Tan have underscored their shared vision for technological progress. Son emphasized the importance of semiconductor leadership for the U.S. economy and global innovation. Tan, who has collaborated with Son for many years, conveyed appreciation for SoftBank’s confidence and stated that both companies share a commitment to advancing U.S. manufacturing and innovation leadership.

What’s Next for Intel?

With increased resources, Intel is expected to:

- Expand U.S.-based manufacturing facilities.

- Pursue leadership in AI, cloud computing, and data infrastructure.

- Invest aggressively in research and development to close the tech gap with competitors and push the boundaries of chip design.

For SoftBank, this investment strengthens its presence in the global tech ecosystem—a strategic position as AI and semiconductors reshape industries worldwide.

Key Takeaways for Market Watchers

- SoftBank’s $2 billion stake is a bullish signal for Intel’s future, and for the health of the U.S. semiconductor sector.

- Investors should watch for further Intel announcements on R&D, manufacturing expansion, and strategic partnerships.

- This deal highlights the broader trend: urgent, large-scale investment is flowing into technologies critical to AI and digital transformation.

In summary, SoftBank’s investment in Intel marks a pivotal moment for both companies and the wider semiconductor industry. For financial bloggers and investors alike, this partnership not only signals market confidence, but sets the stage for disruptive growth and innovation in the years ahead.