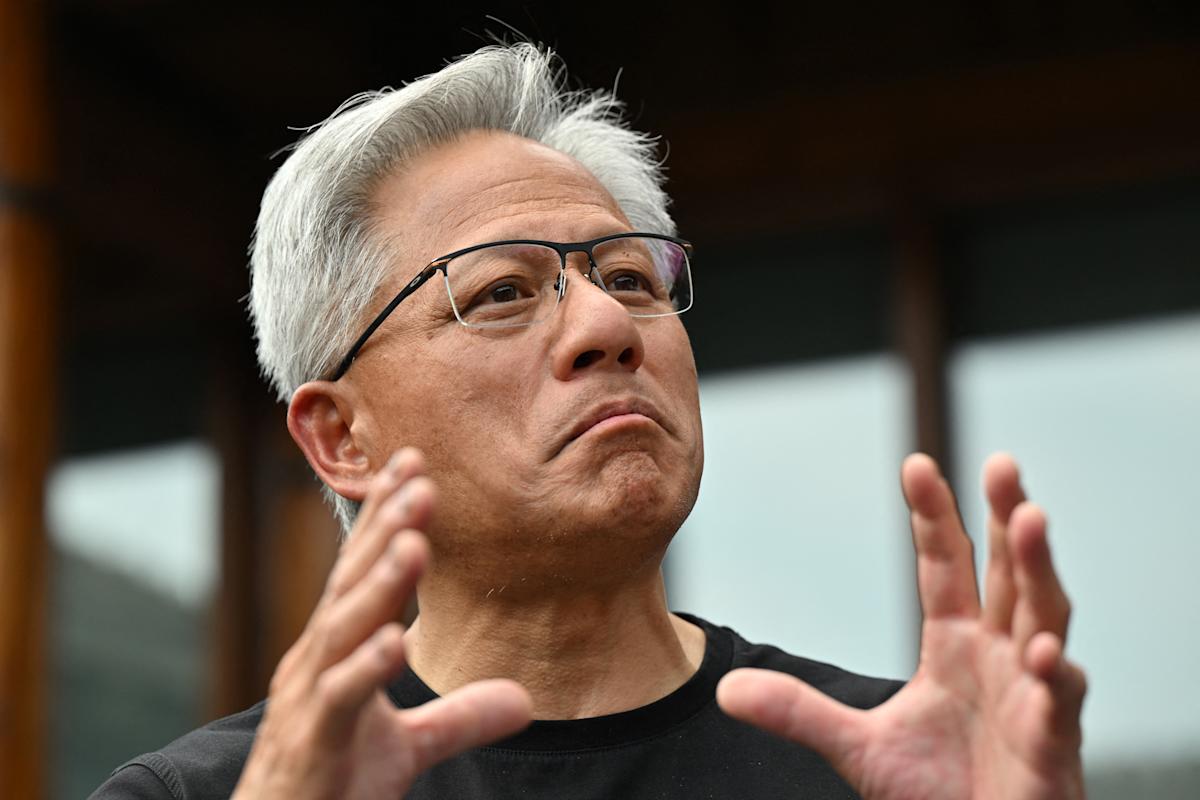

Federal Reserve Board Member Christopher Waller Faces Mortgage Fraud Allegations Amidst Calls for Accountability and Market Concerns

Federal Reserve Board Member Lisa Cook is under intense scrutiny amid serious mortgage fraud allegations, prompting calls for her resignation from political figures including former President Donald Trump. Accused of falsely claiming two properties as primary residences in 2021 to obtain more favorable mortgage terms, these allegations have sparked calls for a Department of Justice investigation. Despite the pressure, Cook has firmly refused to resign, emphasizing her commitment to addressing the claims transparently while highlighting that the mortgages in question predate her Fed appointment. This controversy unfolds against the backdrop of political efforts to influence Federal Reserve leadership and policy, with implications for the central bank’s independence and mortgage market integrity.