|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump Launches 2024 Campaign: What Investors Need to Know Amid Market Volatility

Trump Launches 2024 Campaign: What Investors Need to Know Amid Market Volatility

2026-02-20 @ 14:00

Trump’s 2024 Campaign Kicks Off, Markets React Swiftly

This month, former US President Donald Trump officially launched his 2024 presidential campaign, instantly catching the attention of global financial markets. Within just a few days, key indices like the S&P 500 and Nasdaq experienced notable swings, reflecting heightened investor sensitivity to political risks. The ensuing volatility rippled beyond the US, shaking asset prices worldwide.

Policy Uncertainty Fuels Market Anxiety

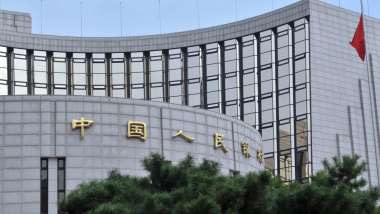

Given Trump’s historically tough stance on economic and trade policies, his re-entry into the political arena extends this sense of uncertainty. Recent news highlights investors watching closely for potential moves on tax cuts, trade barriers, and attitudes toward China and other trade partners—factors that could profoundly impact multinational corporations and global supply chains.

Reassessing Investment Strategies — Risk Management Is Key

Amid rising political risk, many advisors are urging caution. Market analysts recommend diversifying portfolios to hedge against volatility, with particular attention to low-volatility assets and safe havens. Recent data points to gold and the US dollar index as effective risk buffers, suggesting investors consider ETFs or commodities linked to these assets for portfolio balance.

Corporate Strategy Shifts and Emerging Markets to Watch

Beyond financial markets, companies are adjusting strategies, particularly in tech and manufacturing sectors, reevaluating supply chains and investments in light of potential trade policy shifts. Large-cap US stocks have shown recent price fluctuations, underscoring the need for investors to track earnings reports and policy responses closely. Additionally, emerging markets in Asia are gaining attention due to geopolitical factors.

Important Investment Caution

While political news grabs headlines, investment decisions based on political events should be made cautiously. Markets are inherently volatile, and elections often amplify sentiment-driven moves. Maintaining objective evaluation, staying informed with multi-source analysis, and aligning strategies with individual risk tolerance remain essential. Monitoring expert reports and financial news will help navigate this landscape.

In summary, Trump’s 2024 campaign announcement injects significant uncertainty into markets worldwide. Investors must heed the heightened risks and adjust portfolios prudently to safeguard assets. Keeping a close watch on unfolding policy details in the coming weeks will be key to understanding where the markets may head next.