|

| Gold V.1.3.1 signal Telegram Channel (English) |

AUDUSD: Bullish Breakout and Strong Fundamentals Signal Uptrend Continuation

2025-12-17 @ 08:01

Over the past 24 to 48 hours, AUD/USD has shown renewed strength following relatively steady movement. The pair closed yesterday at 0.66324, slightly down by around 0.11% from the previous day but holding near recent highs. The market’s reaction to the Reserve Bank of Australia’s (RBA) continued hawkish stance has been broadly positive, regarded as a key support for the Aussie dollar’s upward momentum.

Recent market commentary highlights the Australian dollar’s resilience amid anticipation of US non-farm payroll data and tech sector volatility. While the RBA kept interest rates steady, its cautious stance on inflation risks has boosted investor confidence in the AUD’s medium to long-term prospects. Additionally, positive Chinese economic indicators and trade surplus figures bolster the AUD given China’s status as Australia’s largest trading partner.

For the average investor, these market developments resemble a steady vessel navigating uncertain waters. Despite the ongoing global economic and geopolitical uncertainties, the AUD is buoyed by robust macroeconomic policy and optimistic market sentiment. Investors should watch for upcoming US labor data and global equity market swings, as these may trigger short-term currency adjustments and present further trading opportunities.

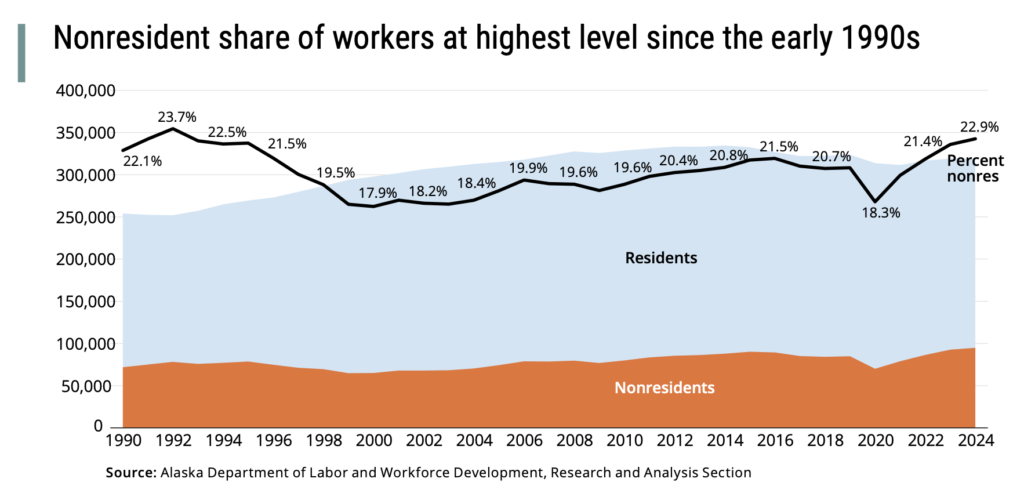

The daily chart shows a steady uptrend in AUDUSD, with prices consistently above the 50-day and 200-day moving averages, confirming medium-to-long term bullish momentum. The Bollinger Bands are slightly expanding, indicating an increase in volatility, while the MACD remains positive and rising, reinforcing buying pressure. Currently, price oscillates around the 0.663 to 0.666 zone, awaiting a clearer next directional move, with technicals supporting further upside.

Hourly chart analysis over the past 3-5 days reveals a strong upward trend. After breaking the key resistance at 0.6605, the price continued climbing. Short-term moving averages are bullishly aligned, with a bullish MACD crossover signaling strengthening momentum. Prices are consolidating near the upper Bollinger Band, which acts as dynamic support. A recent bullish engulfing candlestick suggests strong buying interest, implying potential further gains in the next 24 hours.

Technical Trend: Trend Direction: Decisively Bullish

Technically, AUDUSD is in a strong bullish phase with expanding positive MACD momentum and a confirmed breakout above major trendlines. The Bollinger Bands’ widening suggests potential for continued price expansion. The hourly bullish engulfing candlestick is a key short-term bullish signal indicating sustained buyer strength. Traders should remain alert to monetary policy and macroeconomic data shifts that could affect price direction. The combined technical and fundamental factors make now a confident entry point for bullish trades.Today’s economic calendar features several events such as Japan’s trade balance and UK consumer price index data; however, none are expected to directly affect AUDUSD significantly. Market focus remains on upcoming US Federal Reserve officials’ speeches and New Zealand GDP data, which could indirectly influence the Aussie. Overall, no major direct economic releases today that would drastically impact AUDUSD, allowing traders to focus on technical trends and market sentiment.

Resistance & Support

The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.