Technical Analysis

Evaluate price trends and patterns, identify potential investments and trading opportunities!

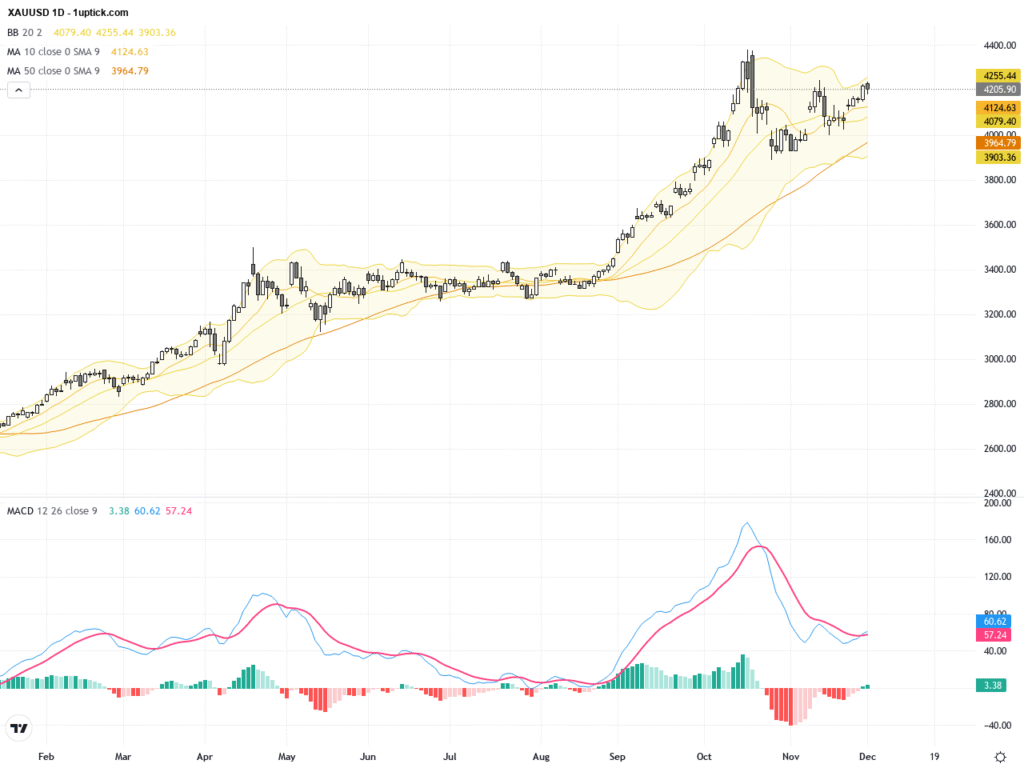

XAUUSD: Gold Breaks Above $4245 Resistance, Bullish Momentum Builds

Over the past three trading days, XAUUSD has demonstrated strong bullish momentum, maintaining a level around $4213 despite brief pullbacks. The prospect of a Fed rate cut and a weakening U.S. dollar have primarily driven…

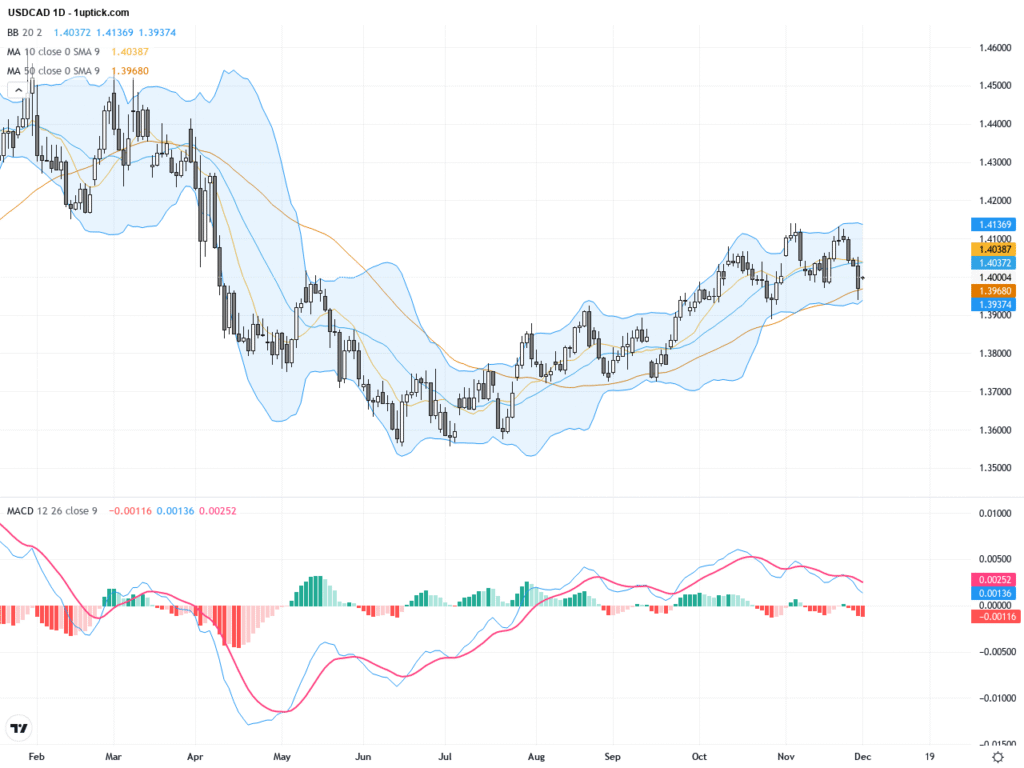

USDCAD: Faces Strong Resistance at 1.4150, Technical Pressure Brewing

Over the past three trading days, USDCAD has shown significant volatility, closing yesterday at 1.40004 and continuing its choppy movement. Recent heightened bets on Federal Reserve rate cuts have pressured the US dollar, with the…

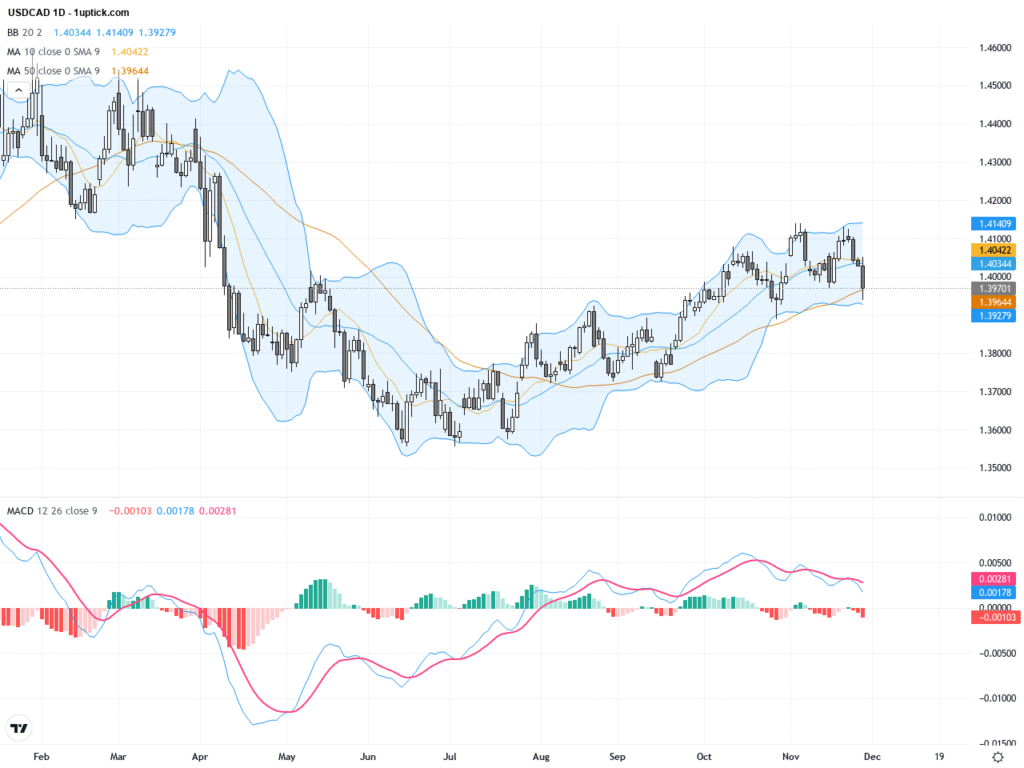

USDCAD: Approaching Key Support at 1.4000 Amidst Ascending Channel Pressure

Over the past three trading days, USDCAD has shown notable volatility, closing at 1.3976 yesterday, down approximately 0.38%. The Canadian dollar has strengthened due to robust Q3 GDP figures, pushing USDCAD downward for four consecutive…

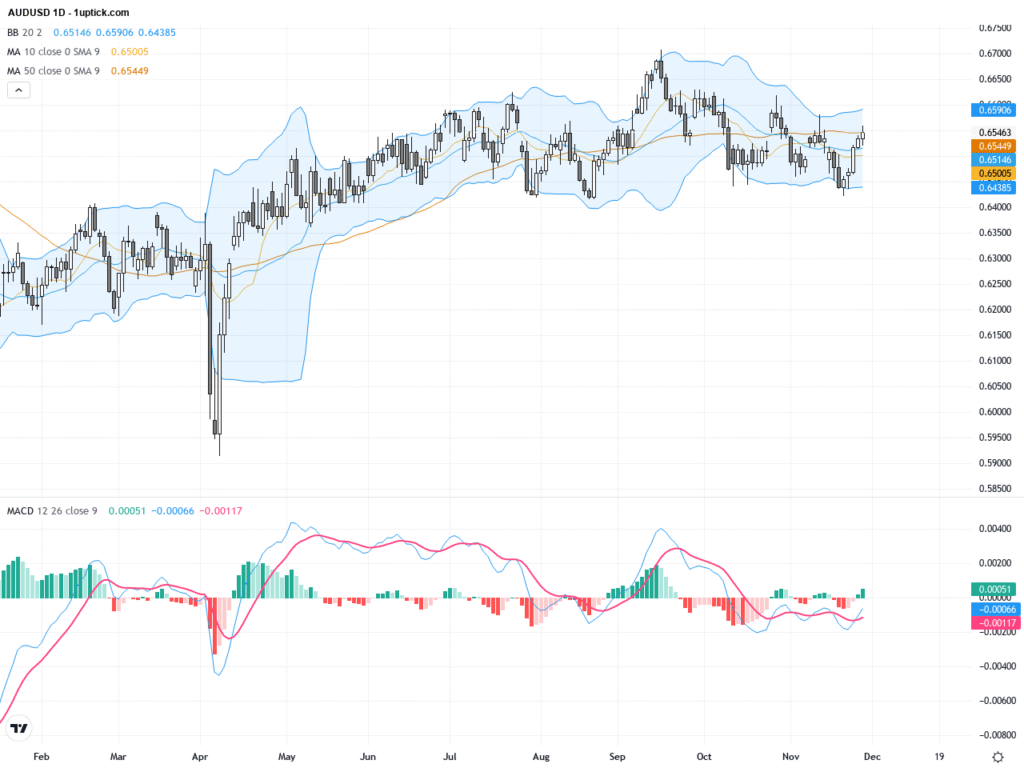

AUDUSD: Bullish Momentum Builds as Price Holds Key Moving Averages

AUDUSD has demonstrated strong rebound momentum over the past three trading days, closing yesterday at 0.65449. The weakness in the US Dollar combined with persistent Australian inflation data has led markets to reassess the RBA's…

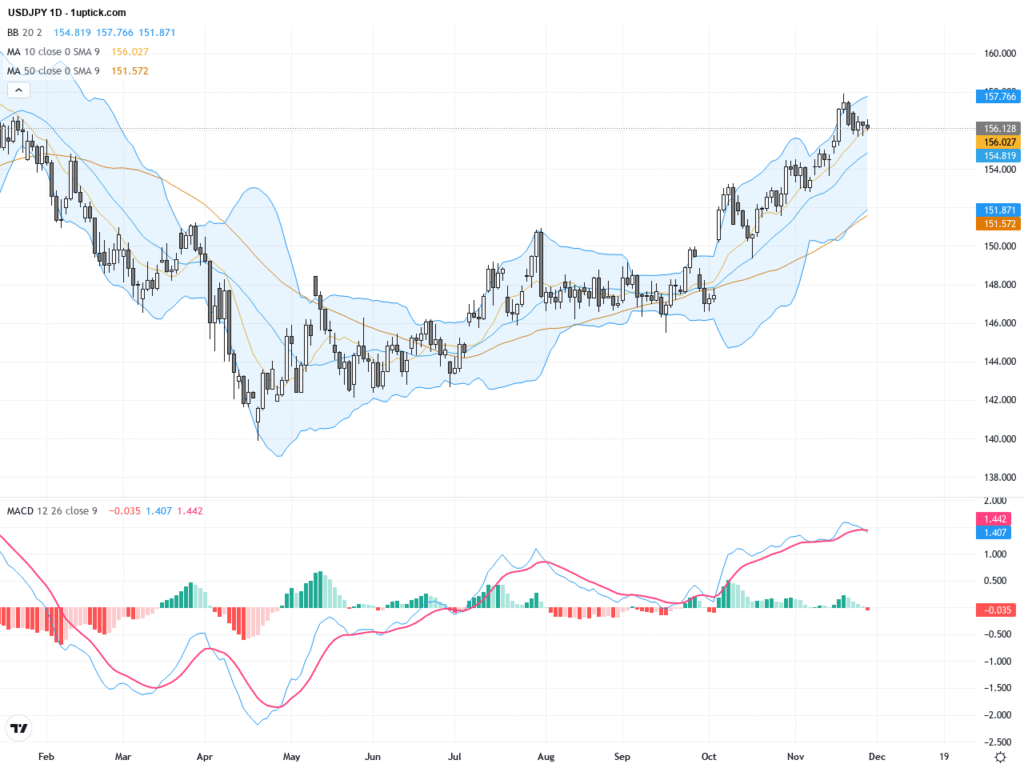

USDJPY: Triangle Consolidation Near 156 Highlights Potential Breakout Ahead

USDJPY has demonstrated choppy price action over the past three trading days, closing around 156.14 with a slight dip. Market sentiment shifted on renewed bets for US Fed rate cuts which pressured the dollar index…

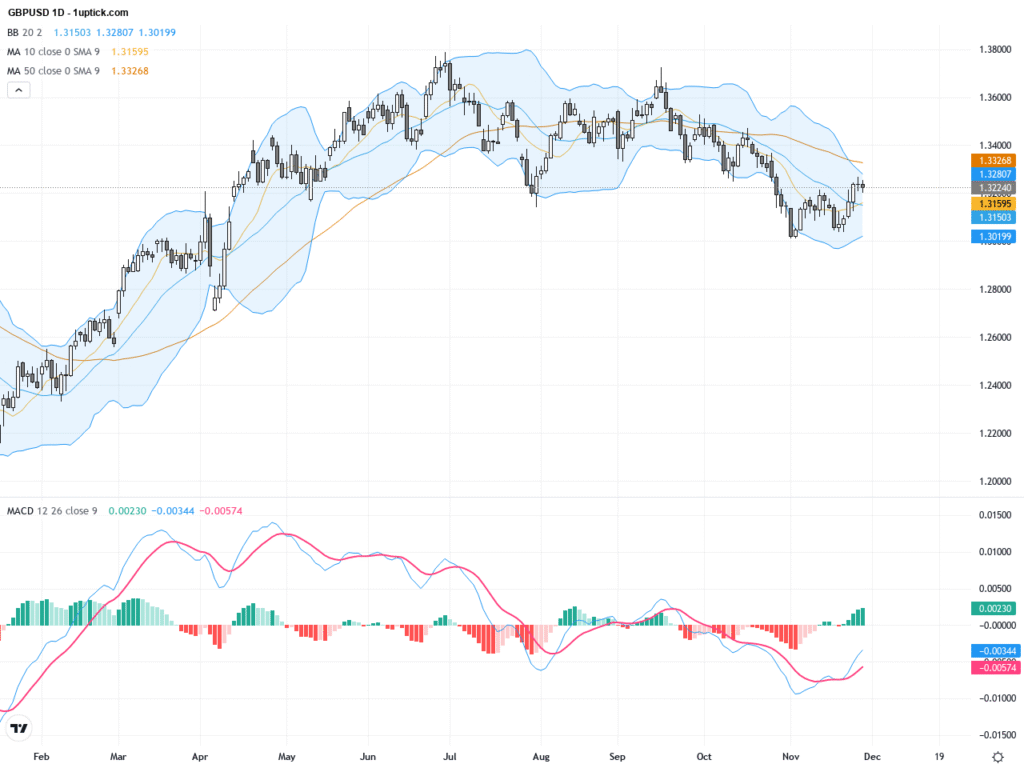

GBPUSD: Bulls Hold Firm Amid Volatility, Eyeing 1.33 Breakout

GBPUSD has demonstrated strong upward momentum over the past three trading days, closing at 1.32417 yesterday. The recent rally is supported by positive UK budget news and market expectations of a December Fed rate cut,…

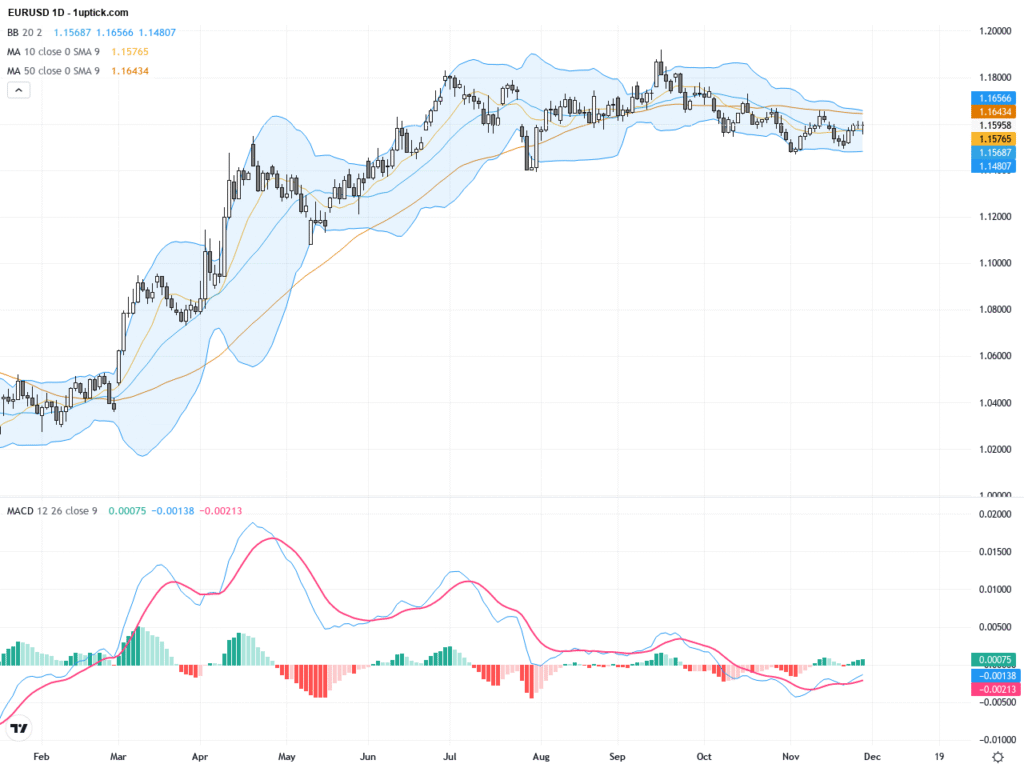

EURUSD: Key 1.16 Support Under Pressure Amid Mixed Eurozone Inflation and Fed Rate Cut Bets

EURUSD has shown a choppy performance over the past three trading days, closing yesterday at 1.1597 within the 1.1555 to 1.1607 range. The market is influenced by European Central Bank's (ECB) expected rate hold and…

Trump’s New China Tariff Threat Sparks Wall Street’s Worst Drop Since April

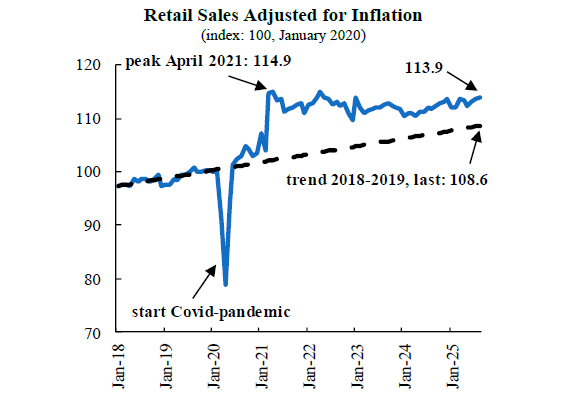

Can the US Economy Re-Accelerate? Latest Data Paints a Mixed Picture

US Economy: Storm Clouds Gather as Tech Stocks Soar

Market Analysis

Insightz