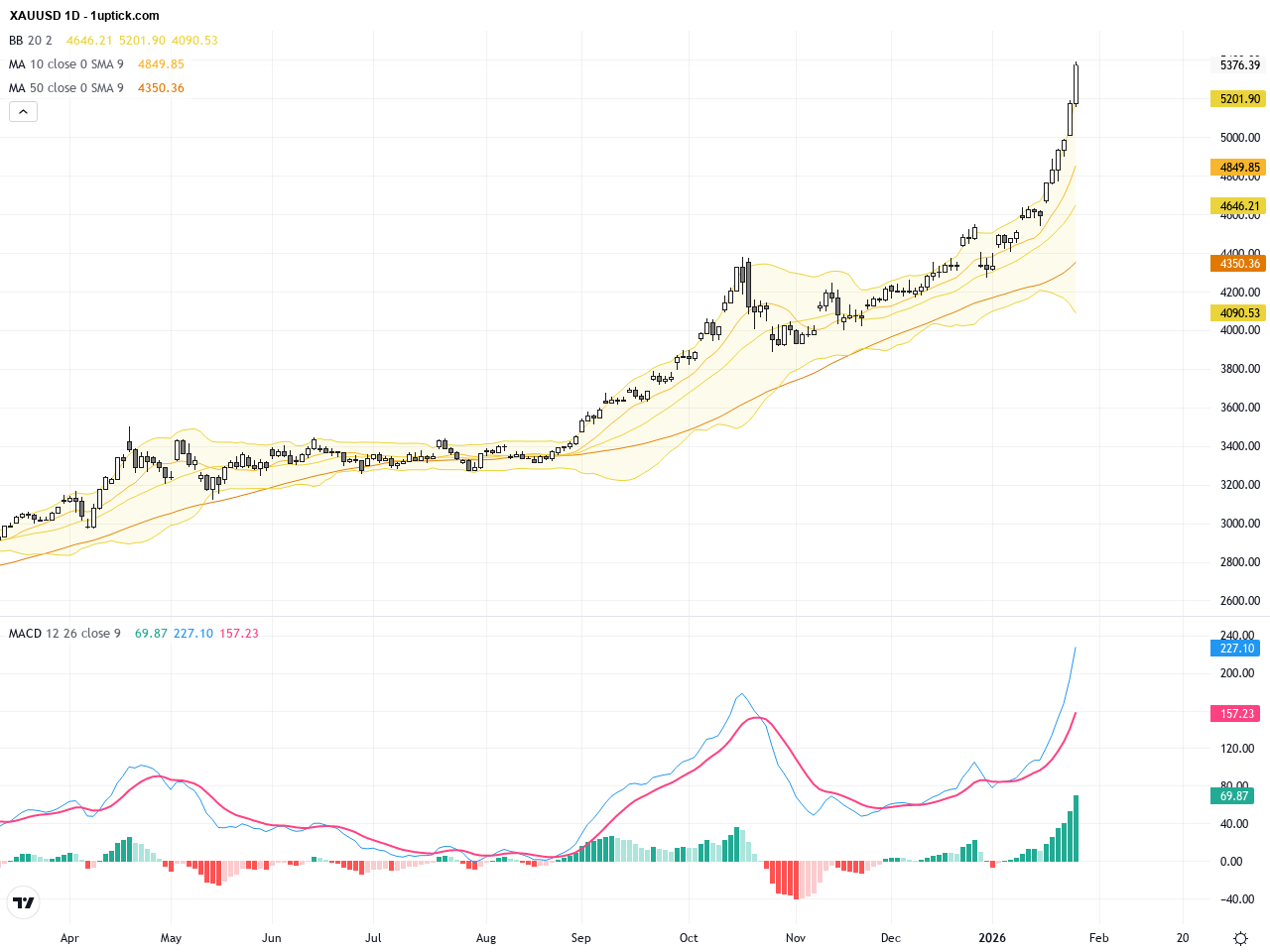

XAUUSD: Gold Faces Critical Correction Phase Amid Key Technical & Fundamental Factors

XAUUSD (gold) has seen intense volatility recently, closing near $4668 yesterday after a significant pullback from recent highs. Market sentiment was shaped by Deutsche Bank’s reiteration of a $6,000 target, signaling strong long-term bullish potential, yet expecting 8-9 weeks of price corrections. Heightened risk asset volatility has constrained gold’s safe-haven demand. This week, gold rebounded off a low near $4402 and is currently battling within the vital $5002-$5143 zone—a crucial support/resistance area. For everyday investors, this means cautious entry opportunities amid ongoing market uncertainty. Gold continues to play its dual role as a hedge and speculative asset, making it critical to monitor the evolving price action closely.