|

| Gold V.1.3.1 signal Telegram Channel (English) |

Moody’s Senior Economist Flags Market Sectors Likely to Struggle in 2026

Moody’s Senior Economist Flags Market Sectors Likely to Struggle in 2026

2026-01-05 @ 14:00

Moody’s Expert Spotlights Market Sectors Facing Trouble in 2026

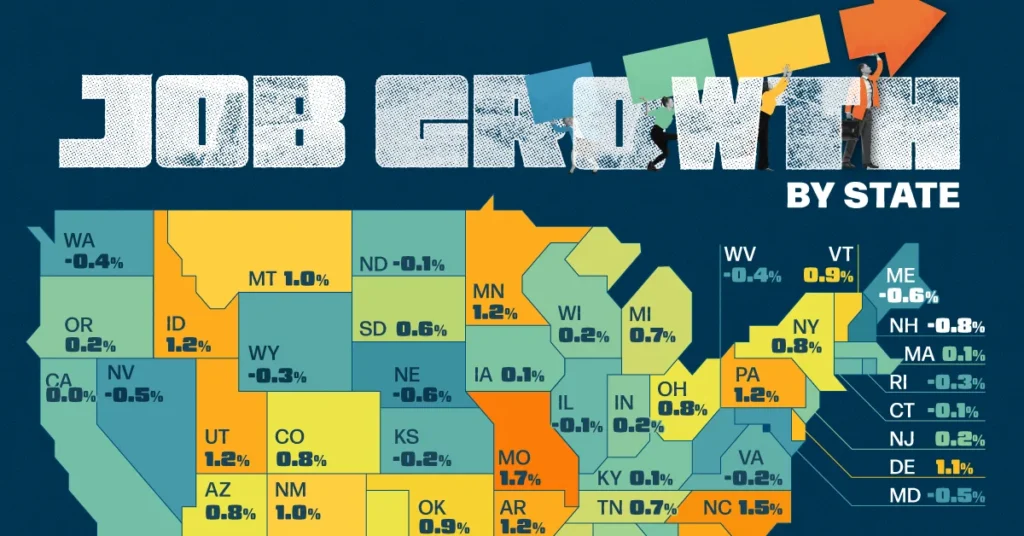

As 2026 kicks off, Moody’s senior economist Mark Zandi has laid out a clear economic and market outlook for the year ahead. While the overall economy is expected to keep its growth momentum—buoyed by steady consumer and business confidence—significant challenges lie beneath the surface. Zandi highlights a slowdown in job creation, an uptick in unemployment, and escalating inflation as critical factors that could weigh heavily on certain sectors.

The slowdown in hiring means companies will be more cautious in adding staff, limiting disposable income growth for consumers. Rising unemployment, particularly impacting manufacturing and select service industries, clouds revenue prospects for these sectors. Combined with stubbornly high inflation—especially in essentials and energy—consumers are likely to tighten spending, which will dent retail, real estate, and durable goods industries.

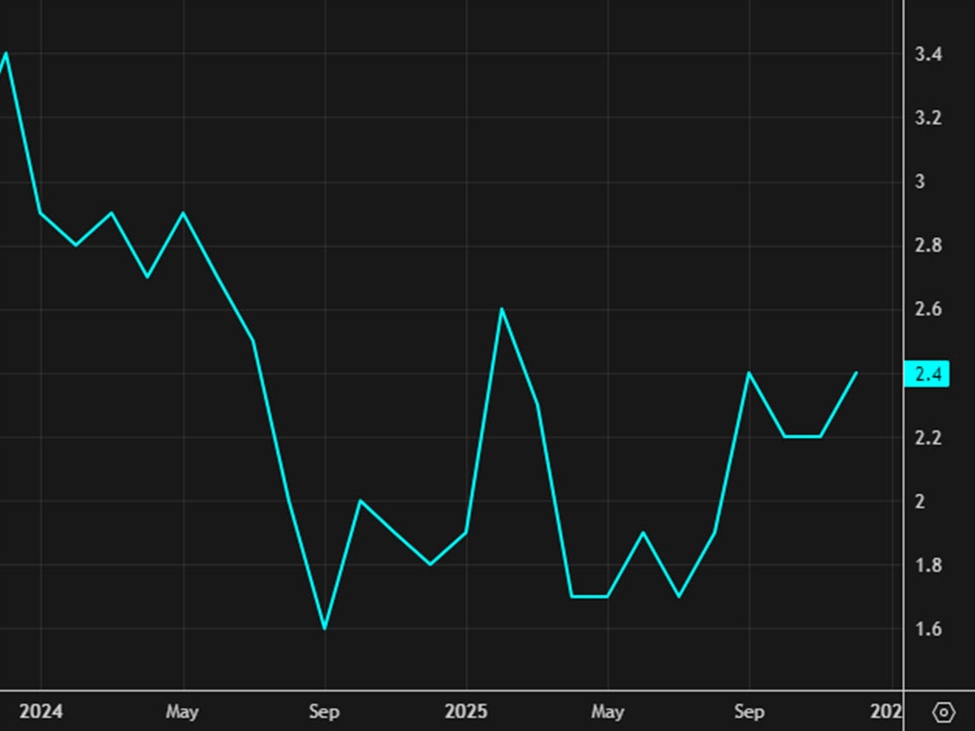

Zandi specifically points to technology and some capital-intensive industries as prime candidates to suffer. Financial market data shows that with persistent inflation, interest rates are set to remain elevated, increasing borrowing costs. This scenario poses serious challenges for sectors reliant on financing such as real estate development and infrastructure. Though the energy sector faces short-term supply-demand imbalances, traditional energy firms will also confront pressures from the ongoing energy transition.

Furthermore, external factors like geopolitical tensions and supply chain disruptions could amplify volatility and sector risk. Given these dynamics, investors should tread carefully, diversify portfolios, and avoid concentrated exposure to high-risk sectors that may appear superficially attractive.

In sum, 2026 presents an economy of contrasts—growth paired with clear headwinds. While pockets of opportunity remain, the combination of sluggish job growth and persistent inflation will test many industries. Staying flexible and vigilant with investment strategies will be key to preserving value amidst an uncertain environment.