Technical Analysis

Evaluate price trends and patterns, identify potential investments and trading opportunities!

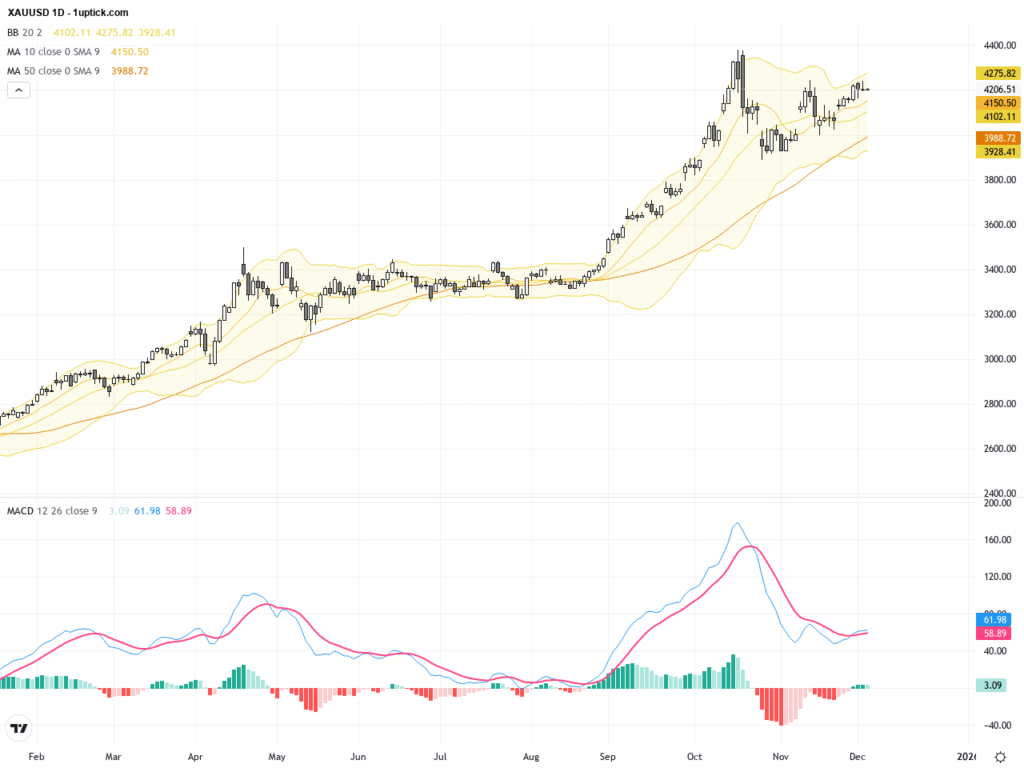

XAUUSD Gold Trading Outlook: Technical Pullback Amid Focus on US Employment Data

In the past three trading days, XAUUSD gold prices have exhibited noticeable volatility, hovering around the $4,200 mark with minor pullbacks. The spot gold closed at $4,207.33 on December 3. Market sentiment was influenced by…

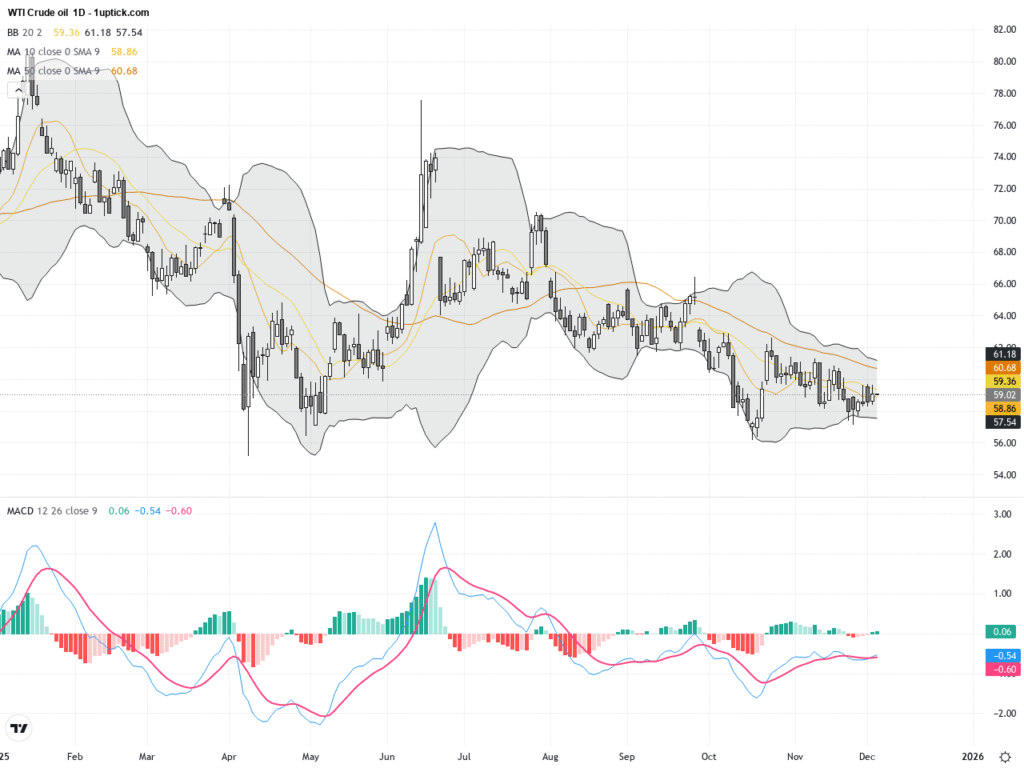

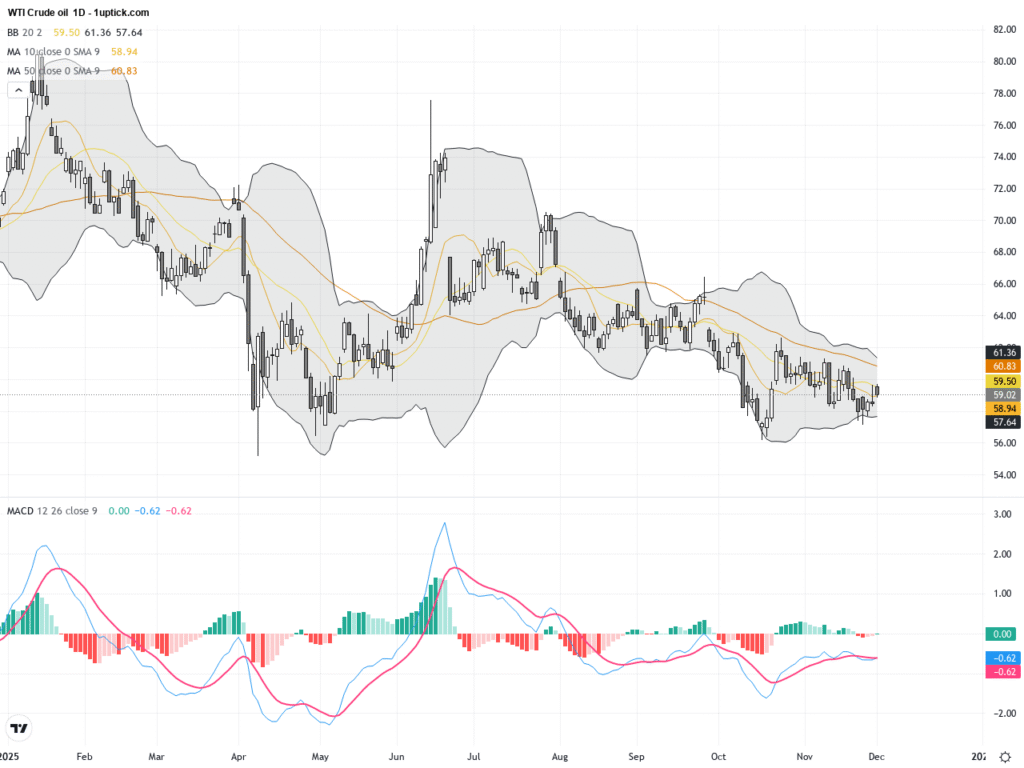

WTI Crude Oil: Navigating Key Resistance Ahead – Trading Outlook and Technical Patterns

WTI Crude Oil has traded within a volatile range of $58 to $59 over the past three days, closing at $59.01 today, slightly up from yesterday's $58.64. The market momentum is influenced by a weakening…

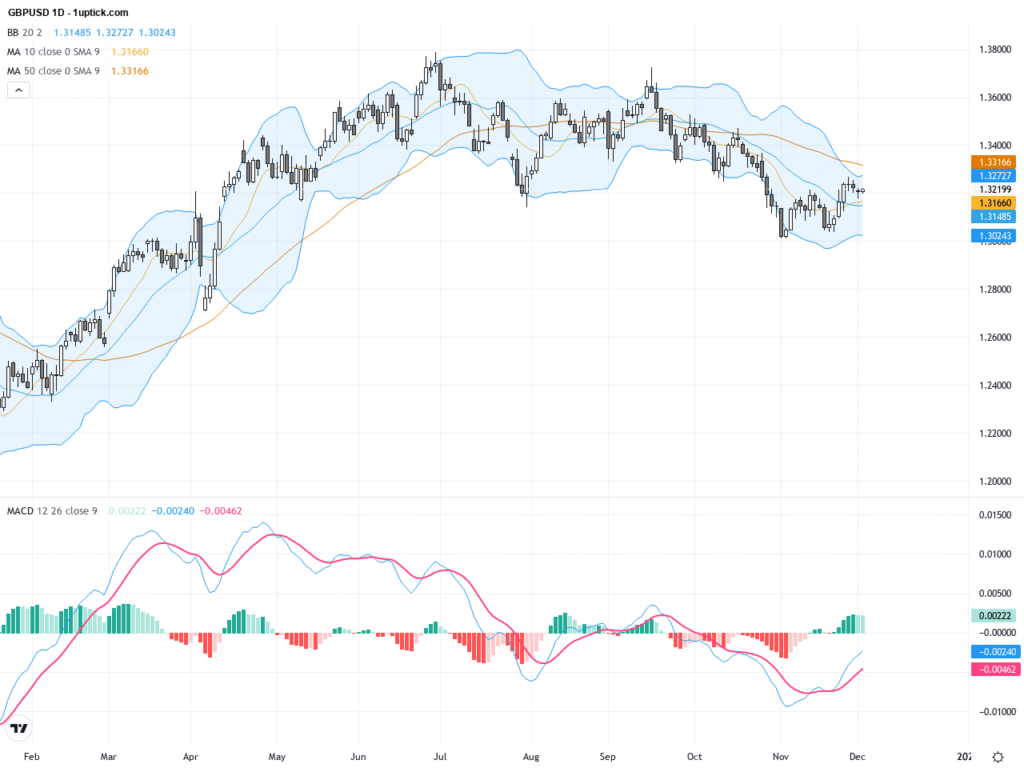

GBPUSD: Steady Rebound Paves Way to Test Key Resistance with Bullish Technical Patterns

GBPUSD has shown a moderate uptrend over the past three trading days, closing yesterday at 1.32198, driven by positive sentiment following the UK’s recent budget announcement. Bank of England Governor Andrew Bailey’s emphasis on maintaining…

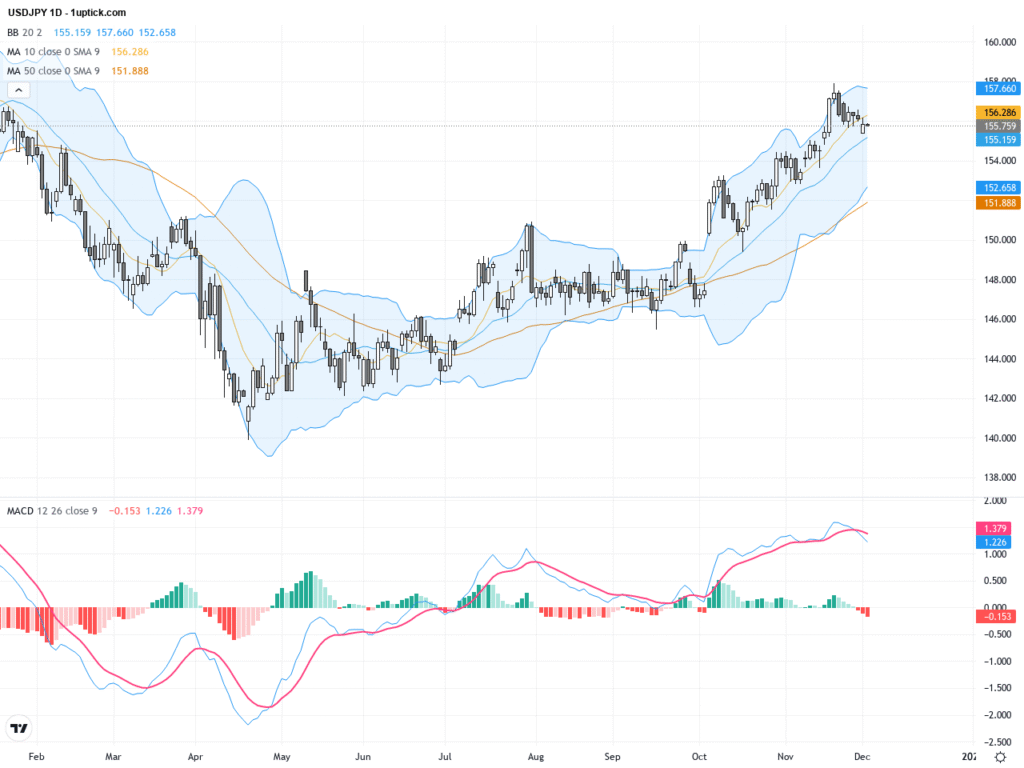

USDJPY Technical & Fundamental Analysis: Trading Outlook After Breaking Above 155.50 Resistance

Over the past three trading days, USDJPY has shown significant volatility, closing yesterday at 155.756, marking a 0.23% increase from the previous day. Despite prospects of a Bank of Japan rate hike, the pair rebounded…

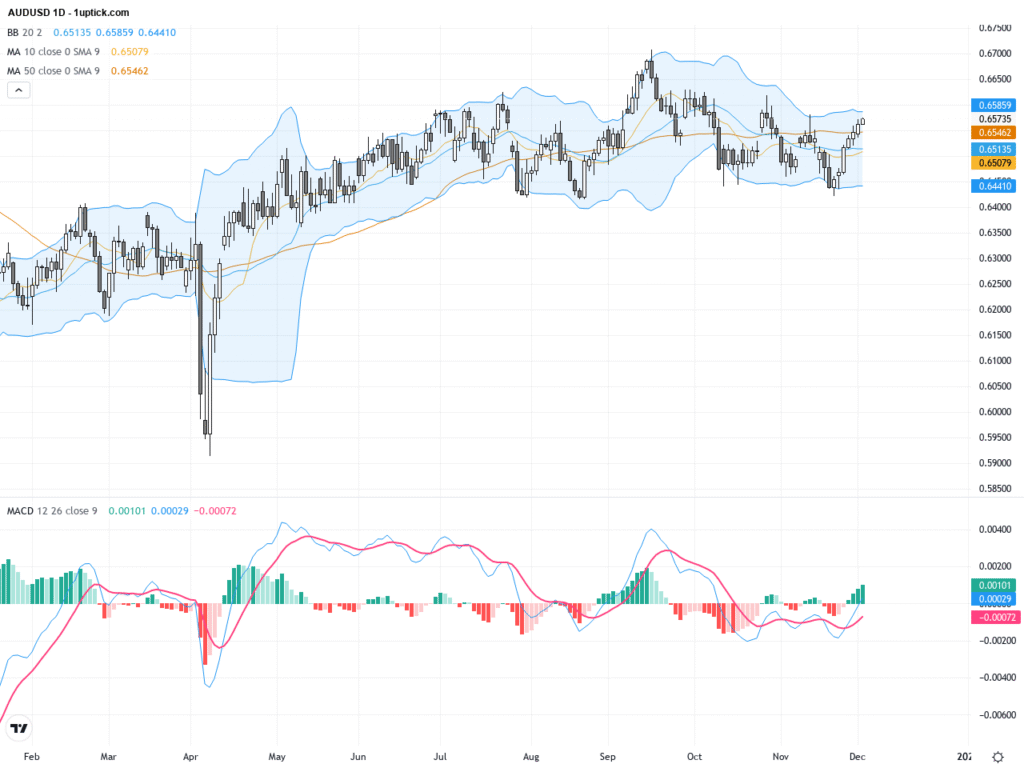

AUDUSD: Consolidation Around 0.6550 with Strong Australian Economic Data in Focus

AUDUSD has been consolidating in the narrow range of 0.6540 to 0.6580 over the past three trading days, closing yesterday at 0.65735. The pair is supported by robust Australian Q3 economic data including GDP and…

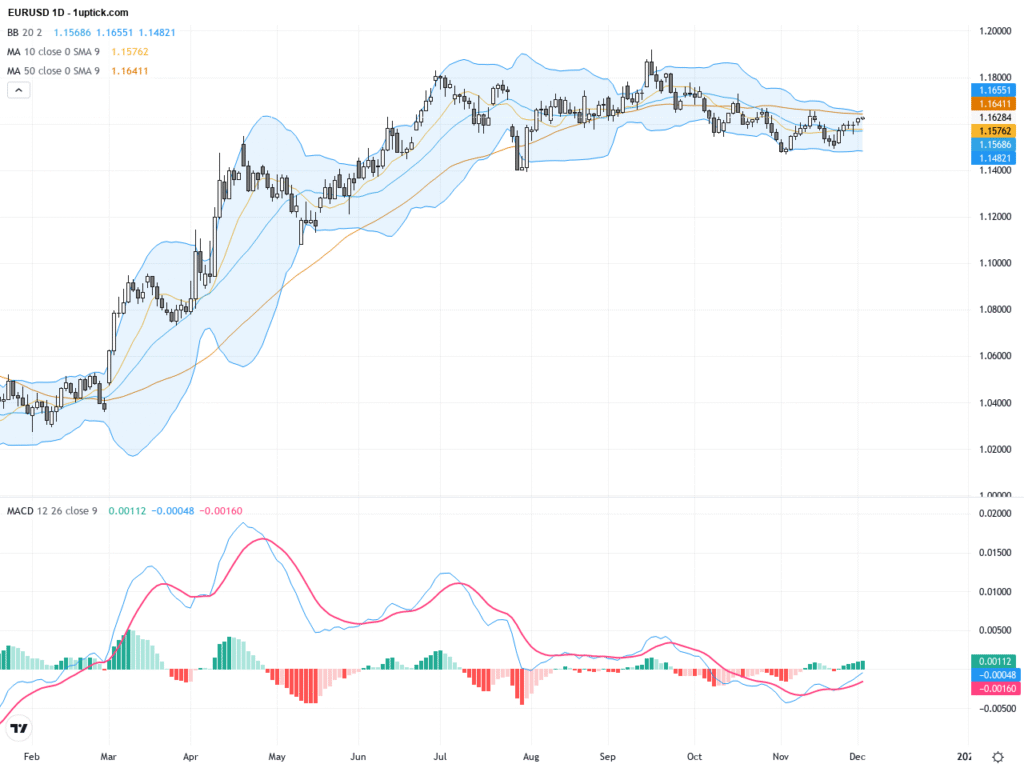

EURUSD: Wedge Breakout Confirms Bullish Momentum – Trading Outlook and Key Support Resistance Levels

Over the past three trading days, EURUSD has consolidated around the 1.1600 level, closing yesterday at 1.16285. Influenced by Natixis' recent forecast, the market holds a bullish outlook on the euro, expecting EURUSD to strengthen…

WTI Crude Oil: Triangular Breakout Signals Strong Uptrend Ahead

WTI Crude Oil exhibited notable volatility over the past three trading days, rising from $58.55 on November 28 to $59.19 on December 2, displaying a steady upward movement. The price surge was fueled by intensified…

The All-New Ferrari 849 Testarossa Has Arrived!

The All-New Ferrari 849 Testarossa Has Arrived!

First Brands Bankruptcy: Is Private Credit Facing Its Own ‘Subprime Crisis’?

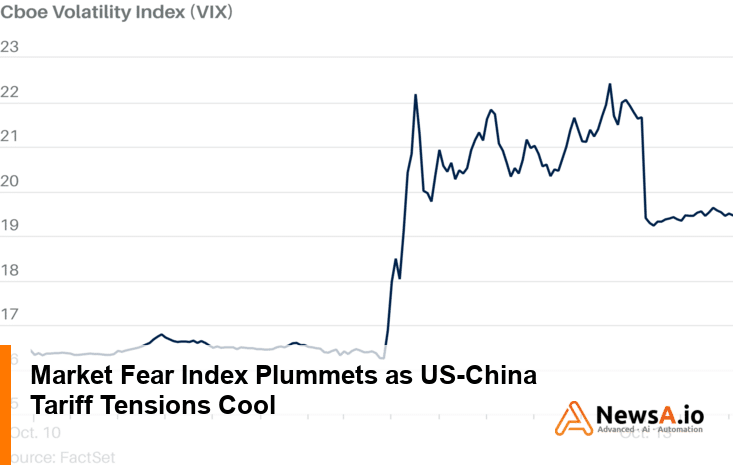

Market Fear Index Plummets as US-China Tariff Tensions Cool

Market Analysis

Insightz