|

| Gold V.1.3.1 signal Telegram Channel (English) |

AUDUSD: Strong Jobs Data Fuels Bullish Momentum With Golden Cross Formation

2026-02-20 @ 06:01

Over the past 24 to 48 hours, the AUD/USD pair has markedly rebounded following robust Australian employment data, reversing much of the previous day’s losses. The pair closed around 0.70546 yesterday, as Australia’s unemployment rate held steady at 4.1% in January, surpassing analysts’ expectations and boosting market bets on further Reserve Bank of Australia (RBA) rate hikes, thereby supporting demand for the Aussie dollar.

This upbeat jobs report signals a resilient Australian economy with sustained growth momentum, prompting traders to reassess monetary policy outlooks and curbing prior selling pressure associated with softening growth signals. Meanwhile, increased global macroeconomic uncertainties and a generally weaker US dollar have helped propel the AUD/USD recovery.

For the average investor, these developments highlight strong underlying fundamentals in Australia’s labor market, increasing the likelihood of ongoing RBA tightening, which in turn bolsters the Australian dollar. This suggests AUD remains a currency to watch closely in current foreign exchange and diversified portfolio strategies.

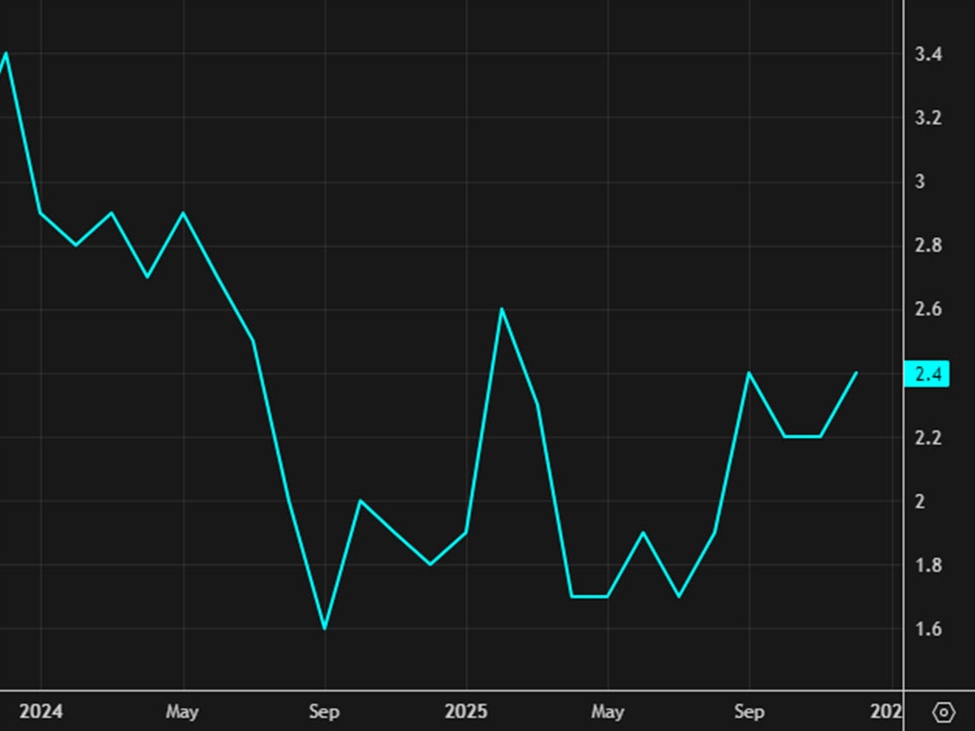

The daily chart shows AUDUSD rebounding steadily from its January lows, recently breaking above both the 50-day and 200-day moving averages, creating a classic golden cross – an indication of solid medium-term bullish momentum. The price remains above the Bollinger Bands’ middle band, supported by a positive MACD histogram, confirming a clear uptrend. Overall, the pair has moved from sideways consolidation into a sustained upward trajectory, aligning with optimistic economic expectations from Australia.

On the hourly chart, the pair shows a recent minor pullback but quickly found support near the lower Bollinger Band. The MACD is poised for a bullish crossover, and RSI hovers near neutral, hinting at imminent upward momentum. In the past 3-5 days, prices have oscillated between 0.7000 and 0.7080, with a bullish engulfing candle forming recently, reinforcing near-term buying interest and potential for further advances.

Technical Trend: AUDUSD is currently in a cautiously bullish trend, exhibiting steady upward momentum with controlled volatility, indicating moderate optimism among traders.

Technically, AUDUSD’s golden cross signals a decisive bullish turn. The recent bullish engulfing candle along with a MACD bullish crossover strengthens the upward trend narrative. Bollinger Bands help delineate key volatility zones, with prices currently riding near the middle-to-upper band, suggesting controlled strength. Momentum indicators and volume support the ongoing buying interest, offering high-probability trade setups for active traders.Today’s economic calendar (GMT+1) reveals Australia’s unemployment rate steady at 4.1%, matching forecasts, while employment change slightly missed expectations with a gain of 17.8K versus 20.1K forecast. Despite this slower job growth, market confidence remains intact. There are no other significant direct events today impacting AUDUSD, so traders should watch for upcoming data releases from Australia and the US in the coming days for more direction.

Resistance & Support

The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.