|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump Signs Executive Order Tightening Semiconductor Export Controls to China

Trump Signs Executive Order Tightening Semiconductor Export Controls to China

2026-02-19 @ 14:00

Trump Tightens Semiconductor Export Rules with New Executive Order

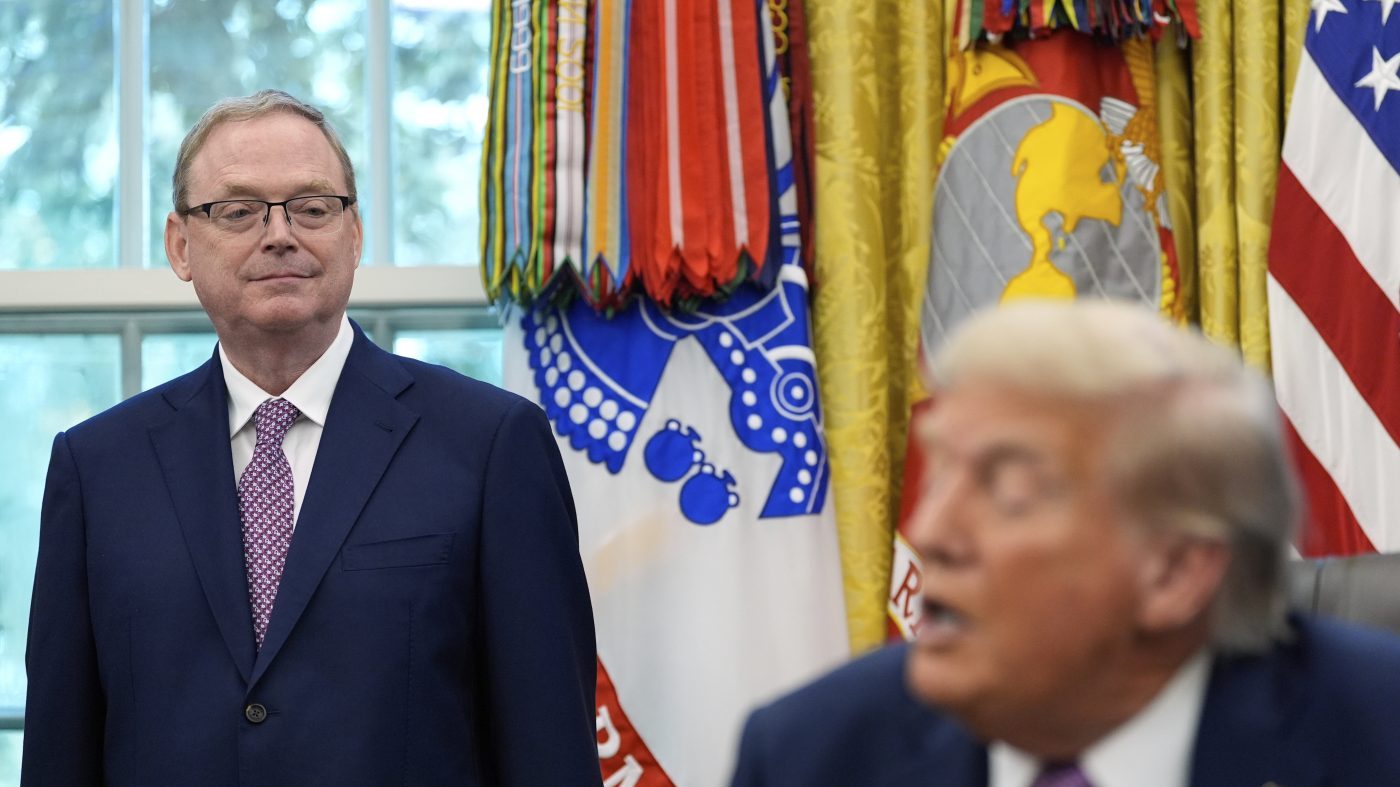

In a significant move, former President Donald Trump has signed a new executive order aimed at strengthening export controls targeting China’s semiconductor industry to protect America’s advanced technology edge. This policy comes amid escalating global tech competition and growing concerns over supply chain security.

Recent reports from multiple reliable sources within the past two weeks confirm that the order expands restrictions to cover a broader range of cutting-edge semiconductor manufacturing equipment and related technologies destined for China. It also intensifies scrutiny and bans concerning technologies linked to military and high-end applications to prevent critical tech from advancing China’s defense capabilities.

The Economic and Security Drivers Behind the Policy

This step closely ties into America’s strategic imperative to control core technology supply chains. Semiconductors are the backbone of modern innovation; controlling their flow effectively shapes future industry influence. Over the past four years, the US has layered investment reviews, technology restrictions, and export bans targeting China’s tech sector. This latest decree marks an even more forceful phase in that approach.

Market reactions suggest that semiconductor equipment manufacturers and tech giants now navigate a more complex regulatory environment, while Chinese companies face hurdles in supply chain access and technology acquisition. Industry analysts highlight that this could accelerate supply chain restructuring and force firms to reevaluate partnerships and market strategies in the near term.

Outlook and Investor Considerations

For investors, this policy signals potentially heightened volatility in high-tech and semiconductor stocks. Companies like TSMC, Intel, and Micron stand at the crossroads of geopolitical risk and market pressures. While the policy’s long-term goal is to safeguard US technological supremacy and national security, it also introduces significant uncertainty.

Investors focusing on semiconductors and tech industries should carefully monitor diplomatic developments, trade negotiations, and evolving global supply chain dynamics that might affect business operations. Prudent portfolio management and risk mitigation are essential in this shifting landscape.

Overall, Trump’s executive order underscores a pivotal shift in the US-China tech rivalry and serves as a stark reminder of how intertwined technology and international politics have become. Staying informed and adaptable will be key for businesses and markets alike.