EURUSD Technical Analysis: Key Patterns and Market News Driving the Price

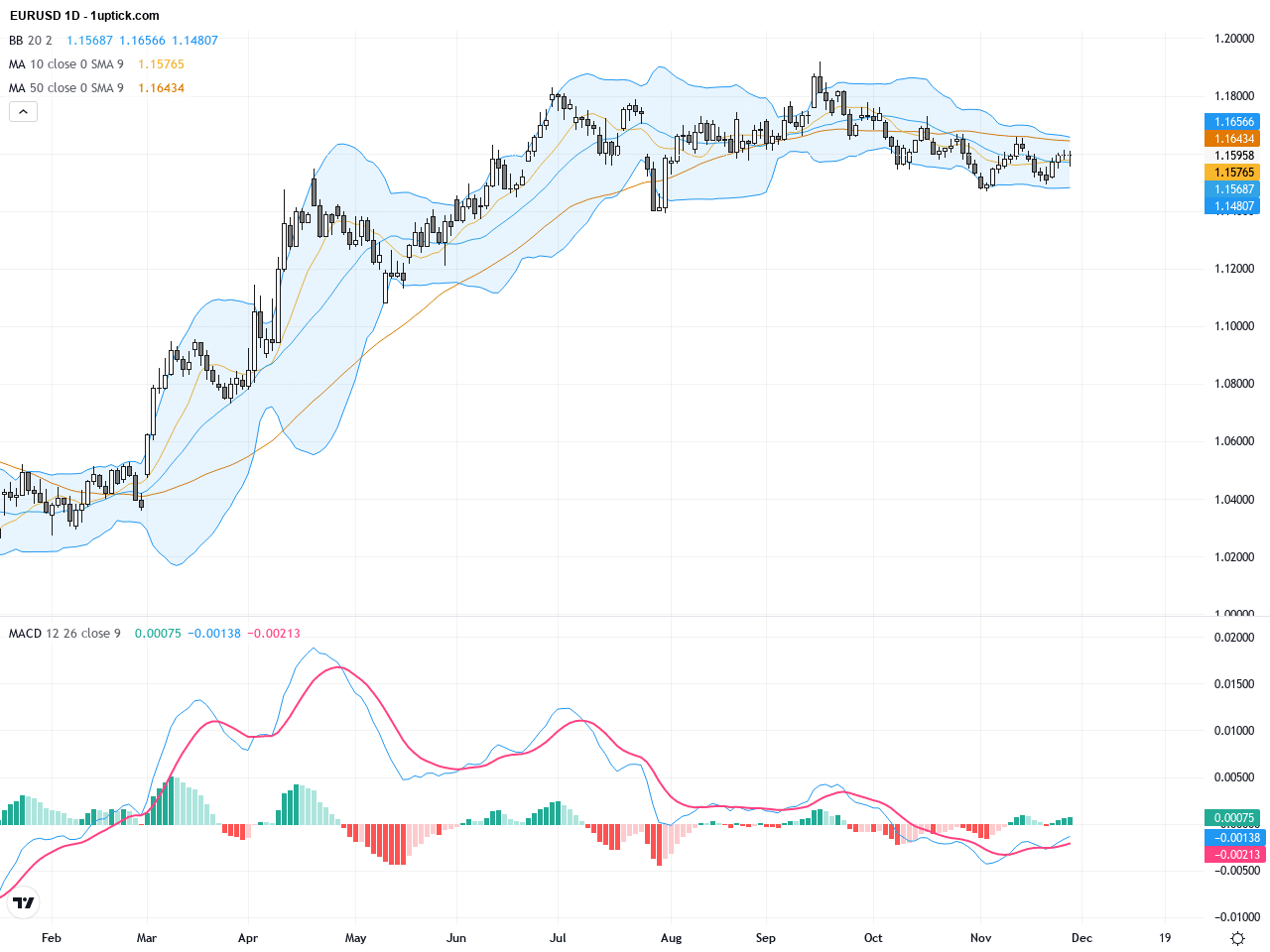

Over the past three trading days, EURUSD has traded steadily within the 1.17 to 1.18 range, closing yesterday at 1.17373. The currency pair has been supported by Goldman Sachs’ forecast of a continued dollar slide and Federal Reserve officials hinting at a pause in easing. Euro nears a two and a half month high amid cautious yet optimistic market sentiment. However, ongoing political uncertainties in France and U.S. bond yield movements have kept some downward pressure. For average investors, this means the market is waiting for decisive Fed policy signals with the pair likely to remain range-bound in the short term. These insights combined with recent technical setups provide valuable guidance for EURUSD trading outlook.