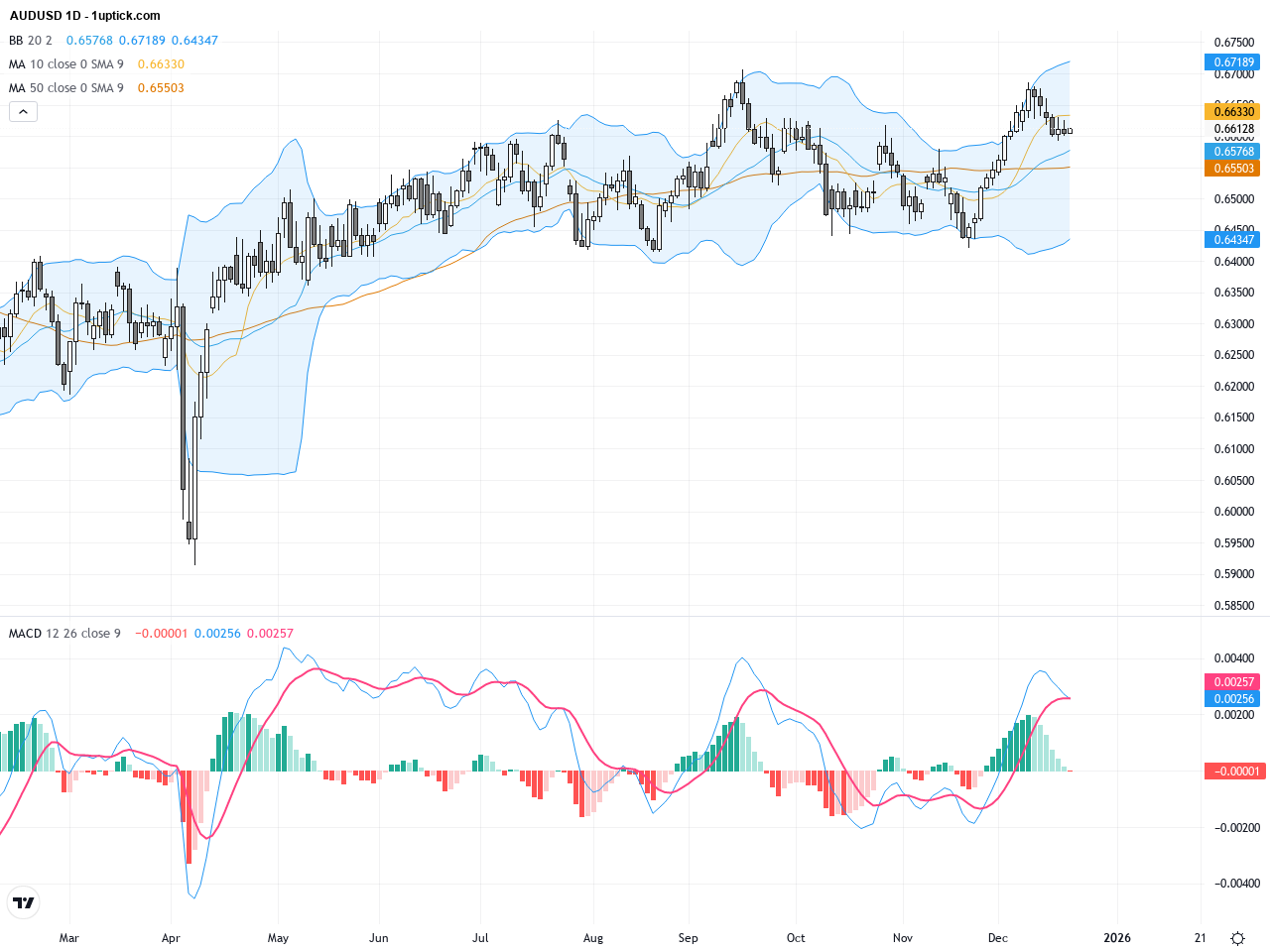

AUDUSD Technical and Fundamental Outlook: Key Support and Resistance Levels Explained

Over the past three trading days, AUDUSD has hovered around the 0.67 handle, experiencing muted volatility due to holiday season low volumes. A stronger-than-expected US labor market boosted the dollar, applying downward pressure on the Australian dollar, which closed yesterday at 0.66767, slightly lower than the prior day. The divergent monetary policy views between the RBA and the Fed continue to shape the pair’s outlook. Recent market news highlights that AUDUSD is testing critical technical levels and may be poised for significant movement. For the average investor, the current scenario is like standing at a crossroads, where careful consideration of technical signals and market news is essential before making a trade decision.