Technical Analysis

Evaluate price trends and patterns, identify potential investments and trading opportunities!

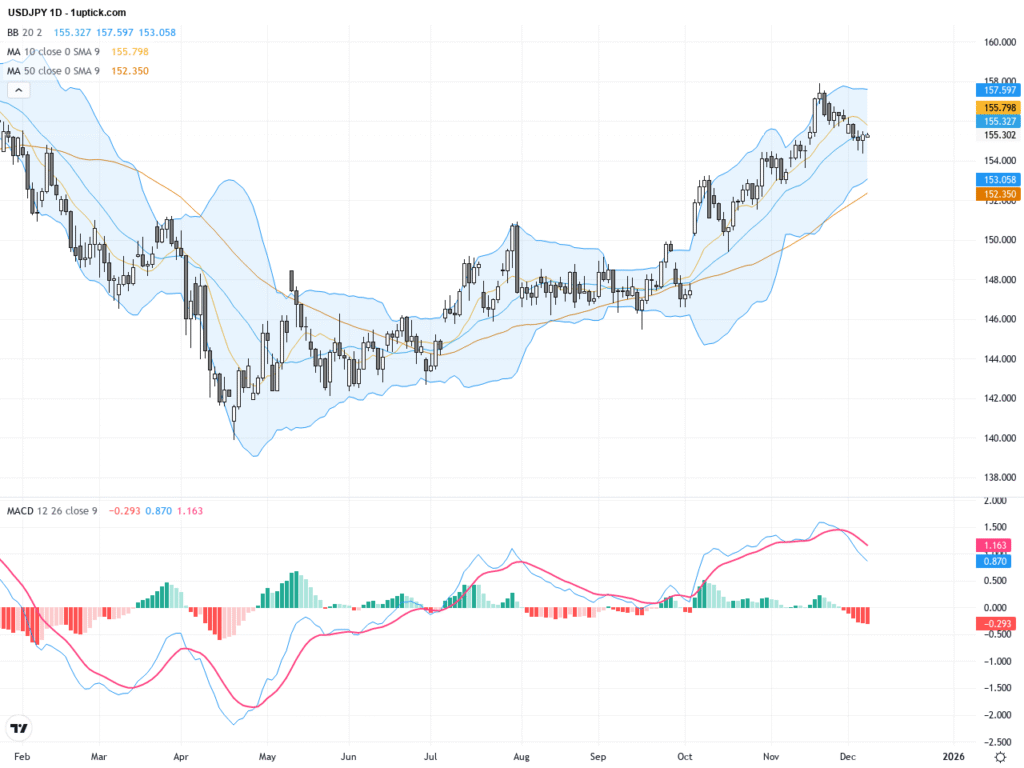

USDJPY Trading Outlook: Price Pressured Below 155 with Key Technical Patterns Emerging

Over the past three trading days, USDJPY has experienced noticeable volatility, with the price retreating from around 155.30 to near 155.25, influenced mainly by looming Fed rate cut speculation and rising Japan-China military tensions. These…

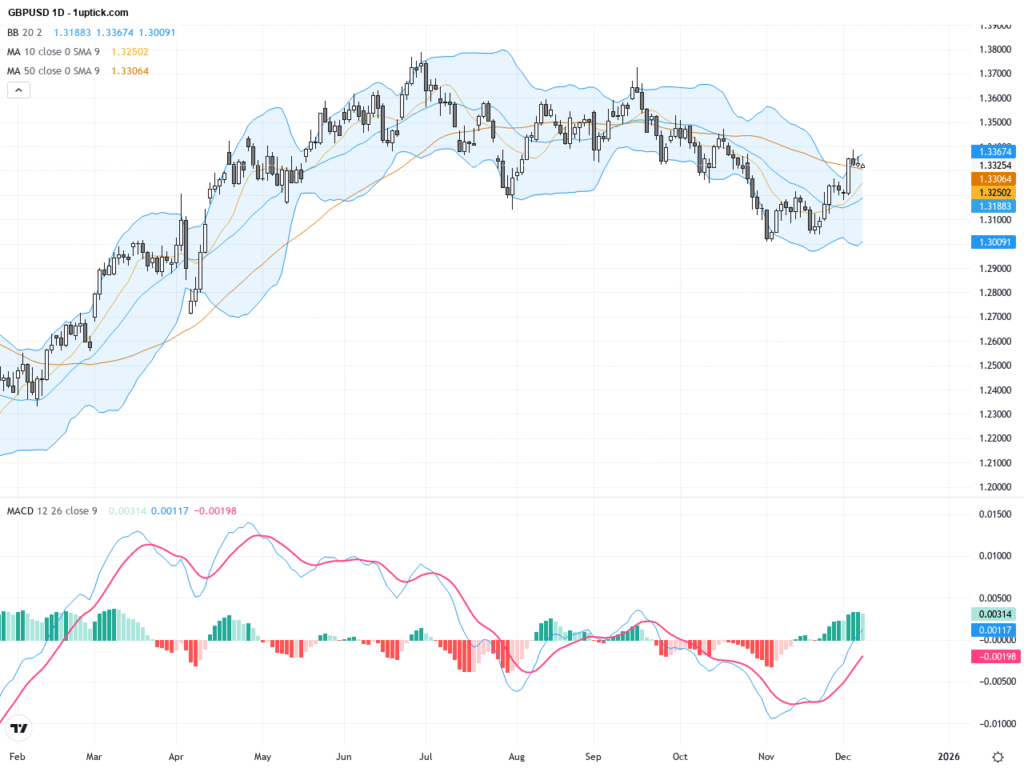

GBPUSD Technical & Fundamental Outlook: Approaching 5-Week High Resistance with Key Trading Signals

GBPUSD has experienced notable volatility over the past three trading days, closing yesterday at 1.33255 near a five-week high. The pair remains supported by a weakening US Dollar Index and improved UK budget sentiment, though…

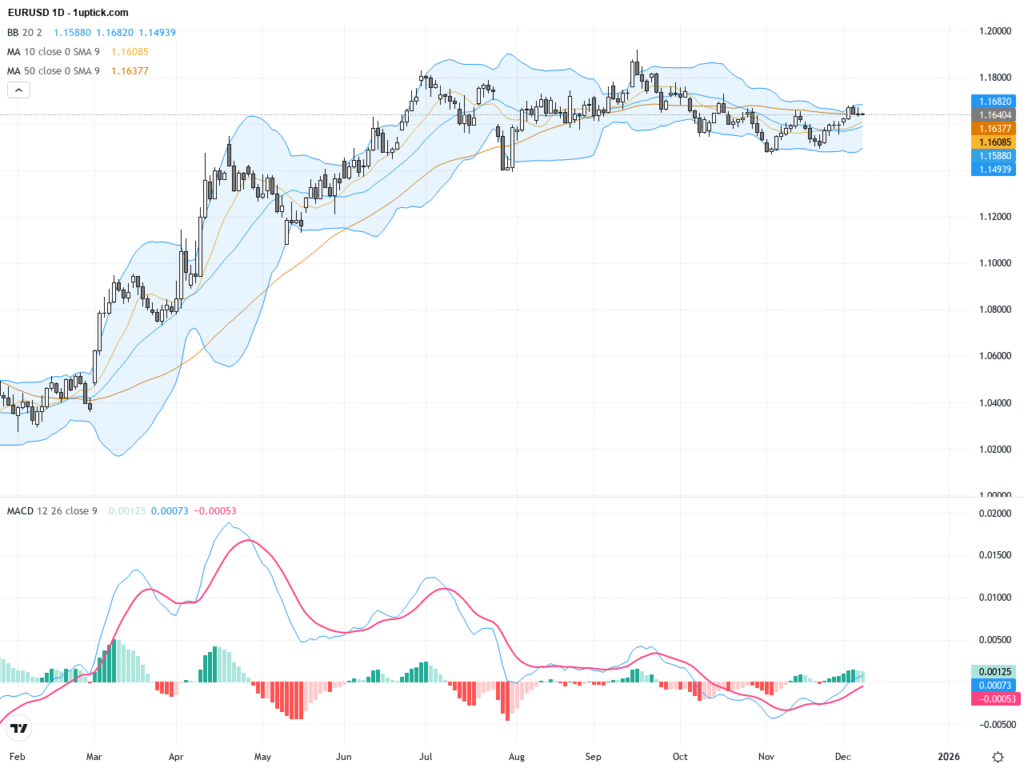

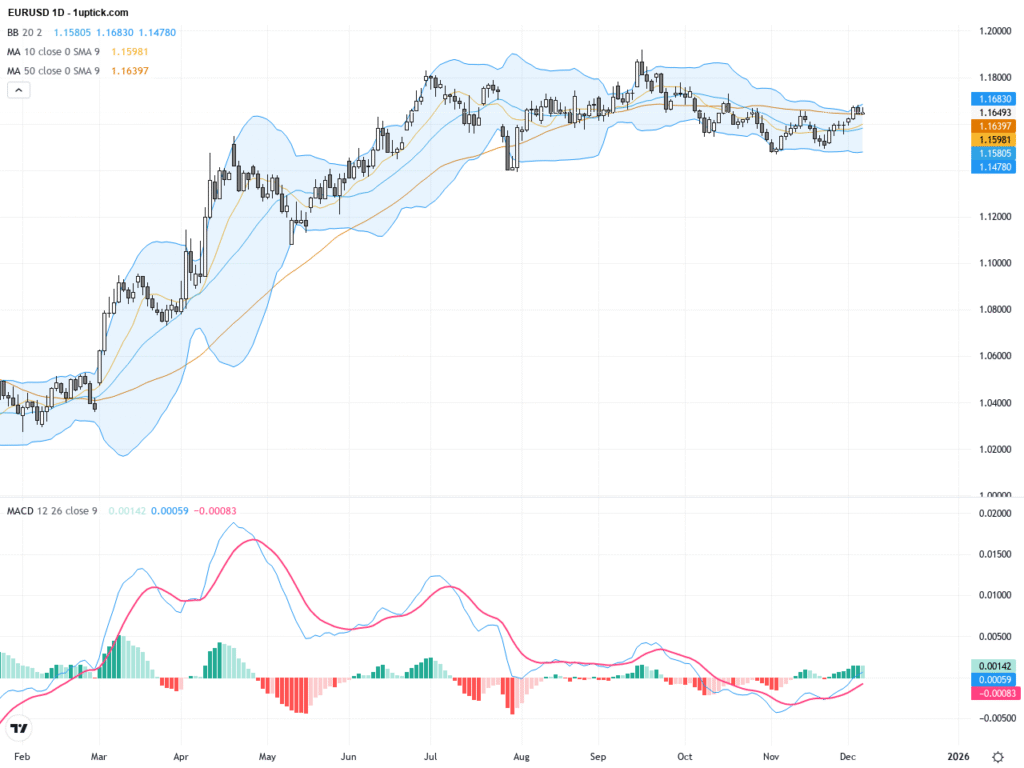

EURUSD: Breakout Above Key Resistance Sparks Bullish Momentum – Trading Outlook and Technical Patterns

Over the past three trading days, EURUSD has exhibited notable volatility and price breakout momentum. Yesterday’s close at 1.16406 kept the pair near recent highs. Market mood shifted primarily due to growing expectations of a…

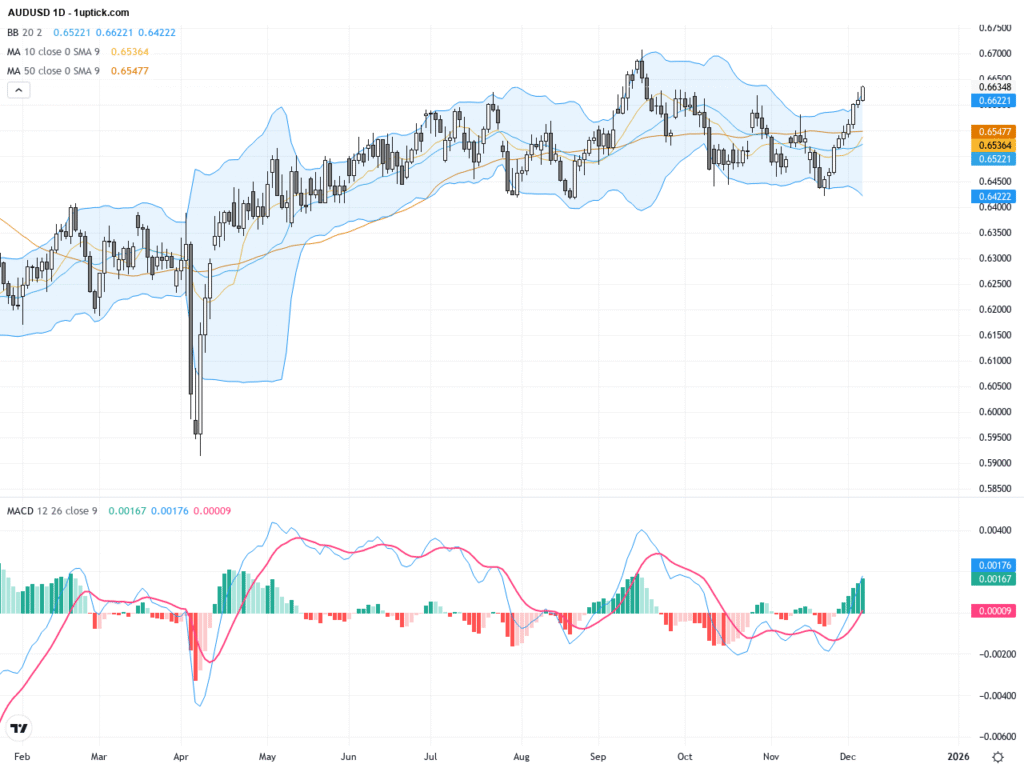

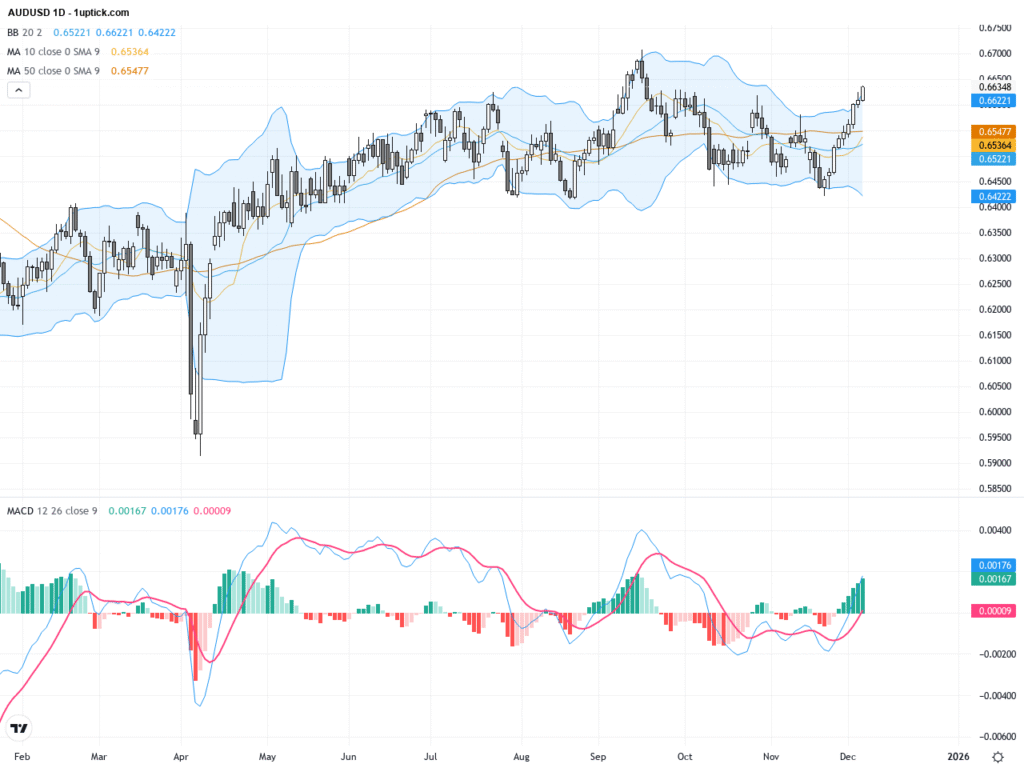

AUDUSD Technical & Fundamental Analysis: Bullish Consolidation Above 0.6600 Facing Key Resistance

Over the last three trading days, AUDUSD has shown steady upward momentum, closing yesterday at 0.66348 near a two-month high. The US dollar weakened ahead of key US Personal Consumption Expenditures (PCE) inflation data, boosting…

AUDUSD Technical & Fundamental Analysis: Bullish Consolidation Above 0.6600 Facing Key Resistance

Over the last three trading days, AUDUSD has shown steady upward momentum, closing yesterday at 0.66348 near a two-month high. The US dollar weakened ahead of key US Personal Consumption Expenditures (PCE) inflation data, boosting…

EURUSD: Breakout Amid Fed Rate Cut Bets Drives Bullish Trading Outlook

Over the past three trading days, EURUSD showcased notable volatility, rising from yesterday's close near 1.1649 to an intraday high of 1.1675. The key driver behind this move is the market's growing expectation of an…

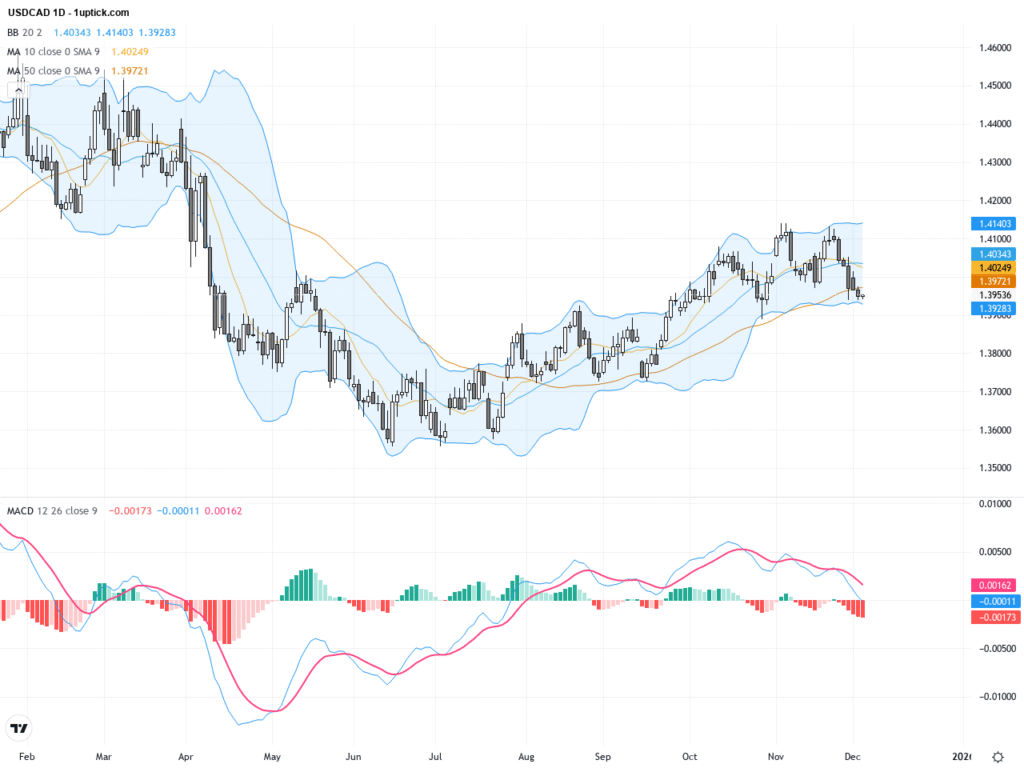

USDCAD: Key Technical Pattern Signals Intense Battle Between Bulls and Bears

USDCAD has experienced notable volatility over the past three trading days, closing yesterday at 1.39535. The pair’s movement is influenced by mixed economic data from the US and Canada, with USD weakening on Fed rate…

Ferrari Team Revives the Legend and Passion of Targa Florio

China Trade Freeze Hits US Soybean Farmers: Rising Costs, Vanishing Profits

IMF Calls for Deeper Asian Regional Integration to Boost Economic Resilience

Powell: U.S. Job Growth Slowdown Signals Need for More Fed Rate Cuts

Gold Price Trends: Is There Still Room for Growth?

Fed’s Miran Backs Swift Half-Point Rate Cut Amid Trade Uncertainty

Market Analysis

Insightz