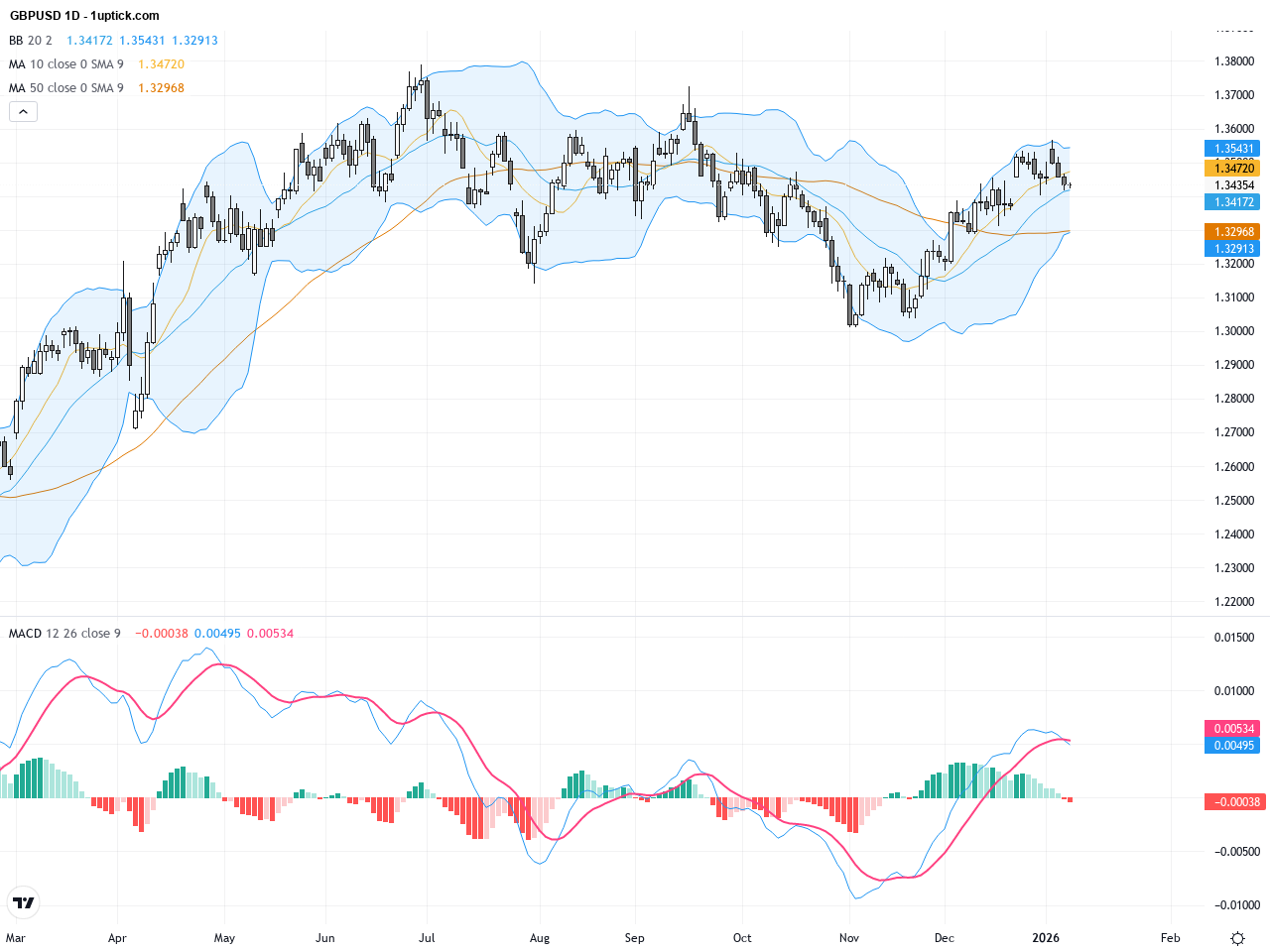

Global Inflation Trends and Central Bank Policies: What Investors Must Watch in 2025

Global inflation in 2025 is expected to show divergent trends, with overall inflation moderating worldwide but remaining persistently high in the United States. Many regions, including parts of Europe and developed countries, are projected to see inflation falling closer to or below target levels, while emerging markets and areas affected by geopolitical tensions, such as Eastern Europe and the Middle East, experience elevated inflation pressures. Central banks face the challenge of balancing rate policies amid this uneven inflation environment, with key risks stemming from tariffs, trade tensions, and geopolitical instability. Investors should closely monitor global core inflation trajectories, central bank policy moves, and evolving geopolitical dynamics as these factors will shape economic growth, market volatility, and investment opportunities throughout 2025.