|

| Gold V.1.3.1 signal Telegram Channel (English) |

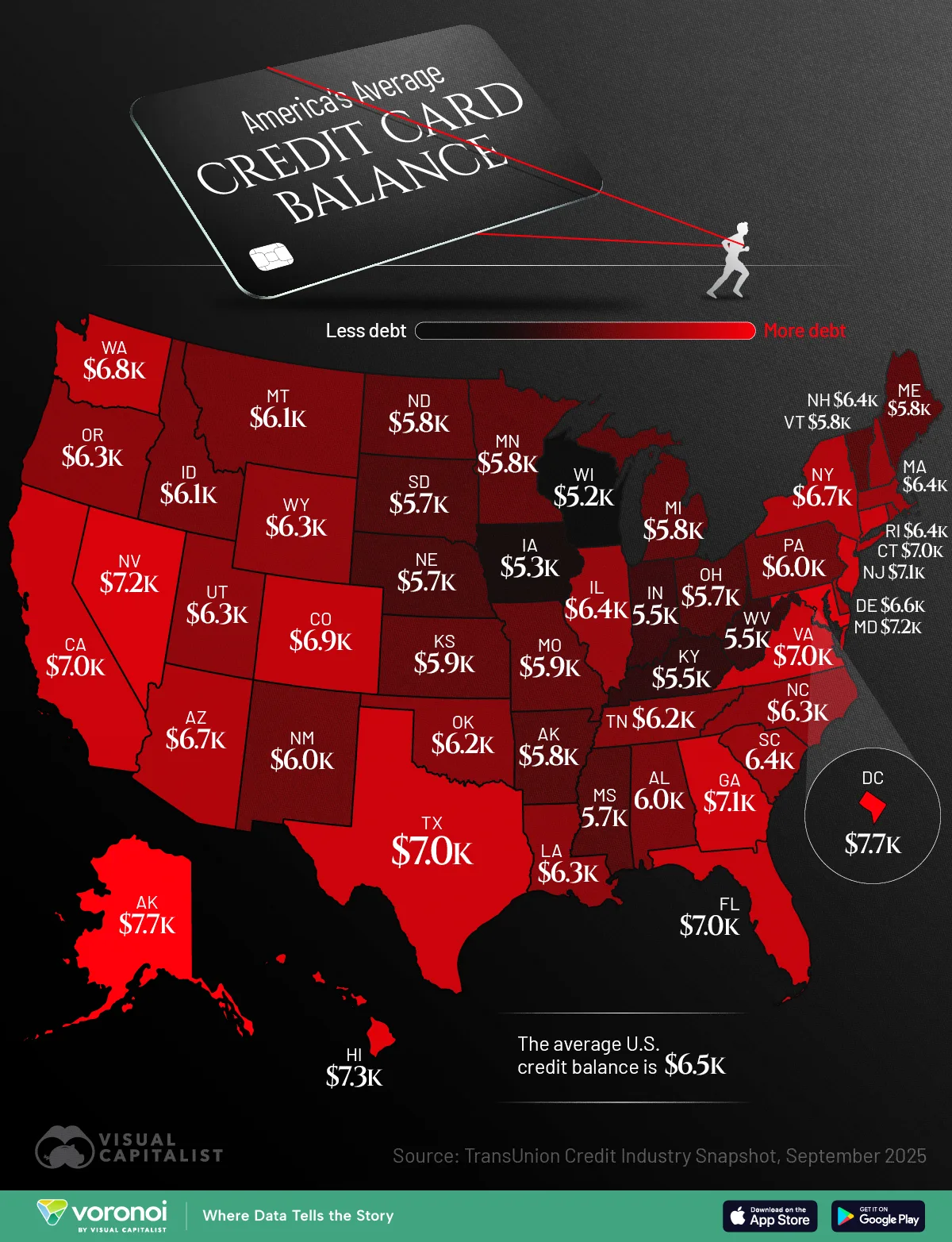

Mapped: Average Credit Card Debt by State in 2025

Mapped: Average Credit Card Debt by State in 2025

2025-12-10 @ 09:00

U.S. Credit Card Debt Hits New Heights: A Snapshot

TransUnion’s latest 2025 data reveals that the average credit card balance in the U.S. has climbed to $6,523, marking a significant peak seen over recent years. The debt burden varies widely across states, with certain regions on the East Coast and the South showing particularly high averages. These figures not only speak to consumer spending patterns but also expose underlying economic pressures and potential financial risks.

Which States Carry the Heaviest Credit Card Debt?

In 2025, states like Nevada, Florida, and Texas all exceed the national average in credit card debt. Nevada stands out especially, likely tied to the rebound in its tourism industry and increased related consumer spending. On the other hand, states in the Midwest and North, such as South Dakota and North Dakota, maintain lower average credit card balances, reflecting more conservative spending cultures and generally stronger personal financial management.

The Financial Implications Behind Rising Debt

The rising average debt signals increasing reliance on credit for many consumers. While this can temporarily stimulate economic activity, it also raises concerns about the growing financial strain on households. Recent slight upticks in credit scores and default rates suggest some consumers are starting to face financial challenges. Both financial institutions and consumers themselves need to stay vigilant about this emerging trend.

Tips for Managing Your Credit Card Debt

With credit card debt hovering at elevated levels, financial experts recommend a cautious and strategic approach to credit use. This includes building an emergency fund, creating monthly budgets, and prioritizing paying off high-interest debt. Adopting a practical mindset towards spending not only helps reduce personal financial strain but also contributes to a healthier and more resilient economy.

Final Thoughts: Debt Management and Economic Health Are Interlinked

The 2025 credit card debt map paints a vivid picture of spending habits and economic dynamics across the U.S. Policymakers, financial institutions, and consumers alike must pay attention to these patterns and adapt strategies accordingly to mitigate risks. Understanding the debt landscape empowers us to plan smarter for the future—creating stronger financial well-being for individuals and the nation as a whole.