|

| Gold V.1.3.1 signal Telegram Channel (English) |

EURUSD: Bullish Momentum Holds as Key Technical Patterns Signal Uptrend Continuation

2026-02-16 @ 09:01

Over the past 24 to 48 hours, the EUR/USD has maintained a mild upward trend with limited intraday volatility, closing slightly lower at 1.18612 compared to yesterday’s close of 1.18678, reflecting a modest 0.06% decline. The market has remained cautious ahead of key U.S. labor market and CPI inflation reports, which directly influence the USD and subsequently EUR/USD price movements.

Several financial institutions, including Scotiabank and ING, have recently raised their medium-to-long-term forecasts for EUR/USD, anticipating a breakout above 1.20, possibly reaching 1.22, indicating optimism for the euro’s outlook. The consensus is that the USD remains stable but lacks strong momentum, especially following inflation data meeting expectations, limiting USD’s bullish impetus.

For the average investor, this suggests the euro may gradually strengthen over the coming weeks, potentially presenting opportunities in euro-denominated assets through exchange rate gains. However, close attention is needed for upcoming U.S. economic releases, which could trigger short-term market volatility and shift trends.

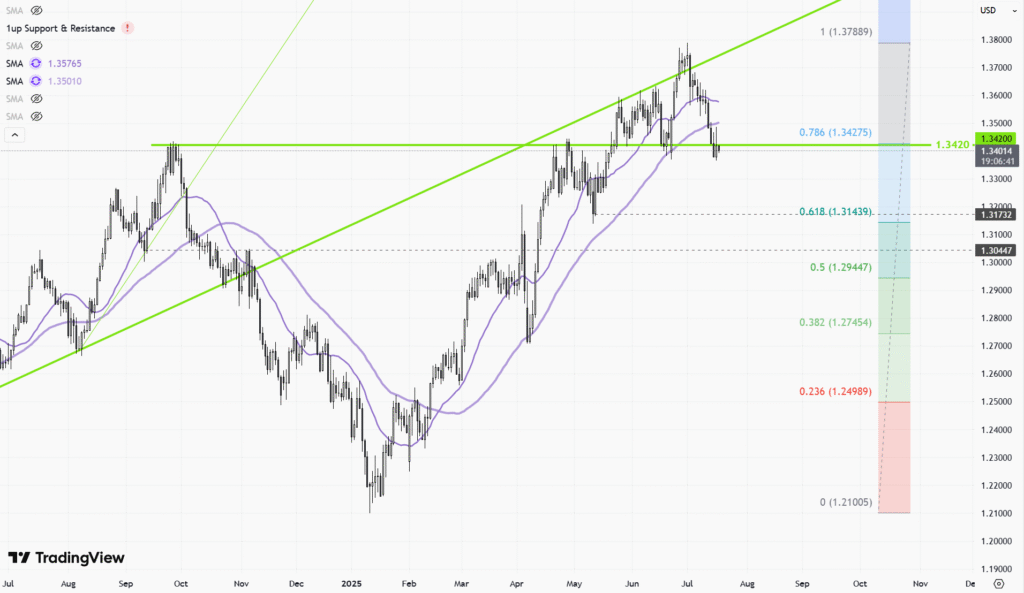

The daily chart reveals a sustained upward trajectory for EURUSD since the start of the year, with short-term moving averages positioned above the longer-term ones, confirming a bullish alignment. Bollinger Bands have narrowed, indicating reduced volatility with room for upward movement. The MACD histogram shows minor pullbacks but maintains positive momentum, signifying buyers remain in control. The pair is trading within a defined ascending channel, with significant support near 1.1750 and resistance around 1.1900.

Hourly chart analysis over the last 3 to 5 days shows a short-term corrective move, as price found support near 1.1830 following profit-taking. Moving averages are intertwined, reflecting consolidation. Price bounced off the Bollinger Bands middle band, and the MACD is poised to form a bullish crossover. An ascending triangle has been forming, supporting the potential for continuation higher if resistance levels are broken.

Technical Trend: Solid bullish trend with minor consolidation

Technical signals highlight an imminent MACD bullish crossover supported by a bounce off the Bollinger middle band and the ascending triangle pattern, indicating bullish continuation potential. Daily moving averages confirm a positive bias, with short-term pullbacks seen as consolidation rather than reversal. The critical challenge remains breaking above daily resistance near 1.1900; success there could open the path towards the psychological 1.20 level.In today’s GMT+1 economic calendar, the Eurogroup Meeting in the Eurozone stands out without direct economic releases but with important policy implications. Additionally, US Federal Open Market Committee (FOMC) member Bowman’s speech at 14:25 may cause USD volatility impacting EURUSD. Other releases from Japan and Nordic countries are unlikely to have significant direct effects on EURUSD today. Overall, no major direct economic event is expected to cause sharp movements in the pair, though traders should monitor developments closely.

Resistance & Support

The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.