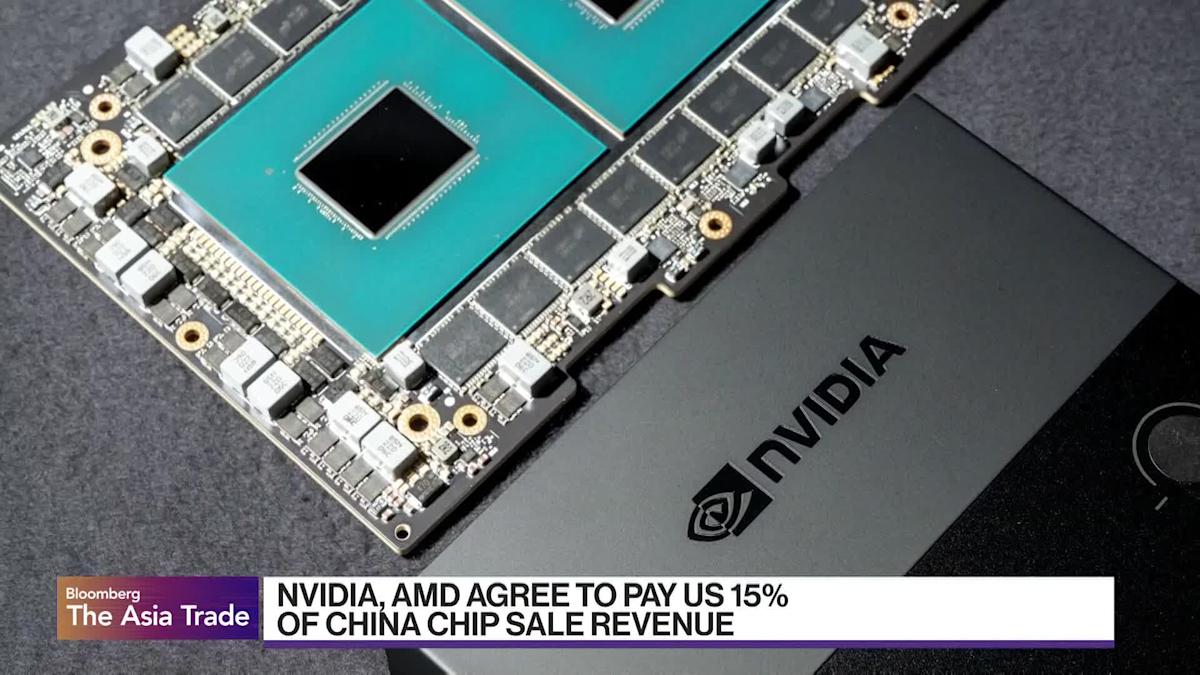

Intel CEO Lip-Bu Tan Faces National Security Scrutiny Amid U.S.-China Tensions and Strategic Semiconductor Challenges

Intel’s newly appointed CEO, Lip-Bu Tan, brings over two decades of semiconductor and technology leadership experience to the company as it faces critical challenges amid U.S.-China tensions and the global semiconductor race. Since taking the helm in March 2025, Tan aims to restore Intel’s market leadership by modernizing manufacturing capabilities, enhancing customer-centric innovation, and driving strategic growth. With a strong background leading Cadence Design Systems and extensive expertise in venture capital and chip design, Tan is focused on transforming Intel into a world-class products and foundry company. His leadership comes at a crucial time when national security scrutiny and supply chain considerations are deeply impacting the semiconductor industry globally. Tan’s appointment has fueled investor confidence and signals a renewed commitment to innovation and competitiveness in the face of geopolitical and technological challenges.