|

| Gold V.1.3.1 signal Telegram Channel (English) |

AUDUSD Technical Analysis: Key 0.6600 Support Holds as Crucial Patterns Signal Upcoming Volatility

2025-12-22 @ 08:01

Over the past 24 to 48 hours, the Australian Dollar against the US Dollar (AUD/USD) experienced relatively subdued moves after testing a two-week low, currently trading at 0.6610, slightly down from yesterday’s close of 0.66122. The price action reflects investors’ fading reaction to recent US Consumer Price Index (CPI) data, which initially sparked a rally but later retreated due to weakening market risk appetite.

One of Australia’s major banks, NAB, highlights that fundamental drivers support a stronger Aussie. However, the currency struggles amid disappointing US and Chinese economic data and weak global equity markets, preventing sustained gains. Especially after the US CPI release, risk-off sentiment led investors to seek safe-haven assets, putting downward pressure on AUD/USD.

In simple terms for the average investor, recent AUD fluctuations are tied to global economic uncertainties, notably US inflation and Chinese data concerns. In the near term, the market remains cautious, waiting for clearer catalysts, keeping the Australian Dollar hovering near the key 0.66 support level.

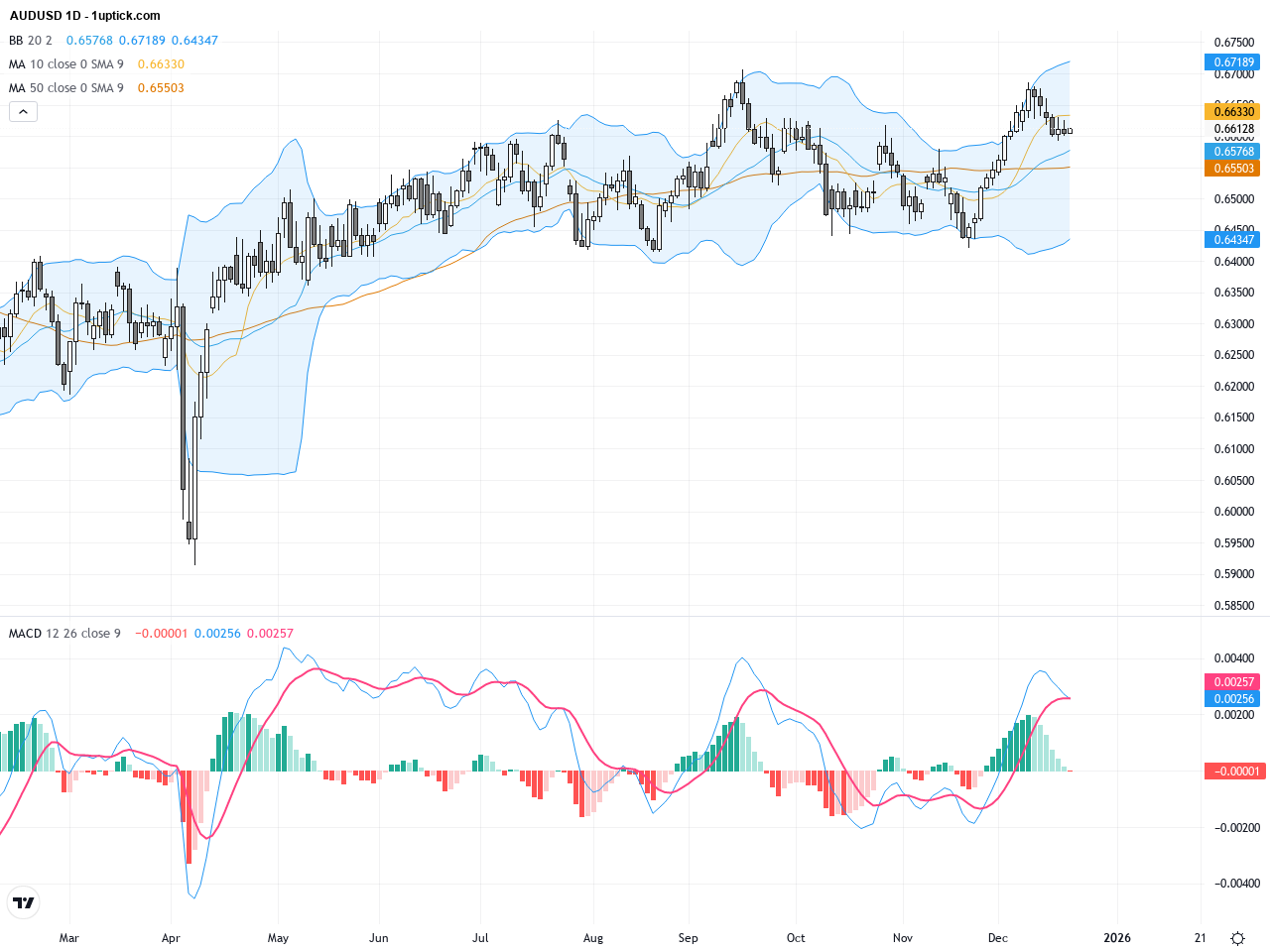

The daily chart reveals AUDUSD’s gradual decline from recent highs near 0.67 down to around 0.66, maintaining positioning above both the 50-day and 200-day moving averages, suggesting sustained longer-term support. Bollinger Bands have narrowed slightly with a subtle downward tilt, indicating contracting volatility but with bearish leanings. The MACD indicator shows weakening momentum but has yet to form a decisive bearish crossover, implying the downtrend lacks full confirmation. The current pattern suggests consolidation, and the critical question is whether the 0.66 support will hold, providing a platform for renewed bullish attempts towards yearly highs.

On the hourly chart covering the past 3-5 days, AUDUSD has frequently tested the 0.6600 support, forming a clear sideways trading range. The price has encountered resistant pressure from the 20-hour moving average multiple times. A recent bearish MACD crossover indicates growing short-term selling momentum. Additionally, widening Bollinger Bands warn of increased price volatility ahead. The emergence of a bearish engulfing candlestick signals potential short-term downside risk in the next 24 hours, warranting caution for traders looking for quick moves.

Technical Trend: Sideways consolidation with cautious bullish bias

AUDUSD is currently consolidating with a firm support at 0.6600. Although the MACD suggests short-term bearish momentum, the longer-term trend remains cautiously bullish. The technical setup indicates a tug of war around key levels, with a breakout above 0.6650 potentially triggering further gains and a breakdown below 0.6600 leading to downside acceleration. Rising volume and volatility hint at imminent price action, making this phase critical for identifying near-term trade opportunities.Today’s economic calendar features no significant events directly affecting the Australian Dollar. The scheduled data releases from Europe, North America, and Asia, such as the UK’s GDP and China’s loan rate, are unlikely to cause immediate AUDUSD swings. Nevertheless, global risk sentiment shifts may indirectly influence AUDUSD given broader market correlations. Investors should monitor these peripheral data points but expect limited direct impact from today’s schedule.

Resistance & Support

The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.