Ontario Strikes Back at U.S. Tariffs with 25% Power Surcharge

Ontario is striking back at U.S. tariffs with a **25% surcharge** on electricity exports to Michigan, Minnesota, and New York. This move, led by Premier Doug Ford, is driving up U.S. household energy bills by **$100 per month** while generating millions for Ontario. As tensions rise, Ontario is warning of further measures, including a complete export cutoff. With political leaders on both sides scrambling for solutions, the Canada-U.S. trade war is heating up. **Will more provinces join Ontario’s strategy?**

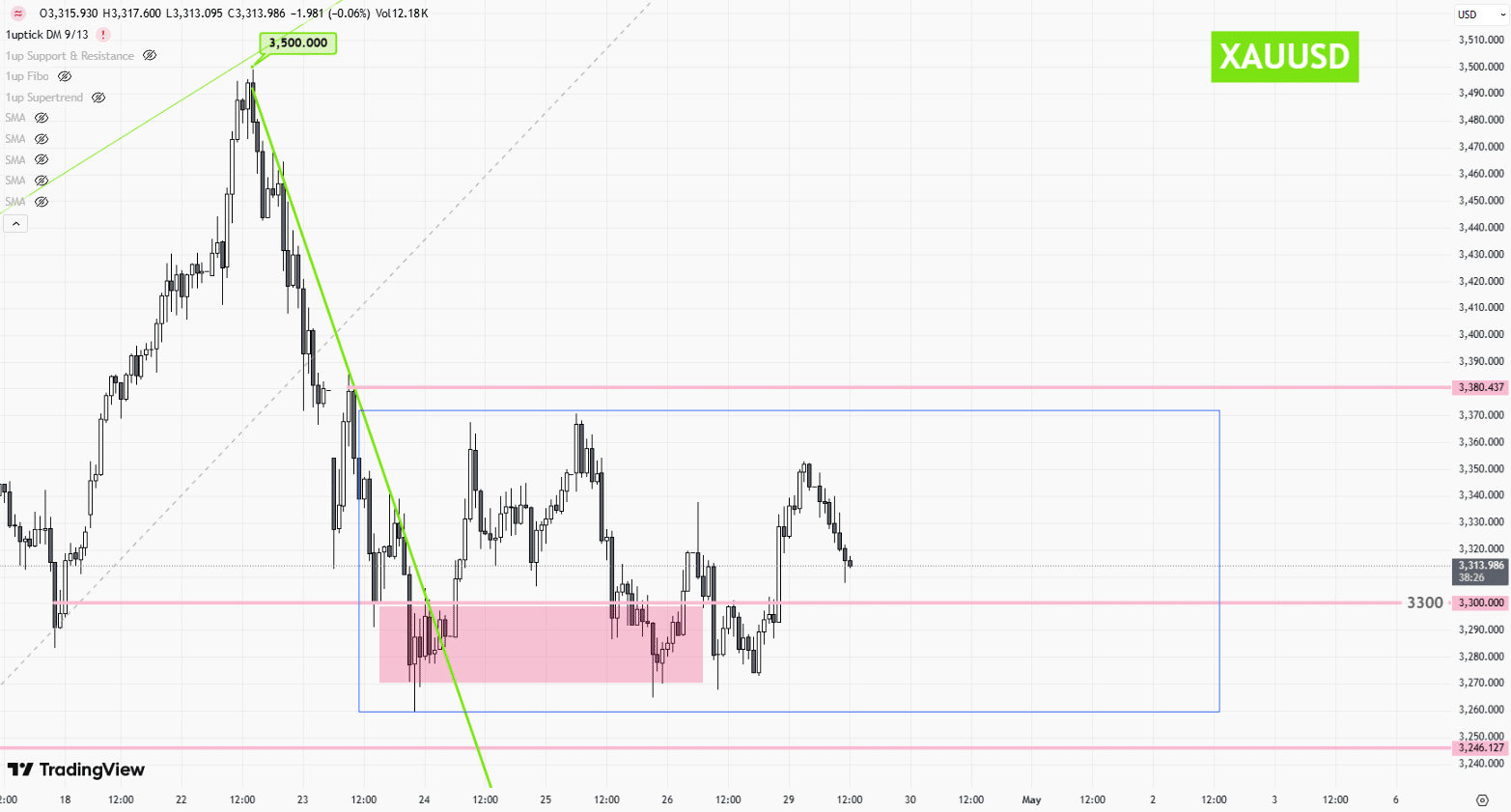

![[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-28T055444.196Z-file.png)