U.S. Tariff Hike Pressures Japan’s Inflation and Rate Outlook—BOJ’s Ueda Warns of Export Strain Impacting Corporate Pricing and Yen Exchange Rate

U.S. Tariff Hikes Threaten Japan’s Inflation Outlook as BOJ Faces Tough Choices

Rising U.S. tariffs could deal a serious blow to Japan’s inflation expectations, according to Bank of Japan Governor Kazuo Ueda. He warns that increased export pressure may weaken Japanese companies’ ability to set prices, potentially undermining current efforts to stabilize inflation.

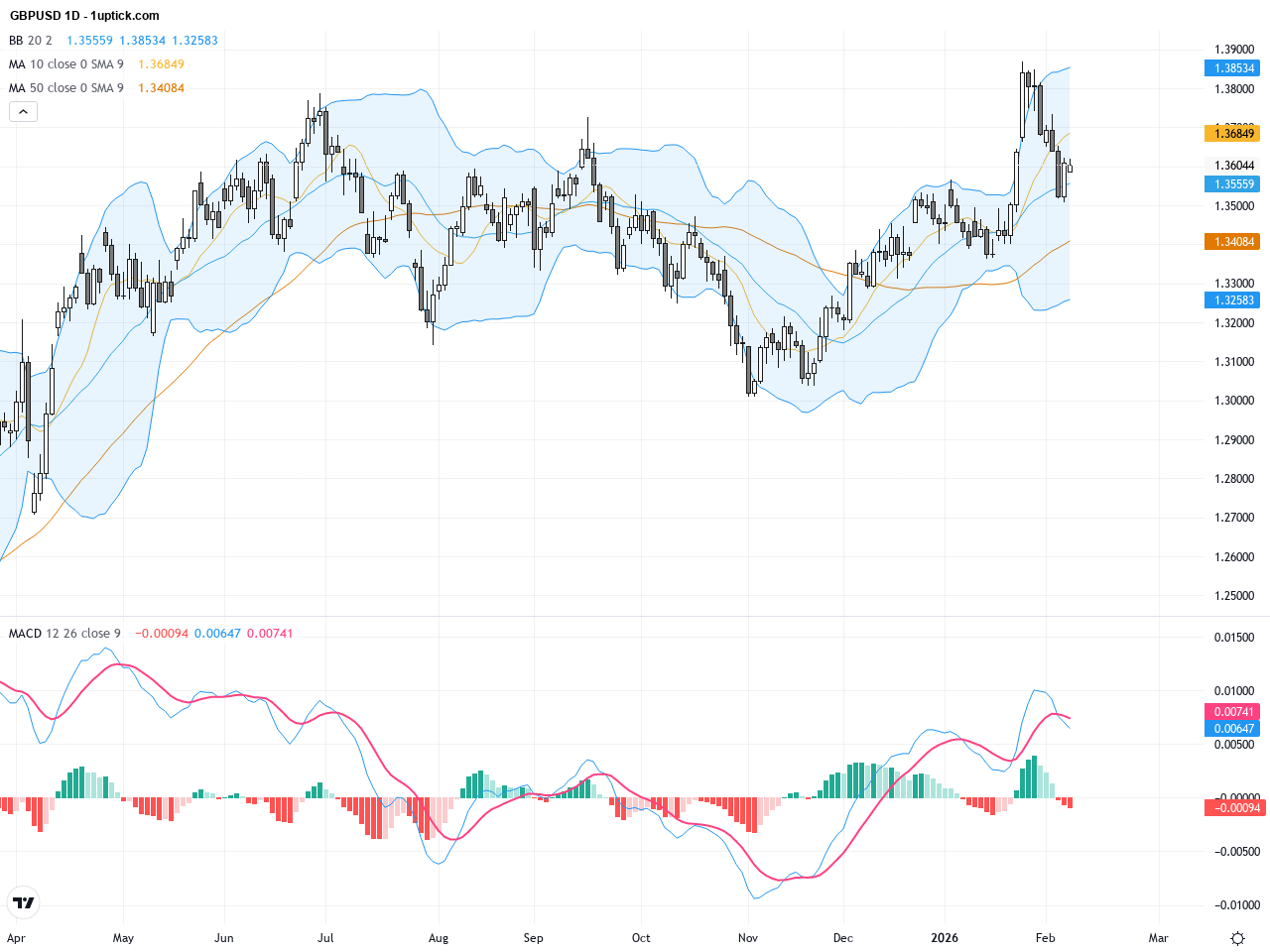

While Japan’s Consumer Price Index (CPI) has shown recent gains, growing external risks—such as protectionist trade measures and weakening global demand—cast uncertainty over the Bank of Japan’s policy direction. Investors are closely watching whether the central bank will delay its next rate hike, as fears of economic headwinds mount.

The Japanese yen’s future trajectory also remains in focus, especially as currency fluctuations and trade negotiations are expected to play a pivotal role in shaping the nation’s broader macroeconomic outlook. Analysts are keeping a close eye on developments to gauge any shifts in monetary policy or trade strategy.