|

| Gold V.1.3.1 signal Telegram Channel (English) |

XAUUSD: Navigating Profit-Taking Pullbacks with Key Support at $4450 Amid Market Uncertainty

2026-01-08 @ 05:01

Over the past 24 to 48 hours, gold (XAUUSD) has experienced notable volatility, retreating slightly from the January 7 closing price of $4,458.58. Early attempts to break above the $4,500 level lost momentum as profit-taking kicked in, pulling prices below $4,450. This indicates a cautious market ahead of the US Non-Farm Payroll report, with gold’s safe-haven demand providing some support.

At the same time, geopolitical events like the US capture of Venezuela’s president fueled a short-term surge in gold and silver prices, reinforcing investor demand for safe assets. However, analysts warn that gold may face near-term selling pressure due to the Bloomberg Commodity Index’s annual rebalancing exercise.

For average investors, this movement highlights how global economic and political uncertainties continue to drive gold’s price. The profit-taking shows some are locking in gains at elevated levels, while the market awaits clearer employment data for the next directional cue. Patience is essential now, as job report outcomes and geopolitical developments will likely dictate gold’s next move.

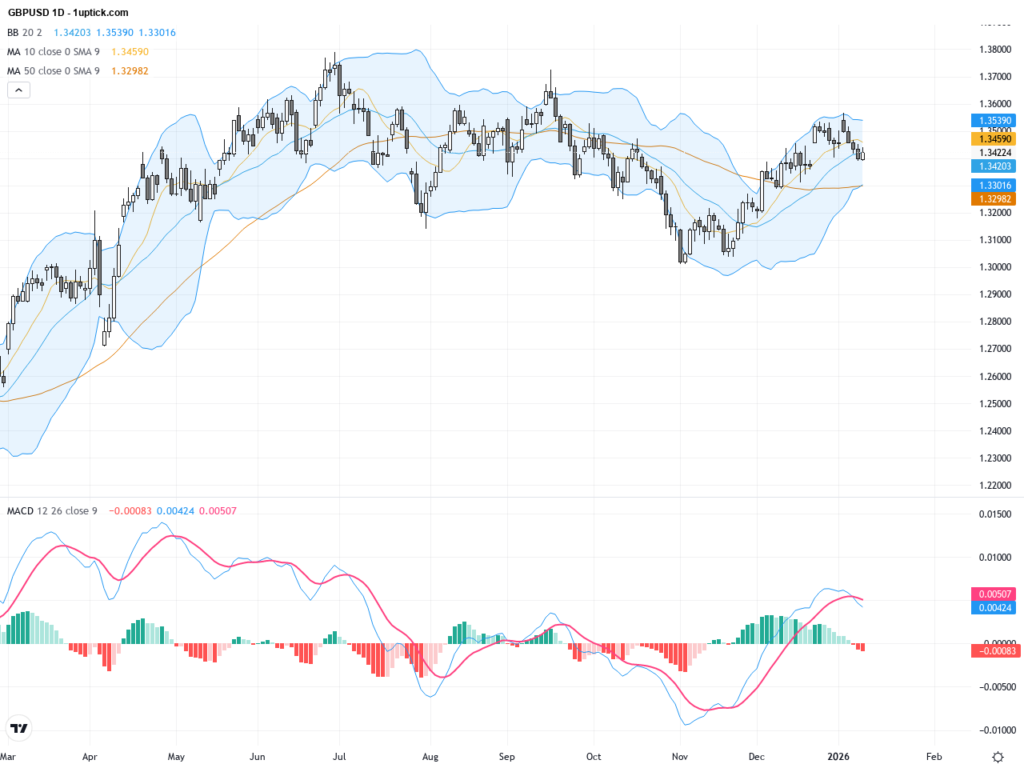

The daily chart shows Gold maintaining an overall upward trend recently, with a brief breakout above $4500 which was unsustained, resulting in a pullback to approximately $4450. The 20-day and 50-day moving averages offer short-term support, and the Bollinger Bands are contracting, indicating reduced volatility. The MACD shows a near crossover of the fast and slow lines, suggesting a slowdown in momentum and a possible consolidation phase.

On the hourly chart, price movements over the last 3-5 days reflect significant fluctuations within the $4460-$4500 range. Short-term moving averages like the 5 and 10 period lines have crossed multiple times, illustrating market indecision. The Bollinger Bands remain narrow and the MACD histogram is shrinking, signaling weakening momentum and the formation of a potential triangle consolidation pattern. Traders should watch for a breakout in either direction.

Technical Trend: XAUUSD is currently in a cautious consolidation phase, with balanced short-term forces awaiting a catalyst from upcoming economic data.

Technically, XAUUSD is currently facing short-term profit-taking pressures, but daily support levels remain intact. A triangle consolidation pattern is emerging, implying an impending directional breakout. Recent hammer candlesticks with long lower shadows signal buying interest at lower levels, suggesting possible short-term rebound or sideways movement. However, the MACD’s fast line approaching the slow line from above points to waning bullish momentum, warranting cautious risk management.Today’s (GMT+1) economic calendar includes European data such as German retail sales and Eurozone consumer price indices, plus Australian CPI and building approvals which hold limited direct impact on XAUUSD. Key US data releases later, including the ISM non-manufacturing index and ADP employment report, are more relevant. Strong US data would likely strengthen the dollar and pressure gold prices, while weaker data could provide support for gold. Traders should focus on these US releases for potential market-moving clues.

Resistance & Support

The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.