Technical Analysis

Evaluate price trends and patterns, identify potential investments and trading opportunities!

[Daily Closing 🔔] Gold – Gold Prices Slip as Stronger U.S. Dollar and Easing Safe-Haven Demand Weigh on Market

Spot gold (XAU/USD) fell for a second straight day, pressured by a stronger U.S. dollar and fading demand for safe-haven assets. Prices dipped to $3,265.45 per ounce, testing key technical support levels. Investors are now…

[Daily Closing 🔔] Gold – Gold Prices Slip as Markets Await Key U.S. Economic Data Release

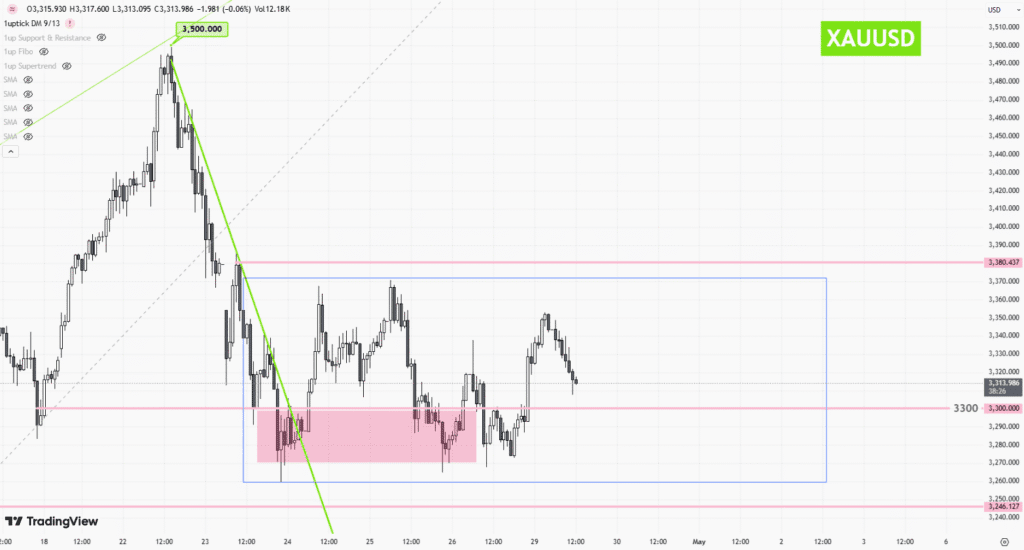

Spot gold prices fell 0.78% over the past 24 hours to $3,316.70 per ounce, as improving market sentiment and investor caution ahead of upcoming U.S. inflation and employment data weighed on prices. A stronger U.S.…

[Daily Closing 🔔] Gold – Gold Prices Slip as Markets Await Key U.S. Economic Data Release

Spot gold prices fell 0.78% over the past 24 hours to $3,316.70 per ounce, as improving market sentiment and investor caution ahead of upcoming U.S. inflation and employment data weighed on prices. A stronger U.S.…

Spot Gold (XAU/USD) 24-Hour Price Movement and Market Outlook

Spot gold has shown a dip-and-rise pattern over the past 24 hours, rebounding sharply as uncertainty over U.S.-China trade talks and increasing demand for safe-haven assets pushed prices higher. Gold briefly touched an intraday high…

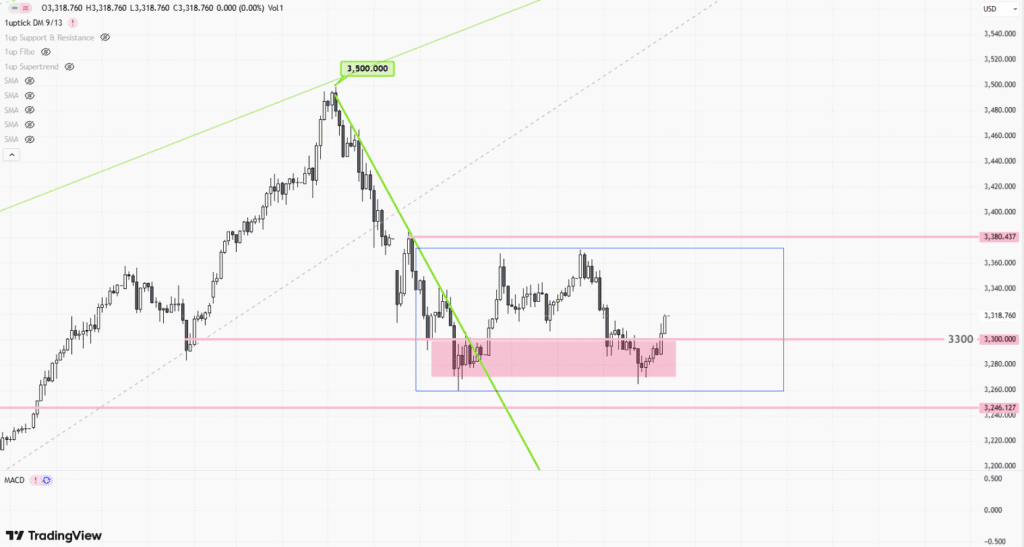

[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors

Spot gold (XAU/USD) fell 4.18% last week, pressured by escalating geopolitical tensions, shifting Federal Reserve policy expectations, and a stronger US dollar. After reaching a record high, gold prices pulled back sharply, with technical selling…

Gold Prices Retreat as Easing U.S.-China Trade Tensions Dampen Safe-Haven Demand

Spot gold prices tumbled 2.55% on Friday, erasing gains from earlier in the week as improving U.S.-China trade relations and a stronger dollar dampened safe-haven demand. On the technical side, gold broke below the key…

EUR/USD Technical Analysis and Outlook for April 21–25, 2025

Between April 21 and 25, 2025, the EUR/USD pair experienced sharp fluctuations, driven by political uncertainties, economic data releases, and technical market dynamics. After reaching recent highs, the euro retreated and entered a consolidation phase.…

Market Analysis

Insightz

![[Daily Closing 🔔] Gold – Gold Prices Slip as Stronger U.S. Dollar and Easing Safe-Haven Demand Weigh on Market](https://int.1uptick.com/wp-content/uploads/2025/05/2025-05-01T045328.050Z-file-1024x576.png)

![[Daily Closing 🔔] Gold – Gold Prices Slip as Markets Await Key U.S. Economic Data Release](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-30T071609.409Z-file.jpeg)

![[Daily Closing 🔔] Gold – Gold Prices Slip as Markets Await Key U.S. Economic Data Release](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-30T034839.563Z-file.jpeg)

![[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-28T055444.196Z-file-1024x551.png)