Technical Analysis

Evaluate price trends and patterns, identify potential investments and trading opportunities!

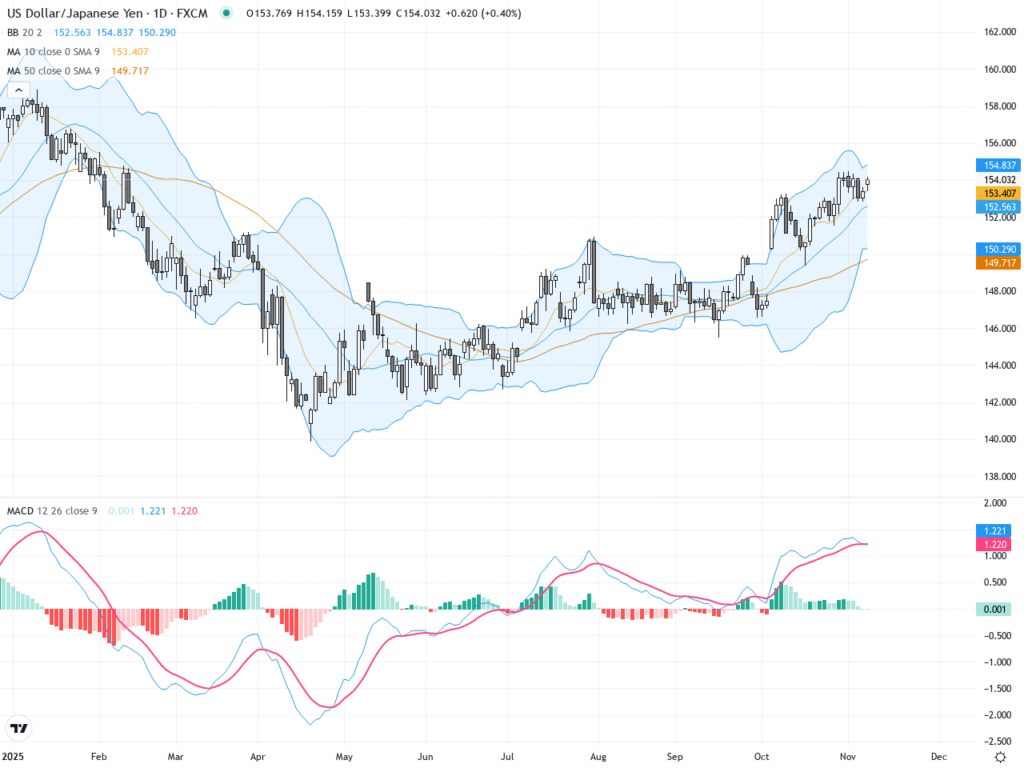

USDJPY: Key Resistance Builds Pressure Amid Sideways Consolidation, Short-Term Pullback Possible

Over the past three trading days, USDJPY has oscillated within a narrow range between 154.3 and 154.7, closing at 154.723 yesterday. The currency pair remains strong but is struggling to break out decisively. With no…

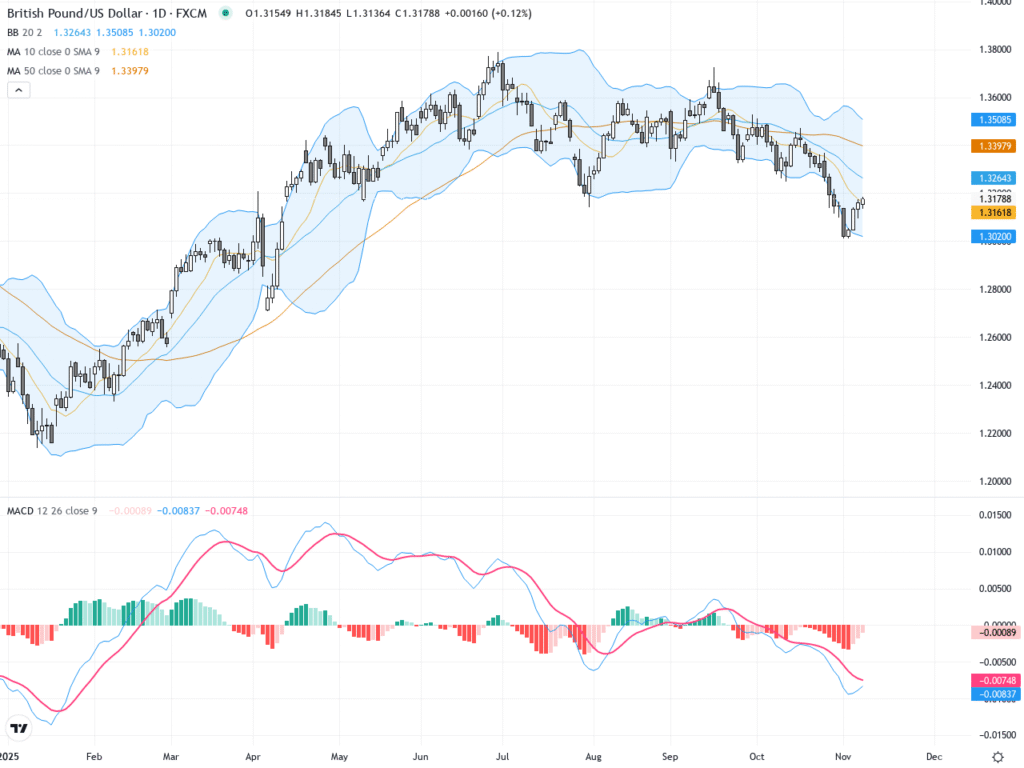

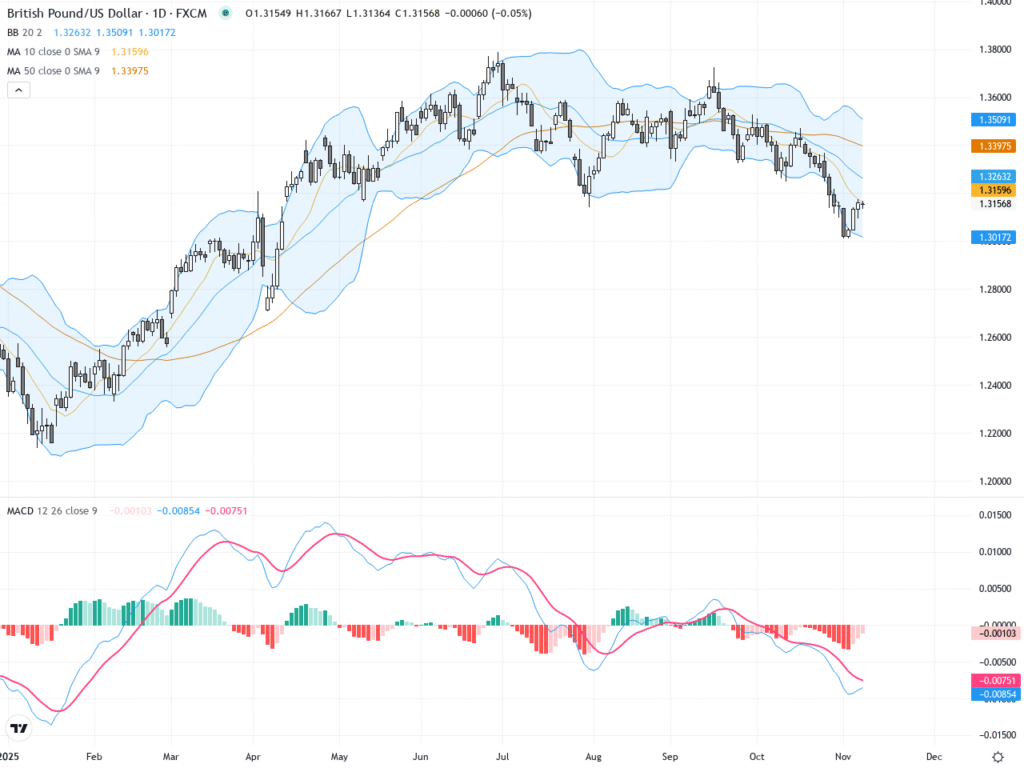

GBPUSD: Bullish Breakout Targets Key Resistance – Technical Momentum Signals Trading Opportunity

Over the past three trading days, GBPUSD has demonstrated clear volatility with a sharp upward bias, climbing towards the 1.31349 region—firmly above yesterday's closing level. Despite a lack of high-impact news headlines, recent UK economic…

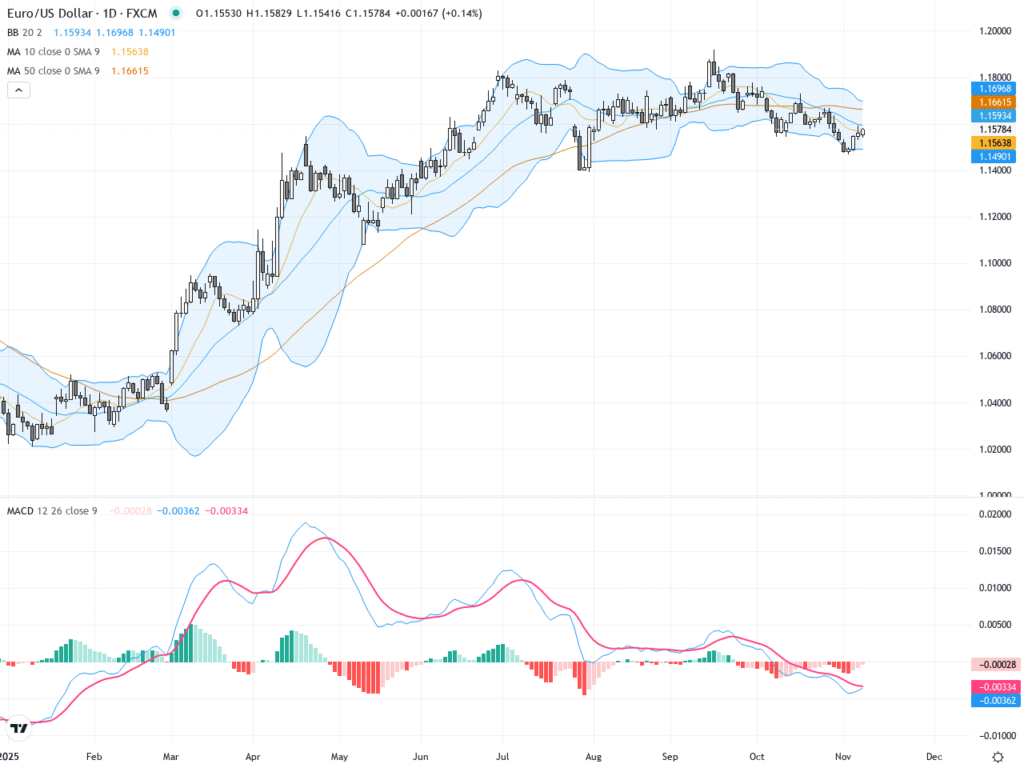

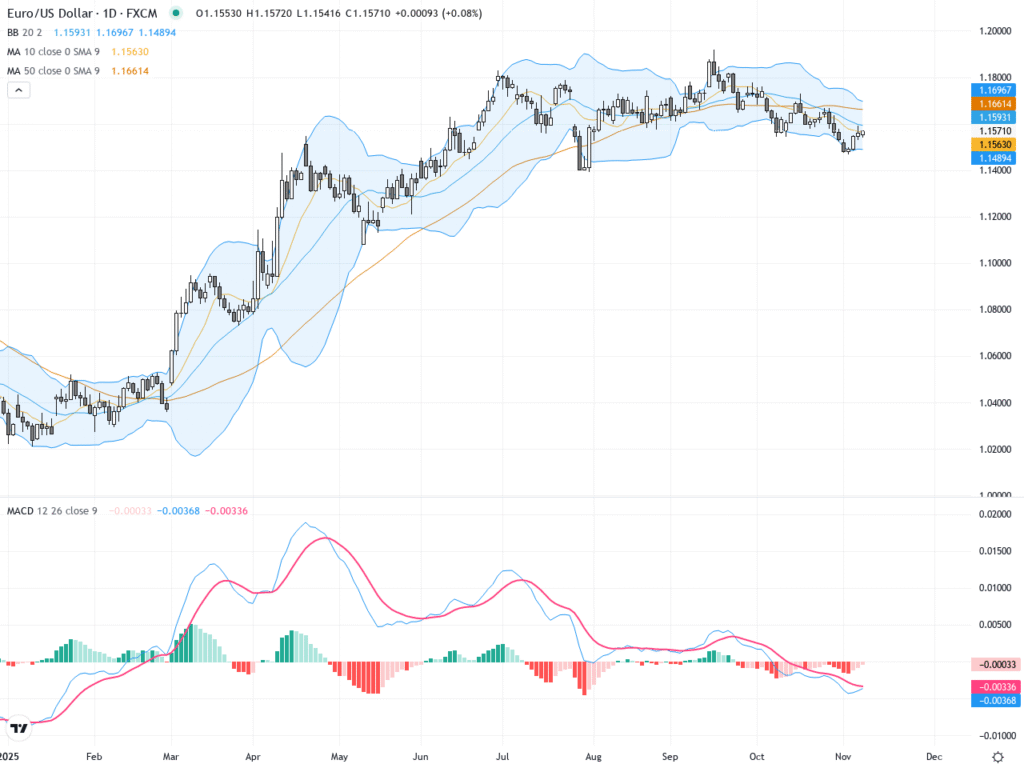

EURUSD: Bulls and Bears Battle at Resistance—Watch These Levels for a Major Breakout

Over the past three trading days, EURUSD has been caught in a tight range, closing at 1.15789 after failing to sustain a push above 1.15830. With no significant Eurozone or US data releases, technicals have…

GBPUSD: Triangle Squeeze Signals a Breakout—Sterling Approaches Make-or-Break Zone

Over the past three trading days, GBPUSD has whipped between 1.31 and 1.32, closing at 1.31789 on November 9, right at the upper edge of its recent range. With no major news headlines in the…

USDJPY: Ascending Flag Breakout Signals Trader Showdown Near 154.40

USDJPY has been surging in the past three sessions, closing at 153.989 yesterday (+0.4%), reflecting ongoing volatility and a tug-of-war at key resistance. No major headlines hit the tape, but traders remain hyper-sensitive to BOJ…

GBPUSD: Major Resistance Test Looms as Tight Range Signals a Breakout Setup

GBPUSD has spent the past three trading days largely consolidating between 1.313 and 1.316, closing yesterday at 1.31468. Price action has been muted, but trading volume is on the rise, indicating cautious sentiment and a…

EURUSD: Fresh Weekly Trading Outlook, Technical Signals & Key Fundamental Shifts

EURUSD demonstrated notable volatility over the past three trading days, with a latest close at 1.15712—slightly higher from yesterday. Although no major news headlines hit the tape this week, the market’s price movement reflected uncertainty…

Market Analysis

Insightz