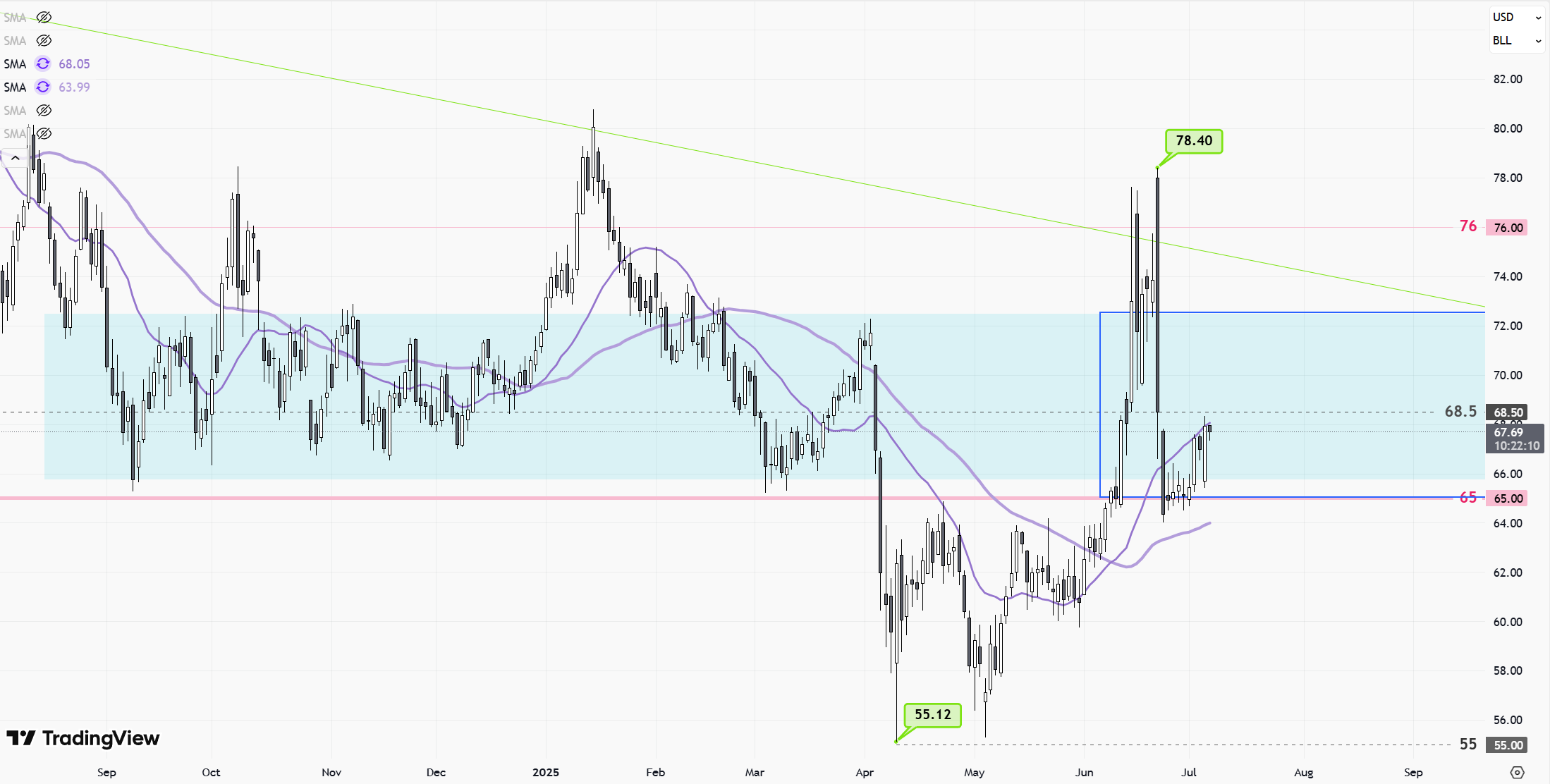

Canadian Dollar Poised to Rise Ahead of April CPI Report, as U.S. Credit Downgrade and Oil Price Swings Take Center Stage

The U.S. dollar continues to weaken against the Canadian dollar as markets turn their attention to Canada’s upcoming April CPI report—an important indicator that could influence the loonie’s short-term direction. Adding pressure to the greenback are recent developments, including a downgrade of the U.S. credit rating and rising trade tensions between the U.S. and Canada. These factors may offer near-term support for the Canadian dollar. Meanwhile, fluctuations in oil prices and mounting expectations of interest rate cuts by the Bank of Canada are also shaping the loonie’s performance. Investors should stay alert to these evolving trends as they could significantly impact CAD exchange rates in the weeks ahead.