TikTok’s Legal Battle in the U.S.: Delays, National Security Concerns, and Executive Power Struggles Ahead of the 2025 Ban Deadline

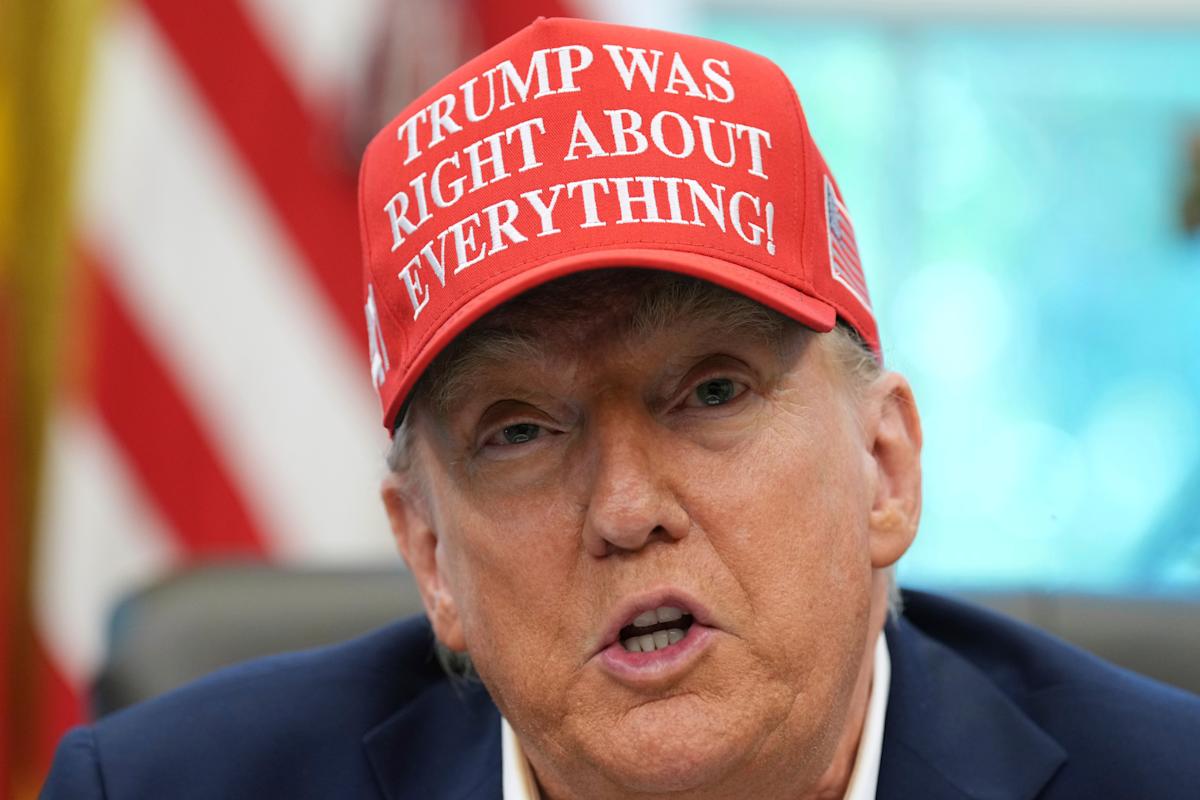

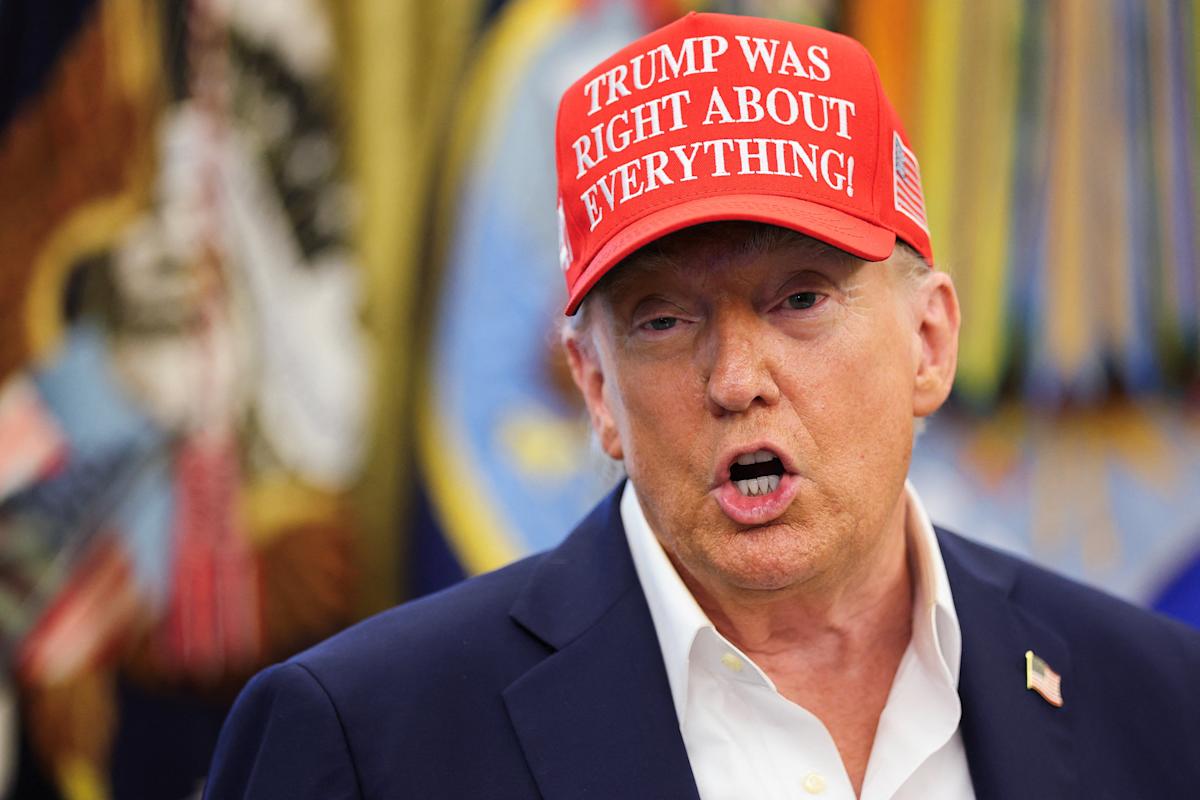

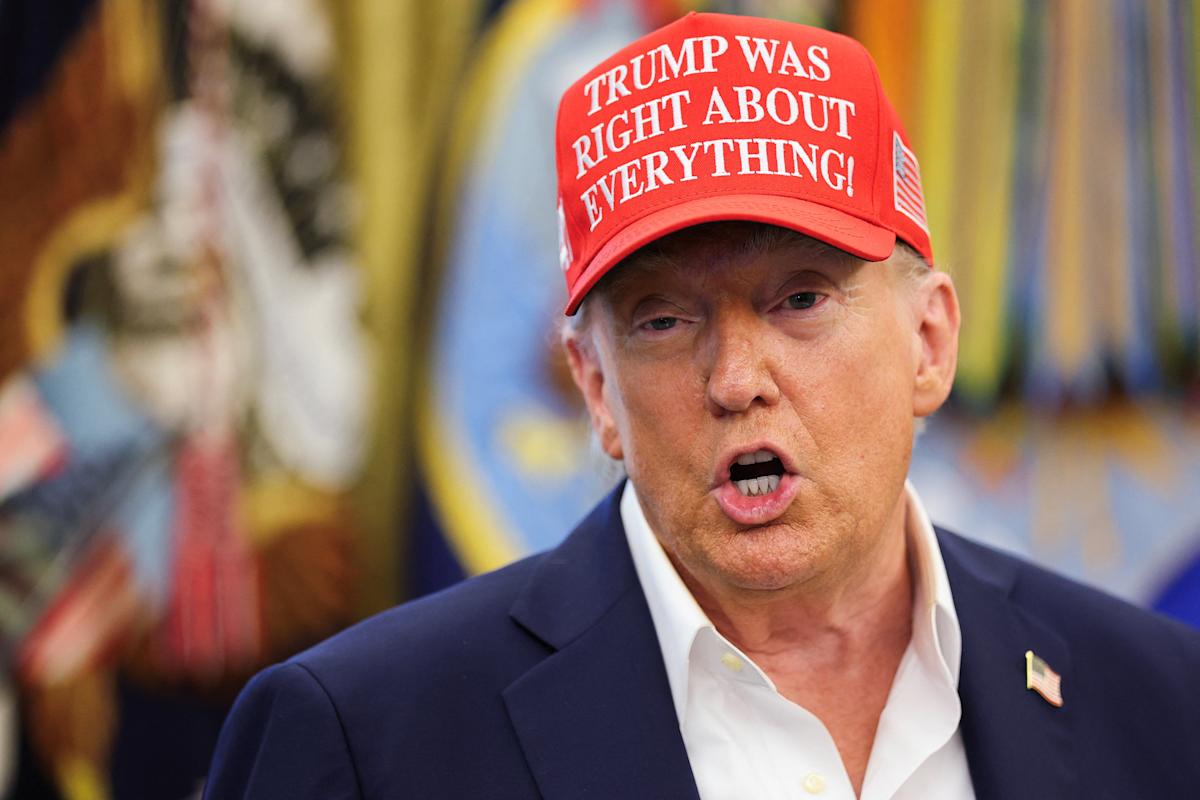

TikTok faces a looming ban in the U.S. with the September 17, 2025 deadline for ByteDance to either divest its U.S. operations or be blocked nationwide. Despite previous suspensions and multiple extensions granted by the Trump administration, uncertainty remains as Chinese government approval is still required, and TikTok continues operating with over 170 million American users. The ban stems from national security concerns under the Protecting Americans from Foreign Adversary Controlled Applications Act, which targets apps controlled by foreign adversaries like China. The ongoing legal and executive battles highlight the complex intersection of technology, security, and international relations as the final ban deadline approaches.