|

| Gold V.1.3.1 signal Telegram Channel (English) |

USDJPY: Critical Resistance Tests at 155 Amid Hawkish Fed and BoJ Rate Speculation

2026-02-20 @ 11:01

Over the past 24 to 48 hours, the USD/JPY pair has experienced notable volatility, edging up from yesterday’s close of 154.942 to around the 155.20 level, driven by multiple converging factors. Japan’s consumer price index (CPI) data revealed a slowdown in inflation to 1.5%, reinforcing market expectations that the Bank of Japan will maintain its accommodative stance, which weighed heavily on the yen and pushed the USD/JPY rate higher.

At the same time, minutes from the January Federal Open Market Committee (FOMC) meeting showed deep divisions within the committee, with hawkish voices gaining ground, supporting a firm dollar especially as the Fed signaled no rush to cut interest rates. This dynamic exerted upward pressure on the dollar, helping USD/JPY test the 155 level briefly.

Across Asian FX markets, geopolitical tensions have driven some investors toward the safe-haven dollar, with the Singapore dollar weakening slightly during Asian trading hours, reflecting a shift of funds into the US currency. Moreover, the US Dollar Index has risen for several days straight, providing additional backing for the dollar against the yen.

In summary, for the average investor, the recent yen weakness reflects broad market consensus around slowing growth in Japan and an ongoing ultra-loose monetary policy, while the relative dollar strength is driven by robust US economic data and heightened hawkish sentiment from the Fed. This has created a tug-of-war scenario, with the yen under pressure and the dollar buoyed by multiple favorable developments, keeping the currency pair oscillating near elevated levels.

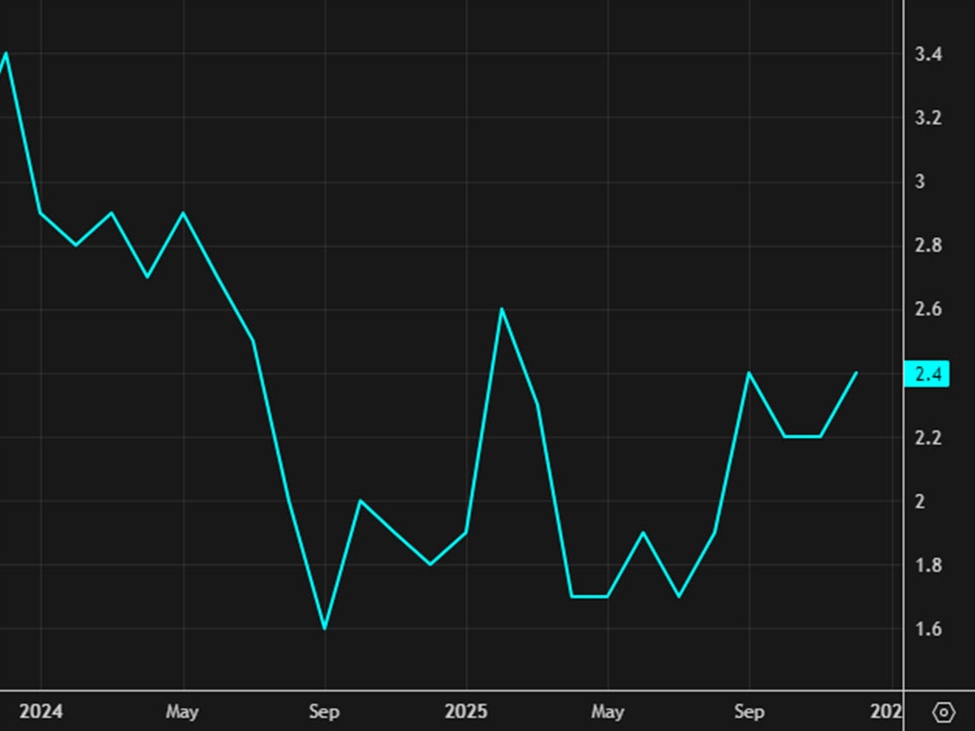

The daily chart shows USDJPY maintaining an overall uptrend since the start of the year, currently oscillating between 150 and 156. Recent price action features repeated tests of the 155.00 resistance level. The price trades just below the 50-day EMA (~156.1), with the 200-day EMA (~150.5) providing long-term support. Bollinger Bands are widening slightly, indicating increased volatility. MACD histogram remains positive but momentum is slowing, suggesting a possible consolidation phase before the next move.

The hourly chart highlights USDJPY trading in a tight range between 154.88 and 155.31 over the past 3-5 days. Short-term moving averages have formed a bullish crossover, implying slight upward momentum. Bollinger Bands are contracting, signaling an imminent breakout or pullback. MACD shows a mild bullish divergence, while RSI sits in a neutral-to-bullish zone. Volume confirms steady trading activity, favoring cautious short-term bullish bias.

Technical Trend: USDJPY currently reflects a ‘volatile sideways’ trend, awaiting fresh fundamental catalysts to break the consolidation and define the next directional phase.

Technically, USDJPY is forming a range-bound pattern with 155.00 serving as a pivotal resistance barrier evidenced by multiple failed breakout attempts. The daily MACD momentum is decelerating but remains positive, suggesting bulls are still present but cautious. On the hourly chart, a bullish moving average crossover combined with tightened Bollinger Bands signals a potential near-term breakout. Given the subdued but persistent inflation pressure in Japan and mixed Fed signals, traders should watch 155.30 as a breakout level and 154.80 as critical short-term support to anticipate high-probability trades.Today’s economic calendar includes Japan’s January Consumer Price Index (CPI) release at 00:30 GMT+1, confirming inflation slowdown to 1.5% year-over-year. This moderates BoJ rate hike expectations and exerts pressure on JPY. The European Central Bank Chairman’s speech later today is unlikely to cause major USDJPY volatility. The most critical events will occur during the US session at 14:30 GMT+1, with the release of PCE Core inflation data and Q4 GDP estimates. Stronger-than-expected US readings will likely bolster the USD and push USDJPY higher, while weaker prints may trigger consolidation or retracement.

Resistance & Support

The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.