|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Forecast 2025: Bulls Hold Key Support as Fed Rate Cut Bets Drive Rally

Gold Price Forecast 2025: Bulls Hold Key Support as Fed Rate Cut Bets Drive Rally

2025-11-27 @ 02:01

Gold Price Forecast: Bulls Defend Key Level as Fed Rate Cut Bets Fuel Breakout Hopes

Gold prices have been on a strong upward trajectory in recent weeks, with the precious metal defending a critical support level near $4,133 per ounce. Investors and traders are closely watching the market as expectations for Federal Reserve rate cuts continue to build, fueling optimism for further gains in the gold market.

At the heart of the current rally is the growing belief that the Fed will begin cutting interest rates in the near term. Lower rates typically reduce the opportunity cost of holding non-yielding assets like gold, making the metal more attractive to investors. This dynamic has helped gold break out of its recent consolidation phase and retest key resistance levels.

In November, gold surged past the $4,133 mark, a level that had previously acted as both support and resistance. The ability of bulls to defend this level has sent a strong signal to the market, suggesting that the underlying demand for gold remains robust. With inflation pressures still lingering and global economic uncertainty persisting, gold continues to serve as a safe-haven asset for investors seeking protection against market volatility.

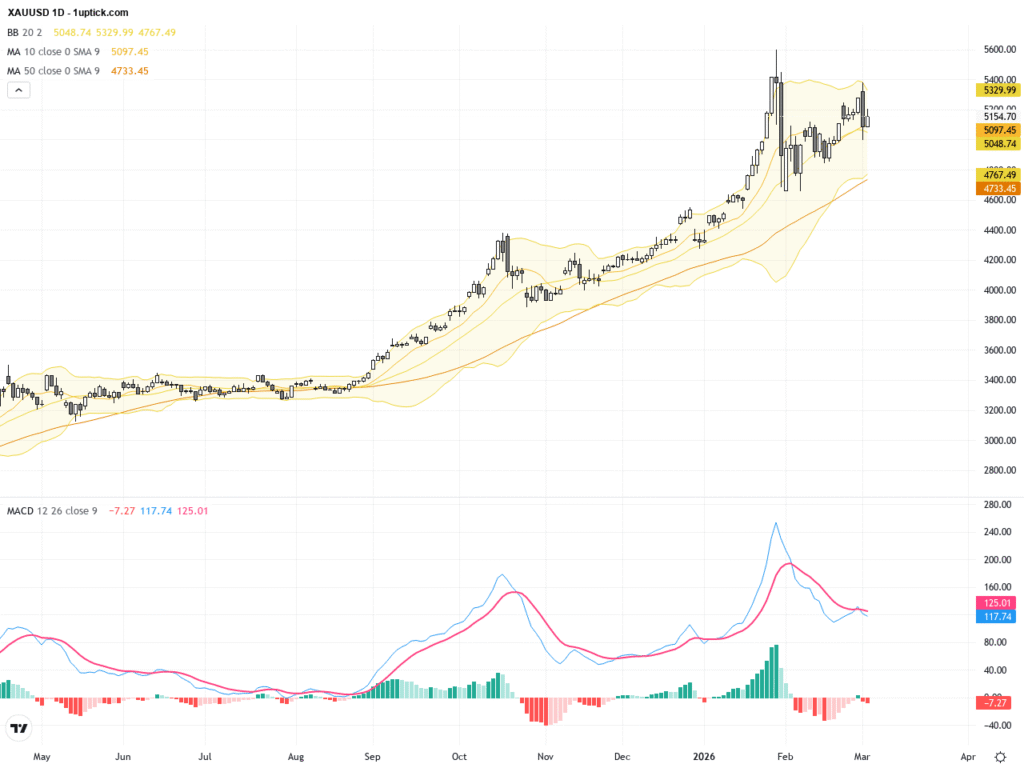

Technical analysis shows that gold is currently trading in a bullish channel, with the price finding support at the 50-day and 200-day moving averages. The Relative Strength Index (RSI) is hovering in the upper range, indicating strong buying momentum. However, traders should remain cautious of potential overbought conditions, which could lead to short-term pullbacks.

Market sentiment remains overwhelmingly bullish, with many analysts predicting that gold could reach new all-time highs in the coming months. The combination of dovish Fed expectations, geopolitical tensions, and ongoing inflation concerns is creating a perfect storm for gold prices. Some forecasts suggest that gold could break above $4,500 by the end of the year, representing a significant upside from current levels.

One of the key drivers behind the recent surge in gold prices is the weakening US dollar. As the dollar index declines, gold becomes more affordable for international buyers, boosting demand. Additionally, central banks around the world have been increasing their gold reserves, further supporting the metal’s price.

Despite the positive outlook, there are risks to consider. A sudden shift in Fed policy or a stronger-than-expected economic recovery could dampen gold’s rally. Moreover, increased volatility in financial markets could lead to short-term fluctuations in gold prices.

For investors, the current environment presents both opportunities and challenges. Those with a long-term perspective may view the recent pullbacks as buying opportunities, while short-term traders should be prepared for increased volatility. Diversifying portfolios with gold can help mitigate risk and provide a hedge against inflation and market uncertainty.

Looking ahead, the focus will remain on Fed policy decisions and economic data releases. Any hints of earlier or more aggressive rate cuts could provide additional fuel for gold’s rally. Conversely, a more hawkish stance from the Fed could trigger a correction in the gold market.

In summary, gold is in a strong position as bulls defend key support levels and rate cut expectations grow. The metal’s appeal as a safe-haven asset and hedge against inflation continues to attract investors, driving prices higher. While risks remain, the overall outlook for gold remains positive, with the potential for further gains in the months ahead.