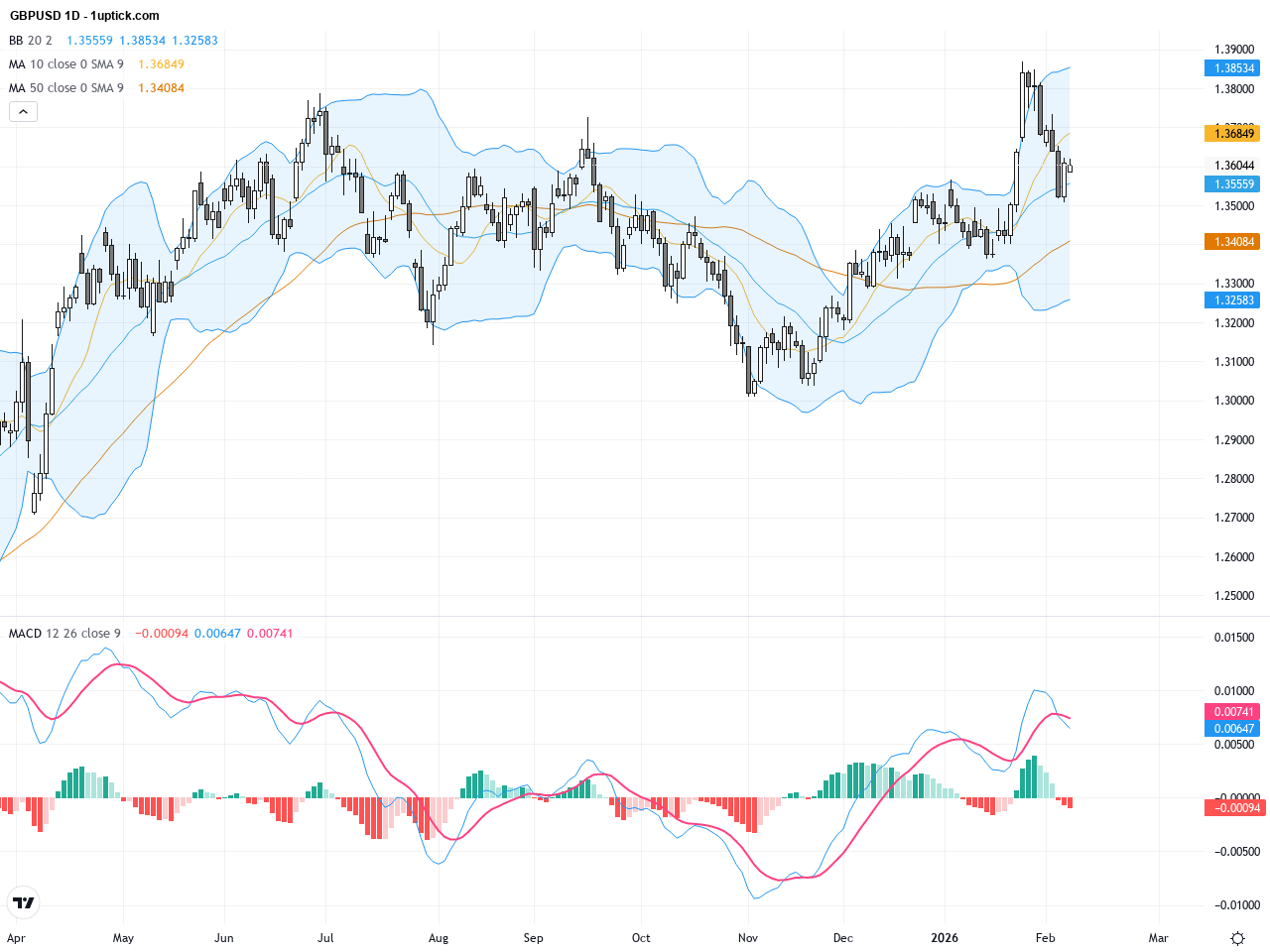

UK Rate Cut Signals Start of Easing Cycle: Falling Inflation Opens New Opportunities in Hong Kong Stocks, Crypto, and Forex Markets

The UK’s inflation rate has continued to decline, with the Consumer Price Index (CPI) rising 2.6% year-over-year in March—coming in below market expectations. In response, the Bank of England made a modest rate cut, lowering the base interest rate to 4.25%. As inflation and wage pressures ease, markets are anticipating a shift toward more accommodative monetary policy, with two additional rate cuts likely by the end of the year.

This policy pivot opens up fresh opportunities for investors across multiple asset classes. Crypto markets, Hong Kong equities, and forex traders should keep a close watch, as changes in UK interest rates often influence capital flows, currency valuations, and risk sentiment across global markets.