|

| Gold V.1.3.1 signal Telegram Channel (English) |

AUDUSD Technical and Fundamental Outlook: Key Support and Resistance Levels Explained

2026-01-02 @ 08:01

Over the past 24 to 48 hours, the AUD/USD currency pair experienced notable volatility. The closing price yesterday was 0.66767, marking a roughly 0.25% decline from the previous day. Market movements were heavily influenced by key economic data, particularly a strong U.S. labor market report that boosted the dollar and put pressure on the Australian dollar. Notably, U.S. jobless claims fell to a multi-year low, reinforcing demand for the dollar as a safe haven, which pushed AUD/USD down near 0.665.

Additionally, the Australian dollar has been struggling with reduced liquidity during the holiday season, hovering around the 0.6700 level, indicating a tug-of-war between bulls and bears. A recent pause in the decline of precious metals boosted the Aussie slightly, prompting bulls to eye the 0.6800 resistance area. Nevertheless, divergent views between the Federal Reserve and the Reserve Bank of Australia continue to overshadow the outlook, creating uncertainty in the near term.

For the average investor, this period can be seen as a currency tug-of-war: robust U.S. economic data lifting the dollar and pressuring AUD, while holiday-thinned market volume limits volatility. In the short term, if the dollar remains strong, the Australian dollar could see further drops, but a rebound in precious metals and improving liquidity might offer some upside for AUD/USD.

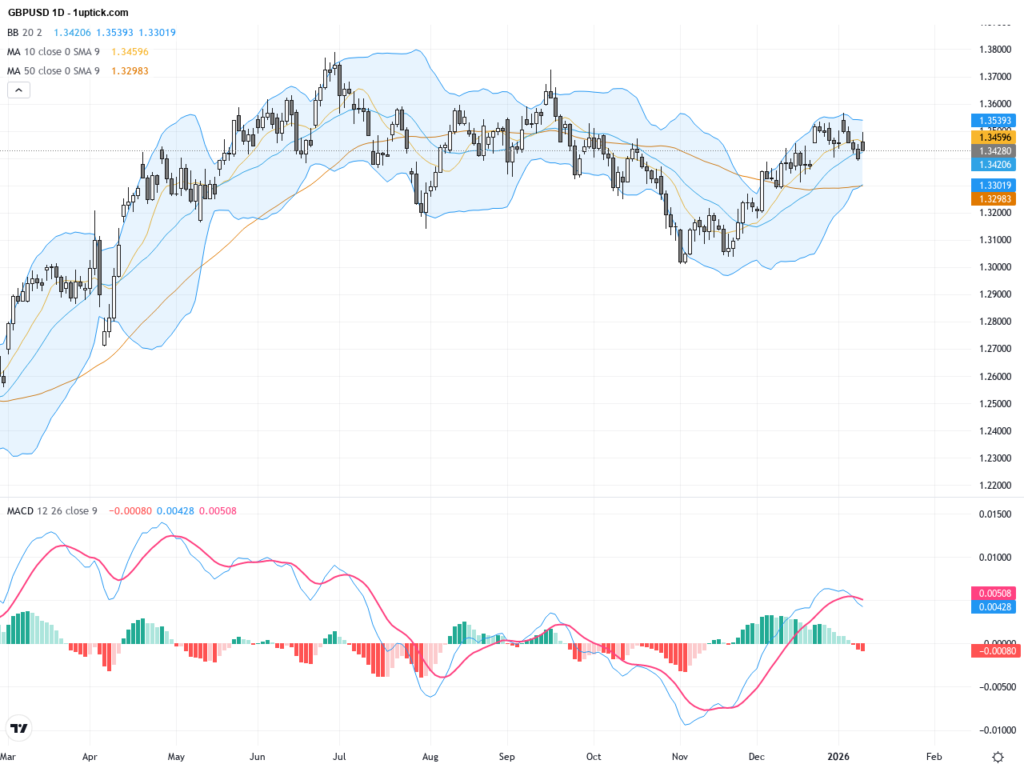

The daily chart shows AUDUSD consolidating between 0.65 and 0.67 after a strong rebound. The price has broken above the 50-day and 200-day moving averages indicating a bullish medium-term trend. Bollinger Bands are contracting, suggesting reduced volatility. The MACD remains above the zero line showing sustained momentum, albeit with some weakening. Overall, the daily chart depicts a firm uptrend though selling pressures are present and maintaining key support levels is crucial.

The hourly chart over the past 3-5 days illustrates AUDUSD oscillating between 0.669 and 0.665 forming a short-term range. The 50 and 200-period moving averages flatten, and Bollinger Bands tighten, indicating a potential imminent breakout. MACD shows bullish divergence at the bottom, signaling potential upward momentum pickup. Recent candlestick patterns, including hammer and engulfing, suggest buying pressure is increasing with possible short-term rebound ahead.

Technical Trend: AUDUSD is currently in a cautiously bullish consolidation phase, awaiting a confirmed breakout to dictate the next directional move.

Technical indicators depict a tug-of-war between bulls and bears: with a bullish bias on the daily timeframe, while the short-term hourly chart suggests a potential breakout. Low holiday trading volumes increase the risk of false breakouts. MACD remains positive without signs of weakening; RSI holds near neutral to slightly high, reflecting ongoing buying interest. Watch for a decisive break below 0.665 support, which could trigger a new lower leg in the correction.There are no significant or directly relevant economic events scheduled today (GMT+1) that would impact the AUDUSD pair. Traders should stay alert for forthcoming Australian and US data releases for market-moving potential.

Resistance & Support

The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.