|

| Gold V.1.3.1 signal Telegram Channel (English) |

GBPUSD: Key Support Holds Spotlight Amid Strong Dollar Momentum

2026-01-09 @ 13:02

Over the past 24 to 48 hours, GBP/USD has experienced notable volatility, reflecting a shift in market risk sentiment. Starting from yesterday’s closing price of 1.34353, the British Pound has come under pressure, primarily due to strong US services PMI data supporting the US Dollar, leading to a weaker Pound. Investor caution has increased demand for the safe-haven dollar, pushing GBP/USD down towards the 1.34 level.

At the same time, ongoing uncertainty about global economic growth has reinforced the US Dollar’s role as a safe-haven asset. Multiple reports indicate that GBP/USD faces downside pressure, highlighting the importance of key support levels. Despite a brief surge above 1.35, the Pound was unable to maintain the gains, indicating limited buying strength.

For the average investor, this period of exchange rate fluctuations means that when risk appetite diminishes, the strength of the US Dollar can weigh on the Pound. Investors should closely watch the upcoming US employment data, as it may again influence dollar volatility and GBP/USD movements.

In summary, recent GBP/USD fluctuations are driven mainly by strong US economic data and heightened market risk-off sentiment, resulting in pressure on the British Pound. This trend serves as a reminder for market participants to consider fundamental changes and manage risks carefully when trading.

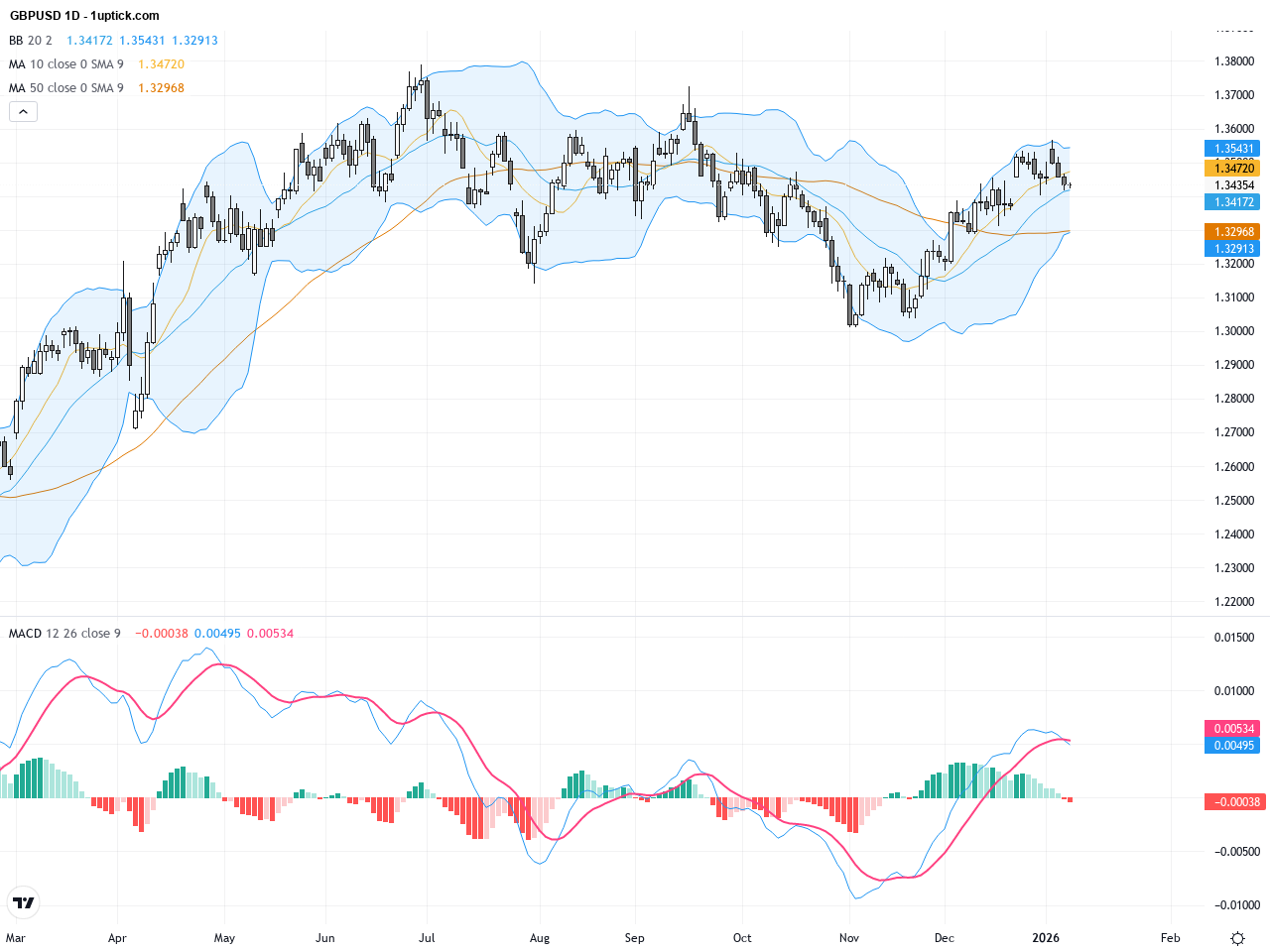

On the daily chart, GBPUSD shows an overall sideways to downward trend over recent weeks, trading mainly between 1.34 and 1.36. Short-term moving averages have turned lower since late 2025, reflecting bearish pressure. Bollinger Bands are narrowing, indicating reduced volatility, with price hovering near the middle band. The MACD is bearish yet converging, suggesting that selling momentum may be weakening but caution remains as key support levels can still be tested.

The hourly chart over the last 3-5 days reveals notable price volatility. GBPUSD hit a three-month high of 1.3562 early in the period before retracing below 1.3450. Short-term moving averages have crossed to form a sell signal, and the price has frequently engaged the lower Bollinger Band, indicating short-term oversold conditions that could prompt a bounce. MACD histogram contraction further suggests waning bearish momentum, yet traders should monitor critical intraday support for potential trend shifts.

Technical Trend: GBUSD currently exhibits a cautiously bearish trend with sideways to downward price action. Short-term consolidation or minor rebounds are possible, but the dominant bias remains weak amid broader risk-off sentiment.

Technically, GBPUSD remains in a cautiously bearish tone as daily charts show downward momentum, with critical support near 1.3430 tested multiple times. The hourly chart suggests some potential for short-term rebounds given MACD divergence and oversold Bollinger Band touches. Recent candlestick patterns highlight a possible short-term top with bearish reversal signals, advising traders to observe support zones closely. Breakdown below 1.3430 may accelerate downside risk, while a hold could encourage consolidation or minor retracement.Today’s economic calendar features several European and US data releases later in the day. There are no significant UK-specific data points scheduled that would directly impact GBP/USD today. US employment and building permits figures, expected around 14:30 GMT+1, are key to watch as better-than-expected results could strengthen the dollar further, thereby potentially pressuring GBP/USD. Overall, no direct events for GBP/USD today, with market attention focused on US labor data and prevailing risk sentiment.

Resistance & Support

The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.