|

| Gold V.1.3.1 signal Telegram Channel (English) |

Commodities Headlines

Commodities Headlines

WCS Discount to WTI Holds Steady as Benchmark Crude Prices Extend Monthly Gains tipranks.com

The price discount of Western Canada Select (WCS) heavy crude relative to U.S. benchmark futures held steady on Friday, signaling a pause after recent widening. WCS…

Source: tipranks.com

WTI, Brent Gain as Talks Ease Conflict Fears rigzone.com

Mars rises as WTI/Brent spread widens tradingview.com

Grades broadly fell on Friday, dealers said, although Mars bucked the trend to edge higher as the WTI/Brent spread widened. The spread between WTI and Brent widened to a discount of as much as minus $4.75 during the session. A spread larger than minus $4 typically encourages export demand, driving…

Source: tradingview.com

Weekly Forex Forecast – WTI Crude Oil, GBP/USD, EUR/USD, DAX, Silver, Gold, USD/JPY, USD/CHF forexfactory.com

The WTI Crude Oil $66 level is an area that seems to be offering quite a bit of resistance and now we find ourselves pulling back from there. I think there are a lot of questions out there as to whether or not we are going to see strikes against the Iranians over the weekend. That being said, …

Source: forexfactory.com

WTI oil rally pauses on OPEC+ hold, bullish trend reversal still intact for 70 later actionforex.com

Oil prices edged lower today after OPEC+ agreed to keep output unchanged for March. Sunday’s brief meeting reaffirmed earlier decisions to freeze planned output increases through the first quarter of 2026.

Source: actionforex.com

OPEC+ agrees in principle to keep oil output pause for March, sources say cnbc.com

The meeting of eight OPEC+ members comes as Brent crude closed near $70 a barrel on Friday, close to the six-month high of $71.89 reached on Thursday.

Source: cnbc.com

Crude Oil Weekly Forecast – 01/02: Steady Upwards (Chart) dailyforex.com

Weekly forecast of major markets for February 2. Oil, Forex, gold, silver and indices with key levels and outlook.

Source: dailyforex.com

How Rising WTI Prices And Mixed Earnings At Occidental Petroleum (OXY) Have Changed Its Investment Story simplywall.st

In recent months, Occidental Petroleum has seen its fortunes tied closely to rapidly rising WTI crude prices, even as its latest quarterly results showed lower revenue but adjusted earnings per share that exceeded analyst expectations.

This combination of stronger oil prices, mixed financial performance and generally cautious analyst views is reshaping how investors weigh the company’s risk‑reward profile.

With rising WTI crude prices as a key backdrop, we’ll now examine how these…

Source: simplywall.st

Europe’s Shift To U.S. Crude Fuels NYMEX WTI Benchmark Growth seekingalpha.com

The inclusion of WTI Midland in the Brent basket has highlighted the growing importance of NYMEX WTI in the global oil market. Read more here.

Source: seekingalpha.com

Natural Gas, WTI Oil, Brent Oil Forecasts – Traders Stay Focused On Iran fxempire.com

North Sea Crude – WTI Midland offered lower tradingview.com

WTI Midland and Johan Sverdrup offered lower.PLATTS WINDOW* Indications are free on board (FOB) unless marked as cost, insurance and freight (CIF) or delivered at place.* There were no deals on Friday.* WTI Midland: Unipec offered for February 23-27 at dated Brent plus $2.65 on a CIF Rotterdam basi…

Source: tradingview.com

Oil’s New Equilibrium: WTI Stabilizes at $65 Amid Simmering US-Iran Tensions markets.financialcontent.com

Oil’s New Equilibrium: WTI Stabilizes at $65 Amid Simmering US-Iran Tensions

Source: markets.financialcontent.com

WTI Crude Oil Pulls Back Off Session Highs to Trade at $64.73 fxdailyreport.com

On Friday, the WTI crude oil price pulled back from the session highs of about $66.42 to trade at about $64.73 after the latest data.

Source: fxdailyreport.com

Cenovus vs. Enbridge: Is it Time to Step Away From Both Stocks? theglobeandmail.com

Detailed price information for Cenovus Energy Inc (CVE-N) from The Globe and Mail including charting and trades.

Source: theglobeandmail.com

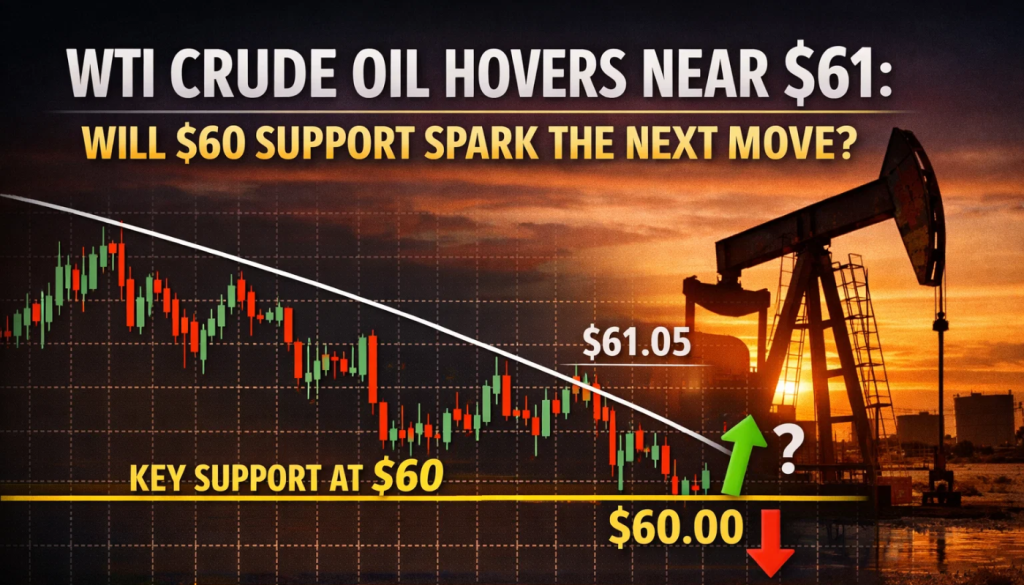

WTI Crude Oil Hovers Near $61: Will $60 Support Spark the Next Move? fxleaders.com

WTI Crude oil is trading near $61.10 a barrel and sticking to last week’s upward trend as a mix of geopolitical jitters and technical…

Source: fxleaders.com