|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump’s 2024 Comeback: What It Means for the Presidential Race and Financial Markets

Trump’s 2024 Comeback: What It Means for the Presidential Race and Financial Markets

2026-02-17 @ 09:00

Trump’s Return to the 2024 Race: What’s Next for the Markets?

Over the past two weeks, former U.S. President Donald Trump officially announced his intention to run for president again in 2024, sending ripples through financial markets. Investors and analysts quickly recalibrated their strategies as Trump’s political comeback introduces a fresh dose of uncertainty for both the U.S. economy and the global market landscape.

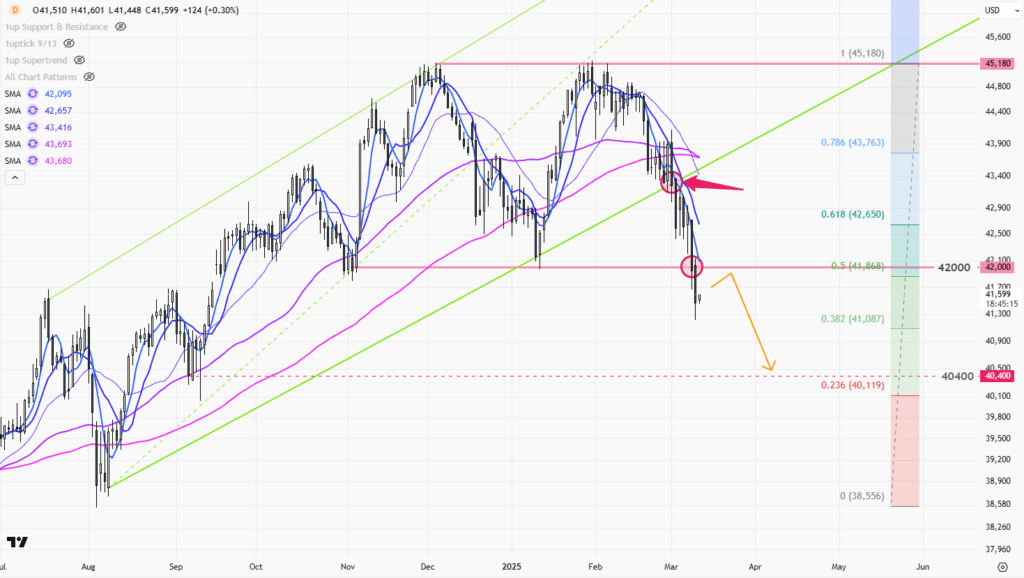

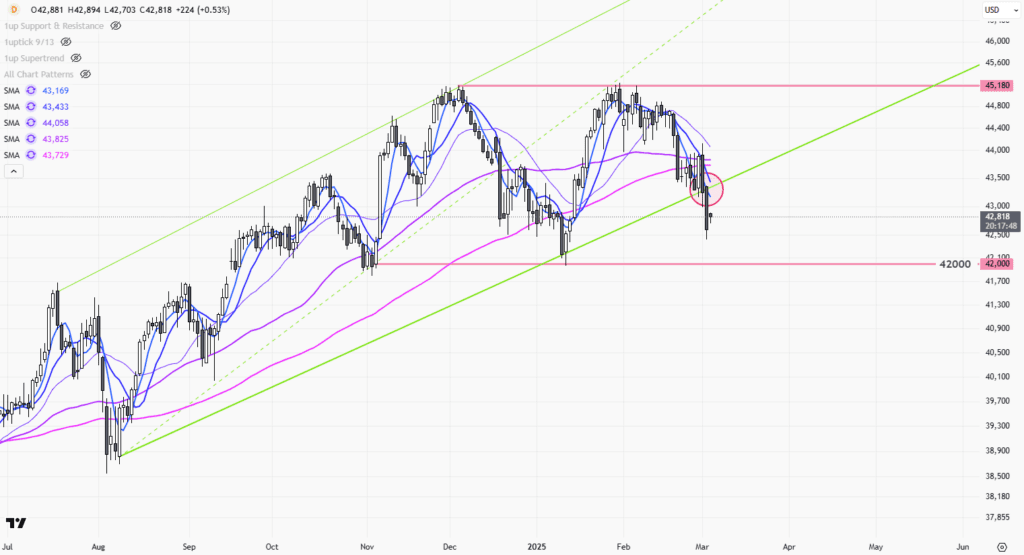

Following the announcement, key indices like the S&P 500 and Nasdaq experienced brief bouts of volatility, signaling investor concerns about potential shifts in policies and the impact on international trade. This comes at a time when inflation remains stubbornly high and central banks maintain a tightening stance, making Trump’s economic platform and tough foreign policy rhetoric especially market-sensitive.

Direct Impact on Corporates and Tech Stocks

The market effects extend beyond broad indices. Major tech companies like Apple and Amazon have seen their stocks fluctuate in line with Trump-related headlines. Risk-averse investors have shown a preference for stable cash-flow businesses and defensive sectors as policy unpredictability looms.

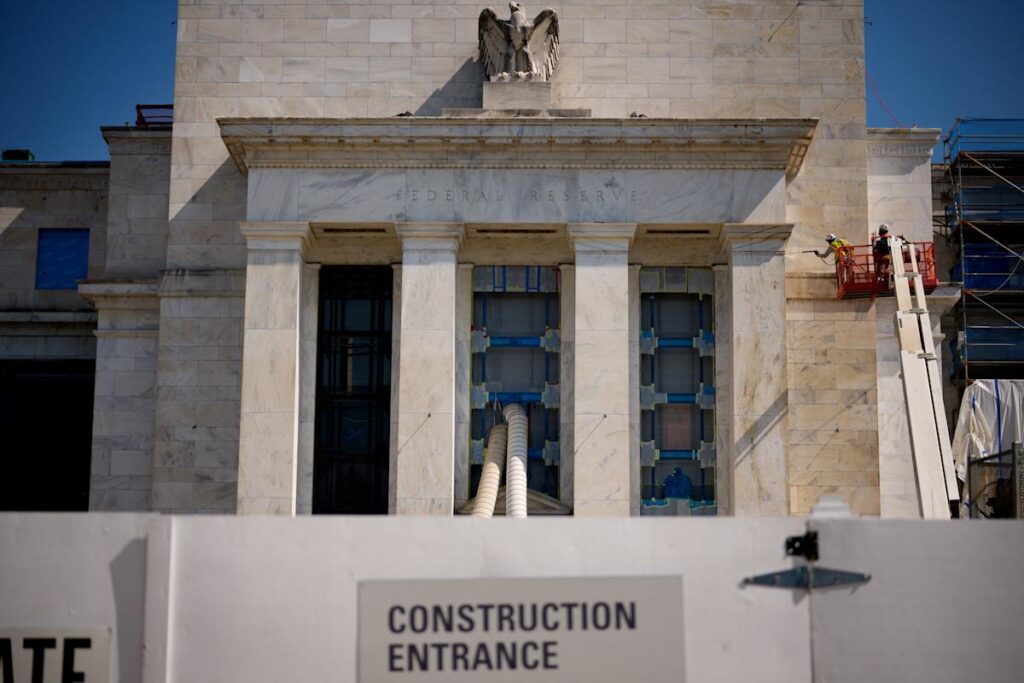

Trump’s historically stringent approach to sectors like semiconductors and 5G technology continues to add layers of regulatory uncertainty. Financial services are also in a holding pattern, awaiting potential tax reforms and regulatory changes tied to Trump’s agenda.

Economic Outlook and Investor Sentiment

While political turmoil often triggers market swings, recent economic data points to an underlying resilience in the U.S. economy. Still, uncertainty will likely mount as the election draws closer, with investor sentiment highly sensitive to the evolution of policy stances.

Experts urge caution. If Trump’s proposed policies take shape, short-term market volatility could intensify. But over the longer term, market direction will hinge on policy stability and clarity. For everyday investors, diversification and remaining informed about political developments are key to managing risk effectively.

Bottom Line: How Will the 2024 Race Reshape Global Investment?

The last two weeks have shown that Trump’s political moves are far from mere headlines—they are catalysts shaking financial foundations. Navigating this uncertain terrain will require vigilance and adaptability. Tracking the latest developments and staying flexible could be your best bet for weathering the 2024 market storms ahead.