2025-10-07 @ 20:01

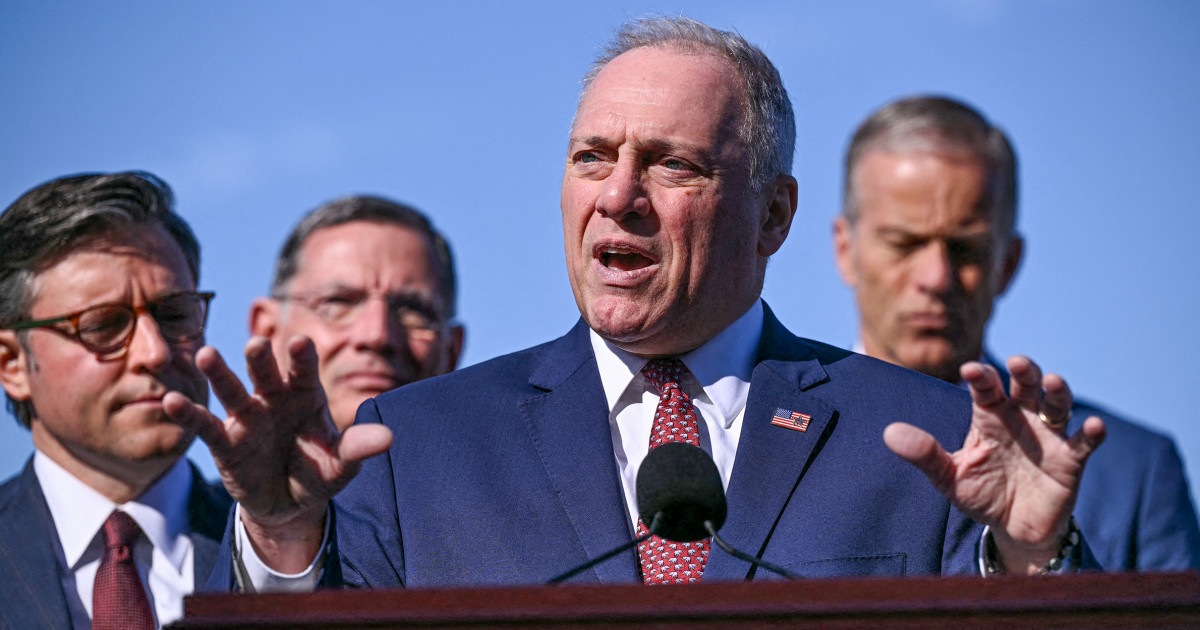

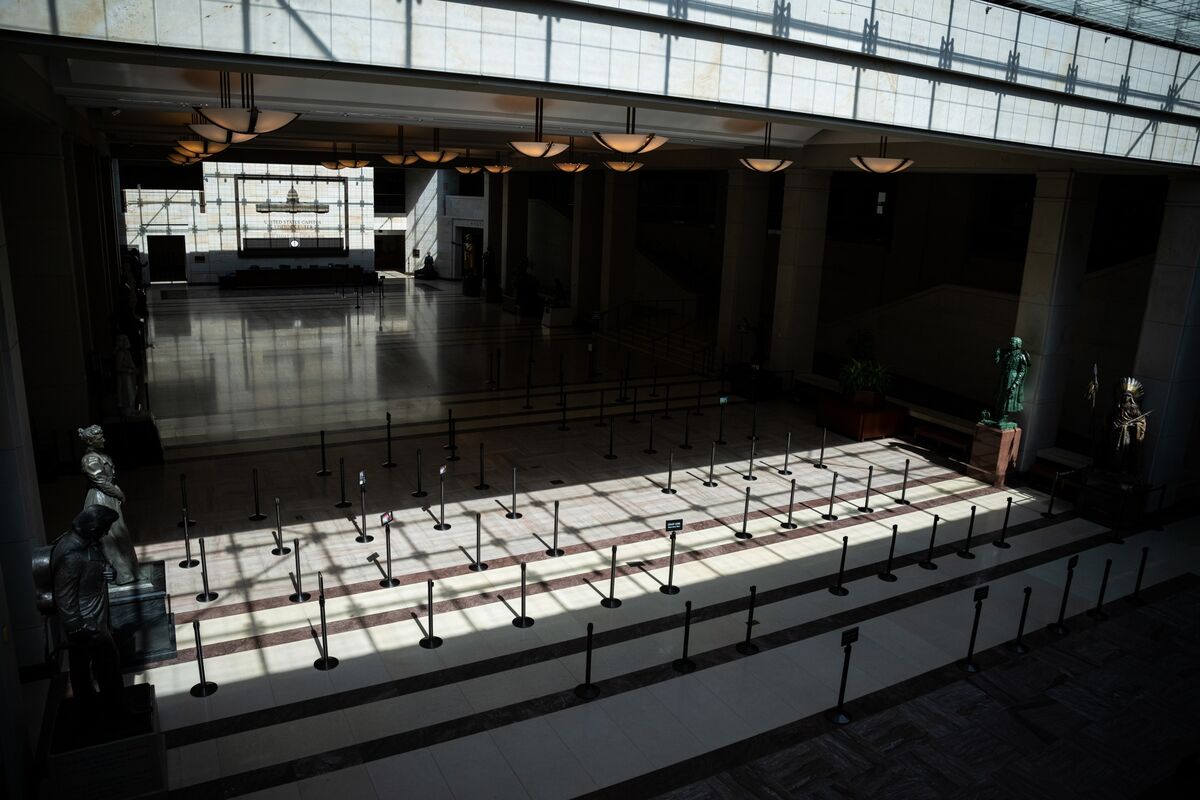

The U.S. government shutdown has now entered its second week, as lawmakers remain deadlocked over federal spending, foreign aid, and health insurance subsidies. With no resolution in sight, nearly a million federal employees have been furloughed, while hundreds of thousands more continue working without pay. Essential services such as Medicare and the Transportation Security Administration remain operational, but many agencies—including the National Institutes of Health, Centers for Disease Control and Prevention, and the WIC program—face partial or full suspensions, impacting millions of Americans.

National parks have closed, Social Security applications are delayed, and the economic ripple effects are being felt nationwide. The shutdown, the first in six years, highlights a deepening political divide in Washington, with both parties unable to find common ground on a continuing resolution or full-year appropriations. As negotiations stall and partisan tensions escalate, the American public is left grappling with uncertainty, unpaid bills, and disrupted government services. With talks ongoing but no breakthrough yet, the duration and full impact of this shutdown remain open questions.